LiveNow

Closing Bell: Sensex gains 372 pts, Nifty around 21,800 on expiry day

Indian equity indices ended higher for the fifth consecutive session on December 28 with Nifty around 21,800. At close, the Sensex was up 371.95 points or 0.52 percent at 72,410.38, and the Nifty was up 123.90 points or 0.57 percent at 21,778.70.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Markets witnessed bullish bets on the monthly F&O expiry day, indicating that the risk-on sentiment is likely to continue going ahead on hopes of a strong local macro play in the new year. The waning higher inflation concerns and expectations of an early rate cut in the world's largest economy has further strengthened hopes that India's growth momentum would continue further thus boosting investors' confidence.

However, amidst overbought technical conditions, key indices may consolidate in the near term but, that said, the medium-term outlook continues to be in favor of the bulls but only on any steep corrective declines. Technically, Nifty has key support at 21659-21501 and faces resistance at 22000-22251 levels.

Mandar Bhojane, Research Analyst at Choice Broking

On December 28, 2023, the Indian equity market demonstrated resilience, closing the year on a positive note for the eighth consecutive time. This achievement is noteworthy given the array of challenges faced throughout the year, including escalating interest rates, bank collapses in the US, geopolitical tensions arising from ongoing wars, surging crude oil prices, and a deceleration in the Chinese economy.

The Nifty index reached an all-time high at the 21,800 level, marking a significant milestone. The day commenced with a gap-up opening, and the Nifty sustained the 21,700 level, underscoring a robust momentum in the market. Overall, Nifty has exhibited a steadfast bullish trend, with immediate support levels identified at 21,700 and 21,600. Positional traders are advised to maintain their holdings in Nifty, with a recommended stop loss set at 21,500.

Analyzing the Open Interest (OI) data, it is noteworthy that the call side displays the highest OI at the 22,000 level, closely followed by the 21,100 strike prices. Conversely, on the put side, the 21,500 strike price boasts the highest OI. These indicators suggest a cautiously optimistic sentiment among market participants.

As the market wraps up the year, the prevailing bullish trend and strategic support levels provide a positive outlook for investors. However, it is essential to remain vigilant and adaptive, considering the dynamic global and economic landscape that influenced market dynamics throughout the year.

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty remained firmly in bullish territory as the index surged to a new all-time high. Strong put writing at the 21700 strike bolstered the bulls, propelling the index toward 21800. Short-term support is situated at 21700, signaling a continued bullish sentiment. A decisive move above 21800 could lead the index toward the 22000 mark.

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets continued to edge higher and gained nearly half a percent on the monthly expiry day. After the initial uptick, Nifty inched gradually higher and finally settled around the day’s high at 21,756 levels.

Most of the sectors participated in the move wherein energy, FMCG and pharma were among the top performers. The broader indices also extended gains and rose nearly half a percent each.

The rotational buying in heavyweights across sectors is helping the index to inch higher and we expect the same trend to continue. Besides, favorable global cues are further adding to the positivity. We thus reiterate our bullish view and suggest continuing with a “buy on dips” approach.

Vinod Nair, Head of Research at Geojit Financial Services:

The benchmark index maintained its optimism and hit fresh high owing to ease in Red Sea issue and reversal of FII inflows. A decline in crude oil prices below $80 prompted widespread purchasing across oil and energy companies. The Asian market too advanced due to an expectation of more aggressive rate cuts by fed next year. While the global market was largely experiencing consolidation due to valuation concerns.

Aditya Gaggar Director of Progressive Shares:

A rangebound activity was observed on the last monthly expiry of the calendar year. Nifty50 advanced by 123.95 points and ended the day at 21,778.70. Except for IT, all other sectors ended the session in green with Energy (OMC stocks) and FMCG being the outperformers followed by Pharma and PSU Banks.

A mixed trend was seen in the Broader markets where Midcap performed in line with the Benchmark Index while Smallcaps outperformed.

One more bullish candle was formed on the daily chart but at the same time, the Index is about to enter an extremely overbought condition as well. There is a possibility of bearish divergence, although it is too premature to say.

Rupee Close:

Indian rupee ended 18 paise higher at 83.17 per dollar on Thursday versus Wednesday's close of 83.35.

Market Close: Indian equity indices ended higher for the fifth consecutive session on December 28 with Nifty around 21,800.

