The market seems to be on a strong footing as the benchmark indices extended their strong rally for a third consecutive session on July 29, with the Nifty50 decisively closing above psychological 17,100 mark, backed by FII inflow and buying across sectors after the Federal Reserve signalled slowing the pace of rate increases.

The BSE Sensex rallied 712 points or 1.25 percent to 57,570, while the Nifty50 climbed 229 points or 1.35 percent to 17,158 and formed bullish candle on the daily charts.

With the increasing confidence among bulls, "if the index sustains above 17,018 levels (the intraday low on July 29), it can extend the upswing towards 17,550, where a slew of resistance points are placed," said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

However, the swift up move from the lows of 16,438 to 17,170 in just three trading sessions can lead to some consolidation or profit booking.

Therefore, fresh positions are advised only on dips but with a stop-loss below 17,020 levels on a closing basis, as consolidation for a couple of sessions above 200-day SMA can eventually lead to higher targets of 17,500 levels, the market expert said.

The broader markets have outperformed frontliners, with the Nifty Midcap 100 and Smallcap 100 indices gaining 1.4 percent and 1.7 percent, respectively, as about two shares advanced for every share declining on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,060, followed by 16,962. If the index moves up, the key resistance levels to watch out for are 17,215 and 17,271.

The Nifty Bank gained more than 100 points to close at 37,491 on Friday, but formed bearish candle on the daily charts as the closing was lower than opening levels. The important pivot level, which will act as crucial support for the index, is placed at 37,223, followed by 36,955. On the upside, key resistance levels are placed at 37,757 and 38,022 levels.

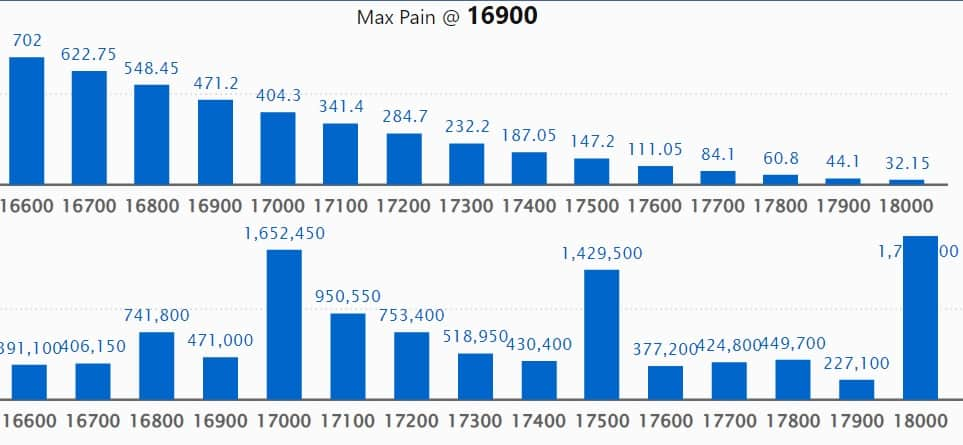

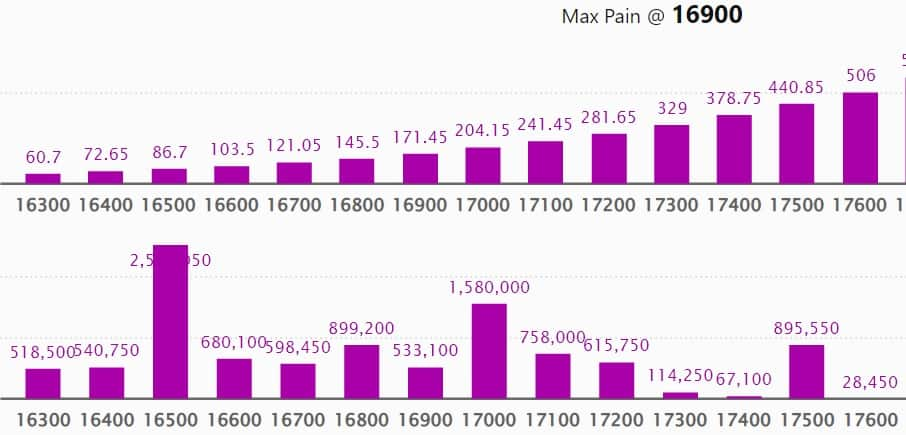

Maximum Call open interest of 17.92 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,000 strike, which holds 16.52 lakh contracts, and 17,500 strike, which has accumulated 14.29 lakh contracts.