At close, the Sensex was up 371.95 points or 0.52 percent at 72,410.38, and the Nifty was up 123.90 points or 0.57 percent at 21,778.70. About 1578 shares advanced, 1728 shares declined, and 73 shares unchanged.

Top gainers on the Nifty were Coal India, NTPC, M&M, Dr Reddy's Laband Hero MotoCorp, while losers included Adani Enterprises, Eicher Motors, LTIMindtree, L&T and Adani Ports.

Except, Information Technology, all other sectoral indices ended in the green with FMCG, realty, oil & gas, power and metal indices up 1-2 percent.

BSE Midcap index up 0.66 percent and smallcap index rose 0.2 percent.

Stock Market LIVE Updates | Antique On CESC:

-Buy call, target raised to Rs 150 from Rs 93 per share

-Company undergoing radical changes

-Company is setting up 3 GW of RE generation plants

-Re plants service Kolkata & Noida circles

-Phase wise contribution will add Rs 600 crore/GW of EBITDA by FY26

-Chandrapur–600 MW can add yet another Rs 600 crore in FY26 EBITDA

-Two months back, APR allowed liquidation of Rs 600 crore for 2019 regulatory claims

-This will see further liquidations in days ahead

Sensex Today | Dollar dips as traders stay fixed on US rate cuts next year

The dollar fell across the board on Thursday with the Japanese yen, euro, and pound all at their strongest against the greenback in five months as bets the Federal Reserve will cut rates sharply in 2024 continued to drive markets.

The dollar index, which measures the U.S. currency against six rivals, fell to a fresh five-month low of 100.76. The index is on course for a 2.6% decline this year, snapping two straight years of strong gains.

Stock Market LIVE Updates | Citi View On Mphasis

-Sell call, target Rs 2,080 per share

-Demand environment hasn’t changed versus start of the quarter

-Deal TCV to revenue conversion cycle remains elongated

-Organic growth in Q3 will likely be muted given higher furloughs

-Revenue contribution from acquisition likely to be lower than annual run rate

-Margin impact from acquisition to be slightly higher

-Confident of company maintaining margin (Ex-M&A) in 15.25-16.25 percent range for FY24

Stock Market LIVE Updates | DAM Capital On Fortis Healthcare

-Buy call, target Rs 452 per share

-Uptick in hospital margins to trigger re-rating

-Over FY23-26, expect company to deliver revenue/EBITDA/PAT CAGR of 10 percent/16 percent/16 percent

-Expect EBITDAM expanding to 20 percent over FY23-26

-EBITDAM partially aided by divestment of underperforming assets and RoCE/RoE inching up to 10 percent/13 percent