Call writing was seen at 17,100 strike, which added 4.99 lakh contracts, followed by 18,000 strike which added 4.32 lakh contracts, and 17,200 strike which added 2.54 lakh contracts.

Call unwinding was seen at 16,500 strike, which shed 97,700 contracts, followed by 16,900 strike which shed 81,750 contracts and 16,700 strike which shed 60,200 contracts.

Maximum Put open interest of 25.36 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the August series.

This is followed by 16,000 strike, which holds 18.58 lakh contracts, and 17,000 strike, which has accumulated 15.8 lakh contracts.

Put writing was seen at 17,100 strike, which added 6.34 lakh contracts, followed by 17,000 strike, which added 6.04 lakh contracts and 17,200 strike which added 5.6 lakh contracts.

Put unwinding was seen at 16,000 strike, which shed 2.45 lakh contracts, followed by 16,100 strike which shed 49,950 contracts, and 16,300 strike which shed 24,150 contracts.

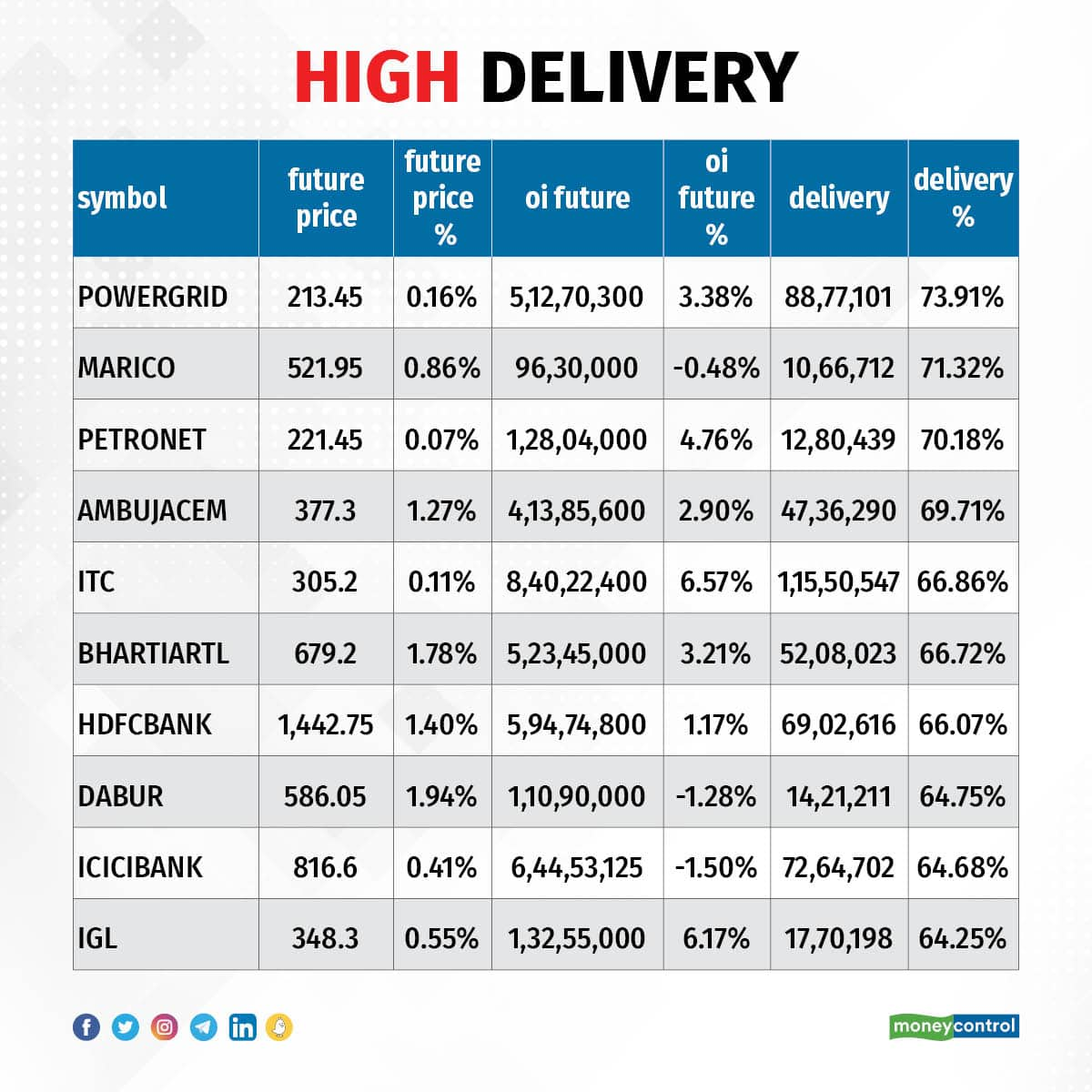

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Power Grid Corporation of India, Marico, Petronet LNG, Ambuja Cements, and ITC, among others.