-See sufficient room for EBITDA growth

-Trends to sustain in medium term as well

| Company | Price at 14:00 | Price at 14:36 | Chg(%) Hourly Vol |

|---|---|---|---|

| Aarey Drugs | 50.50 | 48.00 | -2.50 5.87k |

| One Point One S | 51.80 | 49.25 | -2.55 192.00k |

| Archidply Decor | 94.40 | 90.00 | -4.40 202 |

| HUDCO | 135.75 | 129.45 | -6.30 10.28m |

| Graphisads | 76.70 | 73.15 | -3.55 19.49k |

| Arvee Laborator | 180.00 | 173.10 | -6.90 124 |

| Nakoda Group | 51.00 | 49.10 | -1.90 60.42k |

| Industrial Inv | 182.00 | 176.15 | -5.85 1.29k |

| MCON Rasayan | 170.00 | 165.00 | -5.00 1.83k |

| Indbank Merchan | 38.80 | 37.70 | -1.10 58.66k |

| Company | Price at 14:00 | Price at 14:36 | Chg(%) Hourly Vol |

|---|---|---|---|

| Lagnam Spintex | 81.60 | 92.60 | 11.00 829 |

| Gensol Engineer | 767.50 | 806.65 | 39.15 3.69k |

| DB (Int) Stock | 34.55 | 35.80 | 1.25 98 |

| Kontor Space | 76.05 | 78.70 | 2.65 - |

| Gillette India | 6,162.60 | 6,375.55 | 212.95 1.36k |

| Bombay Metrics | 114.15 | 117.90 | 3.75 56 |

| Rachana Infra | 88.60 | 91.50 | 2.90 52.56k |

| Dishman Carboge | 171.00 | 176.30 | 5.30 262.18k |

| Ashapura Mine | 418.85 | 431.15 | 12.30 13.22k |

| Zee Entertain | 262.50 | 270.05 | 7.55 792.70k |

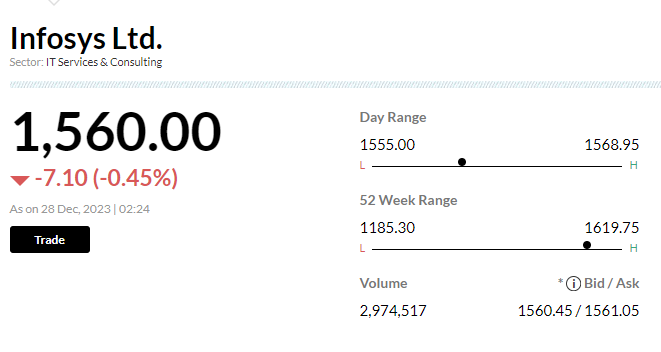

Stock Market LIVE Updates | Infosys to announce third quarter results on January 11, 2024

Stock Market LIVE Updates | Infosys to report Q3 results on January 11

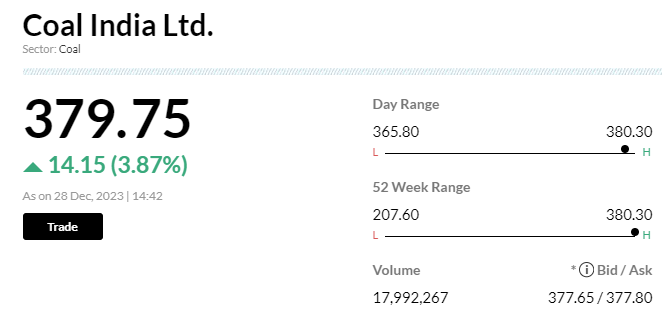

Stock Market LIVE Updates | Coal India gains 4% after Motilal ups target price

Coal India gains 4 percent after brokerage house Motilal Oswal Securities has increased its price target on the stock to Rs 430 a share, up 13 percent from its previous close. It reiterating buy recommendation on the stock. Motilal Oswal said Coal India primed for growth. It notes coal prices surged 80-100% due to increased demand and global prices.

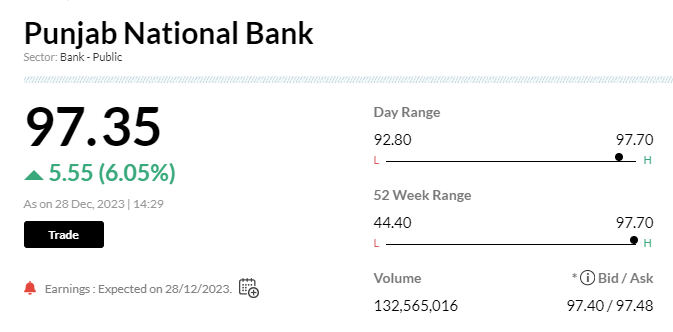

Stock Market LIVE Updates | PNB gains 6% after huge block deal

Shares of Punjab National Bank jumped over 6 percent after a huge block deal. Around 1.35 million shares changed hands in a single block deal, Bloomberg reported. However, details of the buyers and sellers were not known.

Sensex Today | Gold at highest in over three weeks as US rate cut bets firm

Gold prices climbed to over three-week highs on Thursday, as the U.S. dollar and bond yields hit multi-month lows on mounting bets of U.S. interest rate cuts as soon as March.

Spot gold was up 0.4% at $2,085.40 per ounce by 0800 GMT, its highest since a Dec. 4 record of $2,135.40. It looked set for its best year in three with a gain of 14%.

U.S. gold futures edged up 0.2% to $2,096.40.

Stock Market LIVE Updates | Exide Industries invests Rs 40 crore in subsidiary Exide Energy Solutions

Exide Industries has invested Rs 40 crore in the equity shares of the wholly owned subsidiary Exide Energy Solutions. With this investment, the total investment made by the company in Exide Energy Solutions stands to Rs 1,820.01 crore. There is no change in the shareholding percentage of the company in Exide Energy Solutions post acquisition of shares.

Sensex Today | Nifty FMCG index up 1 percent supported by Emami, Nestle, United Breweries:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Emami | 513.60 | 2.89 | 776.57k |

| United Brewerie | 1,756.55 | 2.88 | 322.09k |

| Nestle | 26,249.95 | 2.06 | 103.44k |

| Colgate | 2,506.95 | 1.97 | 273.51k |

| Dabur India | 543.30 | 1.67 | 1.50m |

| Britannia | 5,291.60 | 1.43 | 432.20k |

| Marico | 541.35 | 1.36 | 943.76k |

| Jubilant Food | 574.25 | 1.19 | 1.48m |

| Godrej Consumer | 1,116.35 | 1.17 | 894.65k |

| ITC | 462.40 | 1.16 | 9.14m |

Stock Market LIVE Updates | Central Bank of India in co-lending partnership with Kisetsu Saison Finance for MSME loans

Central Bank of India has entered into a strategic Co-Lending Partnership with M/s. Kisetsu Saison Finance (India) Private Limited to offer MSME Loans at competitive rates, subject to compliance with the applicable law(s) including the applicable guidelines issued by Reserve Bank of India (RBI).

Stock Market LIVE Updates | DAM Capital On Five-Star Business Finance:

-Initiate buy, target Rs 1,000 per share

-With robust cap adequacy of 59.4 percent, see no need of dilution over next five years

-Company has clocked approximately 8.5 percent RoAs in H1FY24

-Current leverage stands at 2.0x resulting in RoEs of ~17 percent

-With strong loan growth, RoAs could possibly come down from current levels

-Stock currently trades at 2.7x on FY26 book & 16x on FY26 EPS

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Salasar Ext | 27.95 | 26.55 | -1.40 0 |

| Bhagyanagar Ind | 103.10 | 98.85 | -4.25 919.94k |

| Viviana Power | 178.00 | 171.00 | -7.00 546 |

| Kundan Edifice | 229.40 | 220.50 | -8.90 - |

| DB (Int) Stock | 35.85 | 34.55 | -1.30 279 |

| SINDHUTRAD | 31.05 | 29.95 | -1.10 1.06m |

| Bannari A Spg | 49.40 | 47.80 | -1.60 7.90k |

| ARHAM | 213.95 | 207.50 | -6.45 648 |

| Asian Hotels | 233.95 | 227.00 | -6.95 447 |

| Venus Remedies | 424.45 | 412.20 | -12.25 122.27k |

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Cybertech | 188.70 | 204.00 | 15.30 9.59k |

| Man Industries | 252.85 | 272.00 | 19.15 9.55k |

| Gokul Refoils | 42.65 | 45.20 | 2.55 12.10k |

| Archidply Decor | 89.50 | 94.40 | 4.90 247 |

| Va Tech Wabag | 617.75 | 646.05 | 28.30 56.63k |

| Guj State Petro | 300.00 | 312.25 | 12.25 145.66k |

| Industrial Inv | 175.50 | 182.00 | 6.50 221 |

| YCCL | 29.25 | 30.20 | 0.95 1000 |

| Damodar Ind | 49.30 | 50.85 | 1.55 1.13k |

| Vertoz Advertis | 470.60 | 485.30 | 14.70 12.38k |

L&T has completed the acquisition of entire shareholding of Sapura Nautical Power Pte Ltd (JV Partner) in L&T Sapura Offshore Private Limited on December 27, 2023.

Stock Market LIVE Updates | Huhtamaki India announces voluntary retirement scheme for employees at Raigad plant

Huhtamaki India rolled out a voluntary retirement scheme (VRS) for certain category of its employees at its Khopoli plant, Raigad, Maharashtra. Hence, 39 employees opted for voluntary retirement involving a pay-out of approximately Rs 5.35 crore to the employees.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 1,715.40 0.74 | 392.47k | 67.39 |

| Reliance | 2,605.75 0.75 | 144.55k | 37.64 |

| ICICI Bank | 1,000.70 -0.1 | 248.29k | 24.97 |

| Tata Steel | 137.90 0.55 | 1.68m | 23.09 |

| SBI | 650.00 0.25 | 356.39k | 23.16 |

| Kotak Mahindra | 1,913.15 0.55 | 118.77k | 22.72 |

| Tata Motors | 749.30 1.17 | 285.60k | 21.26 |

| Power Grid Corp | 237.05 1.48 | 715.40k | 16.94 |

| HUL | 2,624.75 0.59 | 62.21k | 16.27 |

| Bajaj Finance | 7,251.80 0.22 | 20.10k | 14.59 |

Stock Market LIVE Updates | Man Industries announces successful testing of pipes for safe hydrogen transportation

Man Industries (India) announced the successful testing of pipes for safe hydrogen transportation conducted by leading European Research Centre for hydrogen transport.