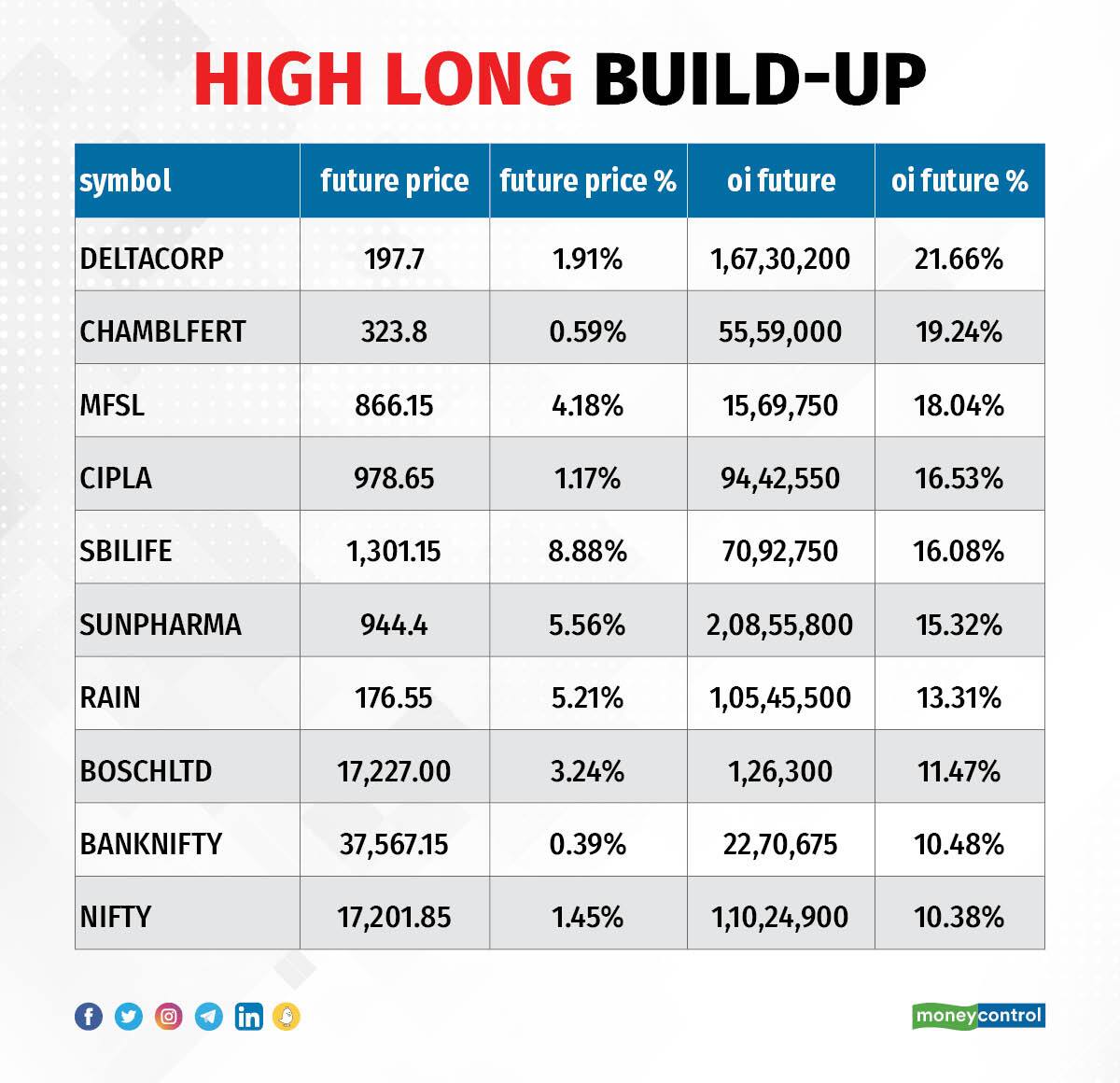

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Delta Corp, Chambal Fertilizers, Max Financial Services, Cipla, and SBI Life Insurance Company, in which a long build-up was seen.