The Hydrogen Service test, ensuring structural integrity and safety for hydrogen transport. This certification safeguards against challenges related to hydrogen's small molecule size permeating materials more easily than other gases.

This accomplishment marks a critical milestone in addressing a major hurdle in the shift to a hydrogen-based ecosystem i.e. efficiently delivering Hydrogen Gas to the point of use.

Sensex Today | Oil prices stabilise as Red Sea transport disruptions ease

Oil prices steadied on Thursday after falling sharply in the previous session, as concerns eased about shipping disruptions along the Red Sea route even as tensions in the Middle East continued to rise.

Brent crude futures inched up 2 cents to $79.75 a barrel by 0736 GMT, while U.S. WTI crude futures were trading 3 cents lower at $74.08 a barrel. Prices dropped nearly 2% on Wednesday as major shipping firms began returning to the Red Sea.

Stock Market LIVE Updates | PTC Industries signs MoU with Nasmyth, UK to vertically integrate supply chain solutions

PTC Industries has signed a Memorandum of Understanding (MoU) with Nasmyth (UK) for collaboration to leverage their capabilities for offering solutions to defence and aerospace customers in India and globally. The MOU will see Nasmyth and PTC work together in support of the ‘Make in India’ Atmanirbhar Bharat programme.

Stock Market LIVE Updates | Sula Vineyards' wine tourism business achieves new records over Xmas weekend

Sula Vineyards said its wine tourism facilities in Nashik and Bengaluru were visited by 12,000 visitors during December 23-25. With a new single-day high revenue of Rs 85 lakh, December 24th claimed the top spot. It recorded revenue of Rs 2.28 crore during December 23-25.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 72358.20 0.44 | 18.93 2.11 | 9.35 18.79 |

| BSE 200 | 9619.86 0.42 | 22.51 2.28 | 9.46 22.53 |

| BSE MIDCAP | 36433.28 0.4 | 43.92 2.28 | 8.07 44.33 |

| BSE SMALLCAP | 42355.97 0.16 | 46.42 1.89 | 6.34 47.86 |

| BSE BANKEX | 54713.36 0.51 | 11.87 1.49 | 10.54 12.29 |

Stock Market LIVE Updates | Kotak Mahindra Bank to appoint C S Rajan, as part-time Chairman

The Reserve Bank of India has approved the appointment of C S Rajan, an Independent Director on the board of Kotak Mahindra Bank, as the part-time Chairman of the bank, for two years, with effect from January 1, 2024.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 21759.55 0.48 | 20.18 2.37 | 9.40 20.07 |

| NIFTY BANK | 48569.65 0.6 | 12.99 1.52 | 10.69 13.41 |

| NIFTY Midcap 100 | 45712.35 0.34 | 45.08 2.11 | 8.12 45.93 |

| NIFTY Smallcap 100 | 15028.55 0.64 | 54.44 2.32 | 8.36 55.91 |

| NIFTY NEXT 50 | 52916.85 0.45 | 25.43 2.71 | 12.20 25.21 |

Stock Market LIVE Updates | Peninsula Land approves allotment of equity shares and CCDs worth Rs 100 crore to Delta Corp

The Allotment Committee of Peninsula Land has approved the allotment of 1.5 crore equity shares for Rs 66 crore, and 77.27 lakh 0% unsecured compulsorily convertible debentures (CCDs) worth Rs 40 crore, to the Delta Corp Limited, a member of the promoter group of the company.

Stock Market LIVE Updates | Adani Enterprises arm Adani Global, Mauritius forms JV with UAE-based Sirius

Adani Enterprises through its wholly owned subsidiary (WOS), Adani Global Limited, Mauritius has executed a term-sheet for formation of 49:51 Joint Venture (JV) with UAE-based Sirius International Holding Limited, UAE.