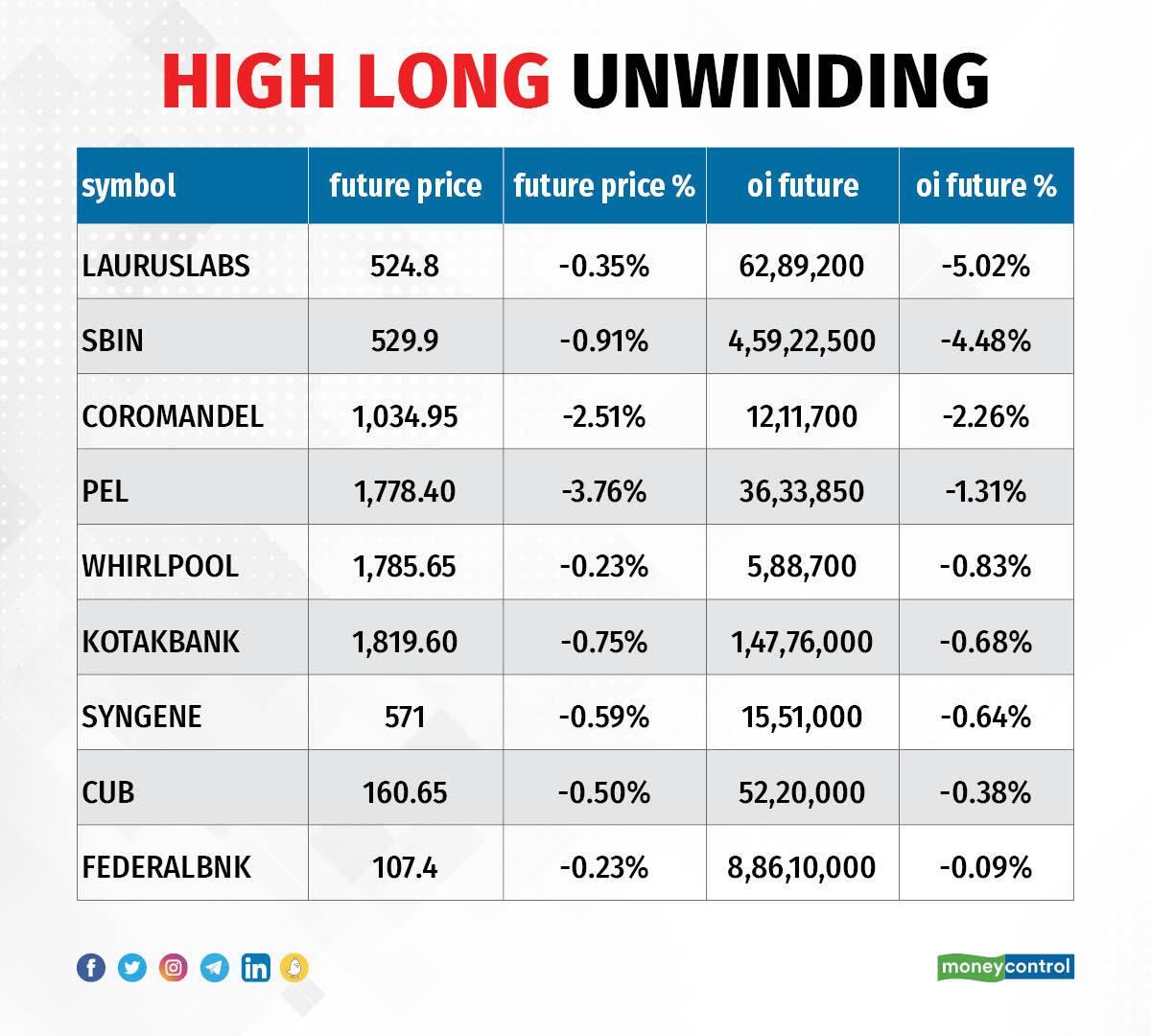

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 9 stocks including Laurus Labs, State Bank of India, Coromandel International, Piramal Enterprises, and Whirlpool, in which long unwinding was seen.

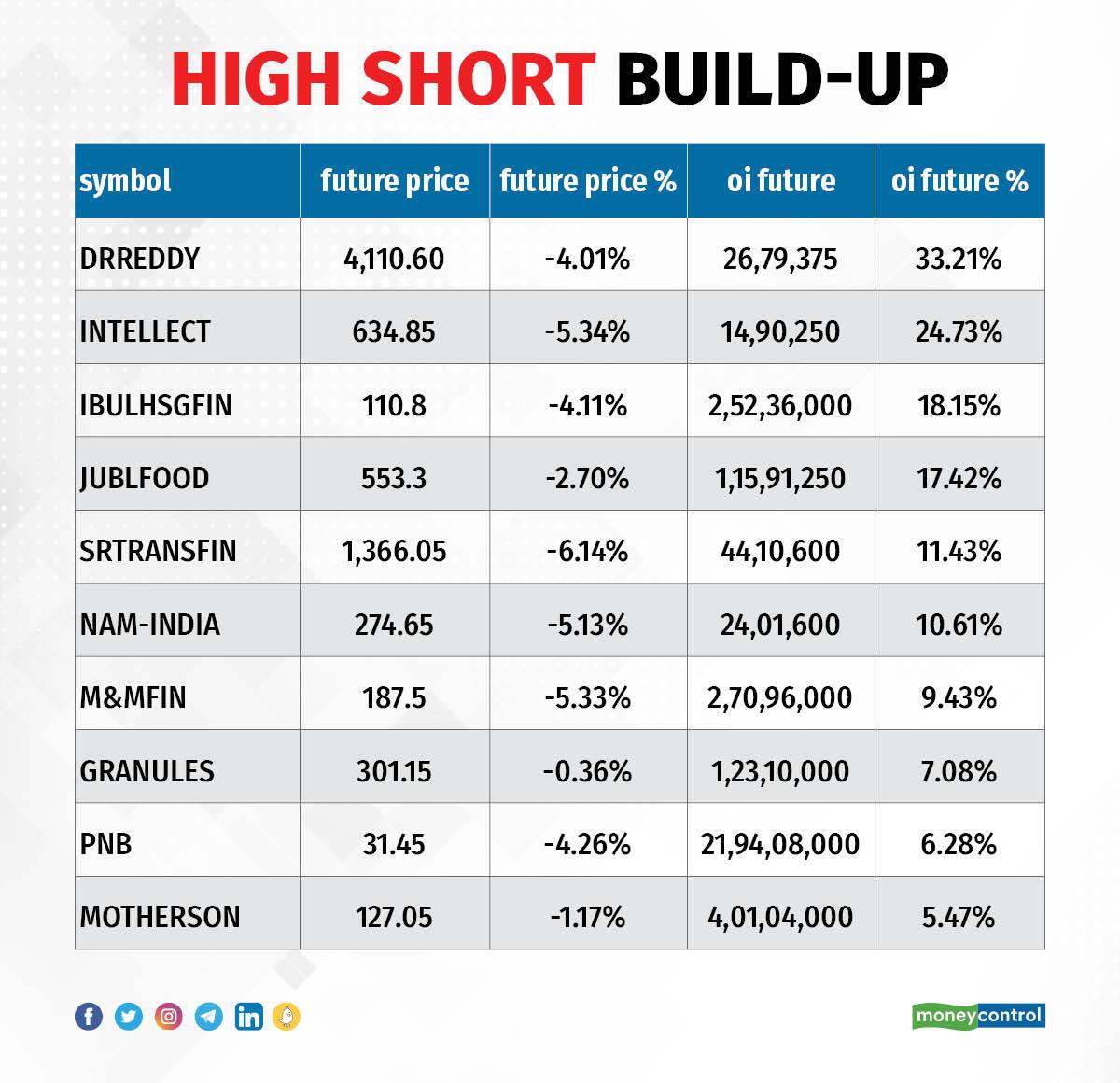

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Dr Reddy's Laboratories, Intellect Design Arena, Indiabulls Housing Finance, Jubilant Foodworks, and Shriram Transport Finance, in which a short build-up was seen.