Stock Market LIVE Updates | Kajaria Ceramics board approves increase investment limits in arm

The Board of Directors of Kajaria Ceramics at its meeting held today has approved increase in the limits of investment by the Company in Kajaria Plywood Private Limited (KPPL), a wholly-owned subsidiary company, from Rs 80 crores to Rs 115 crores, in one or more tranches, through subscription of equity shares of KPPL and/or granting of unsecured loan to KPPL.

Additional acquisition of 18,90,000 equity shares of Rs 10 each of South Asian Ceramic Tiles Private Limited, a subsidiary company, at a consideration aggregating to Rs 510.30 lakh subject to applicable laws.

Sensex Today | Market at 1 PM

The Sensex was up 331.54 points or 0.46 percent at 72,369.97, and the Nifty was up 99.50 points or 0.46 percent at 21,754.30. About 1566 shares advanced, 1652 shares declined, and 99 shares unchanged.

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Ambica Agar | 31.19 | 28.24 | -2.95 17 |

| Roselabs Fin | 21.98 | 20.38 | -1.60 25 |

| Scan Steels | 59.65 | 55.52 | -4.13 12.19k |

| Sakthi Finance | 51.49 | 47.95 | -3.54 11.56k |

| Keerthi Ind | 138.45 | 129.05 | -9.40 118 |

| Dhanalaxmi Cote | 75.00 | 70.11 | -4.89 0 |

| Sanblue Corp | 40.86 | 38.30 | -2.56 15 |

| Emerald Leisure | 123.00 | 116.00 | -7.00 50 |

| SSPDL | 22.00 | 20.76 | -1.24 2.71k |

| Amco India | 67.85 | 64.21 | -3.64 149 |

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Bhagyanagar Ind | 86.95 | 104.17 | 17.22 235 |

| Hind Org Chem | 41.90 | 46.65 | 4.75 139.74k |

| Chemo-Pharma | 57.15 | 63.00 | 5.85 7 |

| Jeevan Scient | 57.75 | 63.00 | 5.25 6.06k |

| GS Auto | 24.30 | 26.10 | 1.80 4.80k |

| Guj Craft Ind | 127.40 | 136.15 | 8.75 165 |

| JMJ Fintech | 19.97 | 21.23 | 1.26 751 |

| Bangalore Fort | 20.20 | 21.39 | 1.19 32 |

| Vineet Lab | 69.76 | 73.49 | 3.73 238 |

| Capital Trade | 34.32 | 36.11 | 1.79 16.09k |

Stock Market LIVE Updates | Morgan Stanley View On Aarti Industries:

-Overweight call, target Rs 575 per share

-Agrochemicals makes up one-third of company's revenue

-Start-up of supplies under the contract will steadily improve asset turns

-Supplies under the new contract could be earnings accretive

-Contract implies annual revenue of $40 m

-Contract implies 3-4 percent accretion to EBITDA over FY25-26 assuming margin of 18 percent

-Contract implies 6-7 percent accretion to earnings over FY25-26 assuming margin of 18 percent

Stock Market LIVE Updates | South Indian Bank to raise Rs 1,750 crore via rights issue

South Indian Bank said the Board of Directors has approved the fund raising of Rs 1,750 crore through issue of equity shares of the bank on a right basis to its existing eligible shareholders.

Sensex Today | BSE Power index gained 1 percent supported by BHEL, Suzlon Energy, NTPC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BHEL | 190.65 | 4.75 | 4.41m |

| Suzlon Energy | 38.27 | 3.29 | 8.08m |

| NTPC | 313.35 | 2.42 | 384.75k |

| Power Grid Corp | 237.55 | 1.69 | 563.04k |

| CG Power | 460.35 | 0.43 | 42.56k |

| Siemens | 3,990.70 | 0.4 | 5.73k |

| NHPC | 64.38 | 0.33 | 706.35k |

| Tata Power | 325.10 | 0.05 | 704.61k |

Stock Market LIVE Updates | Confidence Petroleum India subsidiary bags order worth Rs 67 crore from BPCL

Confidence Enterprises, the subsidiary of Confidence Futuristic Energetech, has received Letter of acceptance from Bharat Petroleum Corporation to supply 450 numbers of CNG Type-I CNG mobile/stationary cascades for BPCL CGD projects worth Rs 67 crore. Confidence Futuristic Energetech is a subsidiary of Confidence Petroleum India.