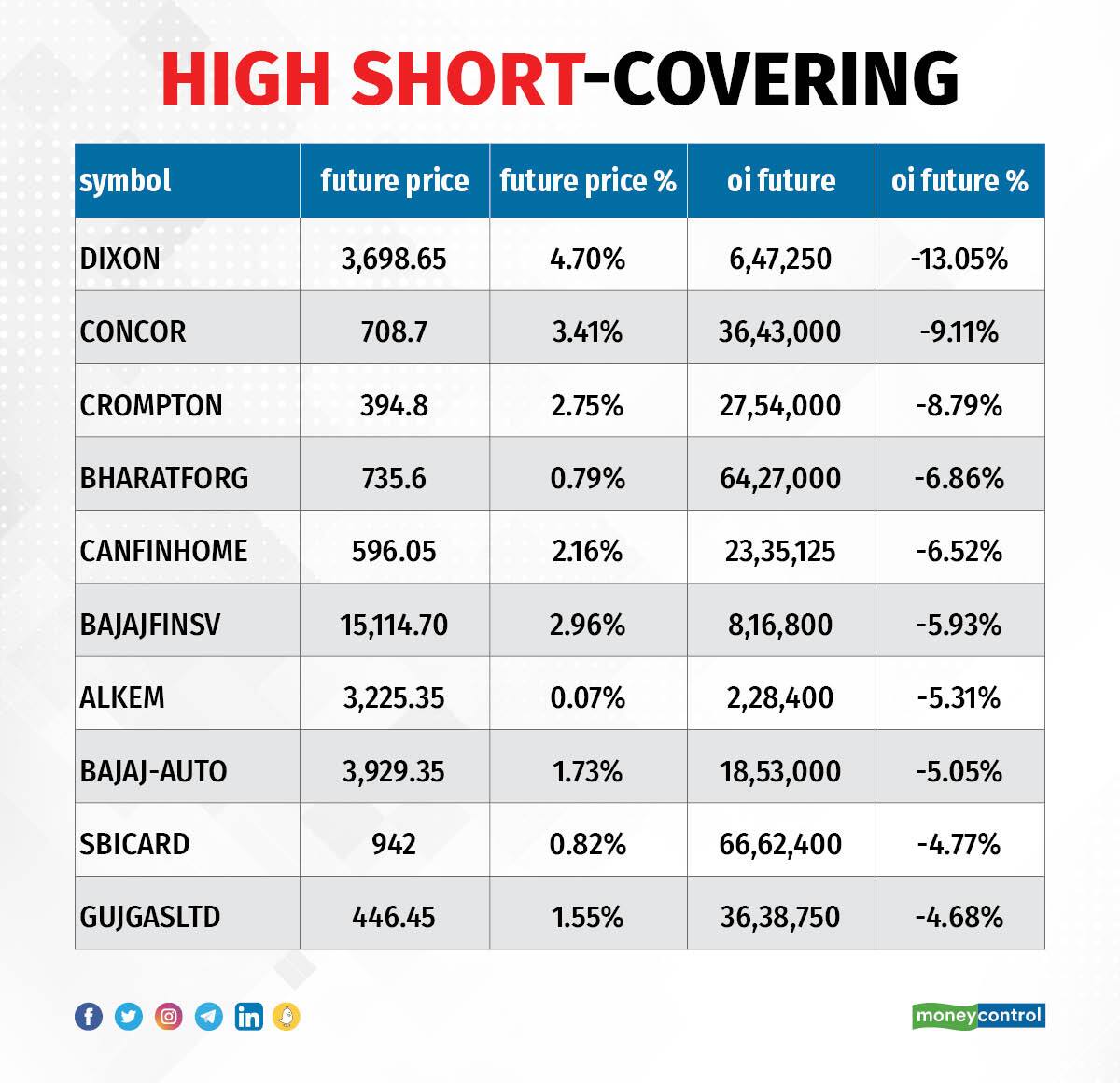

56 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Dixon Technologies, Container Corporation of India, Crompton Greaves Consumer Electricals, Bharat Forge, and Can Fin Homes, in which short-covering was seen.

(For more bulk deals, click here)

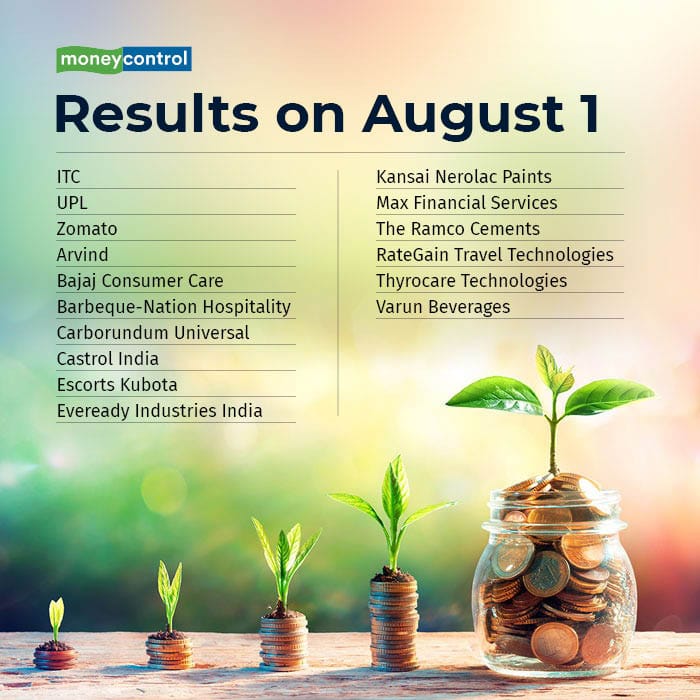

ITC, UPL, Zomato, Arvind, Bajaj Consumer Care, Barbeque-Nation Hospitality, Carborundum Universal, Castrol India, Escorts Kubota, Eveready Industries India, Indo Count Industries, Kansai Nerolac Paints, Max Financial Services, Prudent Corporate Advisory Services, Punjab & Sind Bank, The Ramco Cements, RateGain Travel Technologies, Thyrocare Technologies, Triveni Turbine, and Varun Beverages will be in focus ahead of June quarter earnings on August 1.

Stocks in News

Bank of Baroda: The public sector lender reported 79.4 percent year-on-year growth in standalone profit at Rs 2,168 crore for the quarter ended June 2022, despite fall in other income and pre-provision operating profit. The significant decline in bad loans provisions aided the bottom line. Net interest income grew by 12 percent YoY to Rs 8,838.4 crore in Q1FY23, with credit growth at 18 percent and 10.9 percent YoY increase in global deposits.

IDFC First Bank: The bank recorded highest-ever standalone profit of Rs 474.33 crore in Q1FY23, against a loss of Rs 630 crore in corresponding period of the previous fiscal. The increase in core operating income and fall in provisions aided the profitability, with the sequential growth in profit at 38 percent. Net interest income grew by 26 percent to Rs 2,751.1 crore YoY during the quarter, with 39 bps YoY improvement in net interest margin at 5.89 percent for the quarter. But there was 38 bps decline in net interest margin on a sequential basis.

Dr Reddy's Laboratories: The pharma major entered into a licensing agreement with Slayback Pharma to obtain exclusive rights in the first-to-file ANDA for the private label version of Lumify in the US. Lumify is an over-the-counter (OTC) eyedrop that can be used to relieve redness of the eye due to minor eye irritations. The agreement also provides Dr Reddy’s exclusive rights to the product outside the US.

Rain Industries: The company recorded a 184 percent year-on-year increase in consolidated profit at Rs 668.50 crore for the quarter ended June 2022, driven by healthy top line and operating performance. Revenue grew by 52 percent to Rs 5,540.6 crore due to solid growth in average blended realisation for carbon and advanced material sales, though volumes declined. Operating profit grew by 78.5 percent to Rs 1,210.5 crore during the same period.

Zee Entertainment Enterprises: The company has received no objection letters from BSE and National Stock Exchange of India, for the proposed Composite Scheme of Arrangement amongst Zee Entertainment, Bangla Entertainment, and Culver Max Entertainment (formerly Sony Pictures Networks India). These observation letters permit the company to file the Composite Scheme of Arrangement with National Company Law Tribunal, Mumbai.

Yes Bank: The bank is going to raise Rs 8,898.47 crore from The Carlyle Group and Verventa Holdings (affiliate of Advent) by selling up to 10 percent stake each. The board of directors has approved to allot 369.61 crore equity shares at a price of Rs 13.78 per share and 256.75 crore warrants exchangeable into equity shares, at a price of Rs 14.82 per share, through preferential allotment on a private placement basis, which is subject to approval of shareholders and RBI. The Carlyle Group and Verventa Holdings (affiliated of Advent) will pour in money into the bank against 184.8 equity shares each and 128.37 crore warrants each.

Cipla: The pharma company recorded a 4 percent year-on-year decline in consolidated profit at Rs 686 crore for the quarter ended June 2022 as EBITDA fell by 15 percent YoY to Rs 1,143 crore and revenue fell by 2.3 percent to Rs 5,375 crore in the same period. India business declined 8.4 percent to Rs 2,483 crore and North America business grew by 15.5 percent to Rs 1,199 crore in Q1FY23.

JSW Energy: Subsidiary JSW Energy (Barmer) owned 1,080 MW power plant at Barmer retained access to uninterrupted supply of lignite for its operations. The Rajasthan Government informed Barmer Lignite Mining Company Limited (BLMCL) that it is in receipt of ex-post facto- previous approval from the Central Government for transfer of two lignite mining leases (Kapurdi and Jalipa in Rajasthan) from Rajasthan State Mines and Minerals Limited (RSMML) to BLMCL with effect from the date of transfer of the said mining leases. Accordingly, the previous letters issued by the Rajasthan Government directing BLMCL to stop mining operations at the two lignite mines stand withdrawn.

DLF: The real estate developer reported a 36 percent year-on-year increase in profit at Rs 470 crore for the quarter ended June 2022. Consolidated revenue at Rs 1,516 crore grew by 22 percent YoY in the same period with net sales bookings rising 101 percent YoY to Rs 2,040 crore.

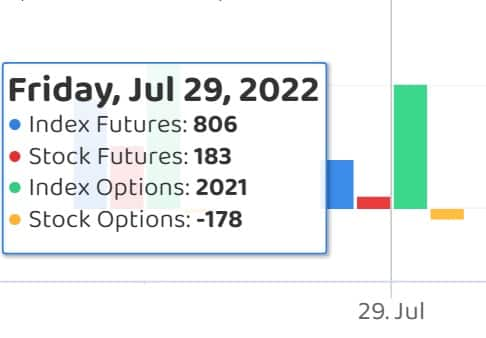

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 1,046.32 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 0.91 crore on July 29, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are in the beginning of new monthly F&O series, we don't have any stock in the NSE F&O ban list for August 1. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.