Stock Market LIVE Updates | Coromandel International gets TNPCB order to restart Ammonium Phosphate Potash Sulphate (APPS) Plant

Coromandel International gets order from Tamil Nadu Pollution Control Board (TNPCB) to restart the Ammonium Phosphate Potash Sulphate (APPS) Plant and other allied units only after ensuring the ammonia pipeline inside the plant are intact and safe and shall obtain NOC from Directorate of Industrial Safety and Health.

Stock Market LIVE Updates | Avendus Spark On Lupin

-Upgrade to buy, target Rs 1,440 per share

-Underappreciated margin levers

-Stability of in-licensed portfolio, MR productivity improvement to aid margin

-Scale up of formulations business ex-India & US in recent years is underappreciated

-See multiple offsets to gSuprep, gPrezista competition in US business

-gSpiriva Rx to ramp-up materially from current levels

-Estimate 16 percent margin in H2FY24

-Continue to remain conservative even in FY25/FY26 at 18 percent/19 percent

Mehta Equities View on Azad Engineering:

Despite bullish sentiment prevailing in the market has pushed markets to fresh life-time highs, the Azad Engineering stock made a below street expectation listing. We believe conservative investors are willing to book profits post listing looking at the last few listed performances which have also underperformed against street expectations.

We believe Azad’s mission and life critical components product profile create a high entry barrier which requires a long and rigorous approval process for any competitor. In the long run we see a lot of growth opportunities come through expansion plans and gaining market share globally from 1% to multifold due to larger wallet share contributions from long standing clientele like Mitsubishi Heavy, General Electric, Honeywell International, Siemens Energy and many more. We think Azad is in the right space and product profile to tap GOI focus under Make in India and the trust Azad has built in its 15 years of business operations would help the company to grow healthy in coming years.

Given the niche product profile with mission and life critical components demand along with ~80% export revenue and superior margin profile, Azad would command a higher valuation multiple. Hence, considering all the parameters, we are recommending allotted long term investors to “HOLD”. For non-allotted investors one can wait and watch for any dips post listing to accumulate and look to hold for a long term like 3-5 years’ time horizon.

Sensex Today | Nifty PSU Bank index up 0.7 percent led by Punjab National Bank, Canara Bank, Indian Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 94.50 | 2.94 | 74.96m |

| Canara Bank | 440.55 | 1.86 | 10.35m |

| Indian Bank | 419.80 | 0.97 | 1.42m |

| Central Bank | 49.45 | 0.82 | 13.74m |

| Union Bank | 119.60 | 0.46 | 7.78m |

| UCO Bank | 40.05 | 0.38 | 7.93m |

| IOB | 43.40 | 0.23 | 9.15m |

| Bank of India | 111.15 | 0.18 | 10.97m |

| SBI | 649.45 | 0.14 | 6.79m |

| Bank of Baroda | 232.15 | 0.06 | 12.64m |

Stock Market LIVE Updates | HDFC Mutual Fund picks 1.96% stake in Suprajit Engineering

HDFC Mutual Fund through its several schemes bought 1.96% stake or 27.2 lakh shares in Suprajit Engineering via open market transactions on December 22. With this, HDFC MF's total shareholding in the company increased to 7.03%, from 5.07% earlier.

Stock Market LIVE Updates | Suzlon Energy rises 4% on bagging order for supply of 100 wind turbines

Shares of Suzlon Energy Limited traded 4 percent higher at Rs 38.5 intraday on December 28 after the company announced winning an order for the development of a 300-MW wind power project for Apraava Energy.

As part of the order, Suzlon will install 100 wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 3 MW each at the client’s site in Karnataka, the company said in a filing on December 28. Read More

Sensex Today | Market at 12 PM

The Sensex was up 276.69 points or 0.38 percent at 72,315.12, and the Nifty was up 75.70 points or 0.35 percent at 21,730.50. About 1567 shares advanced, 1629 shares declined, and 94 shares unchanged.

| Company | Price at 11:00 | Price at 11:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Rockingdeals | 331.95 | 311.00 | -20.95 17.35k |

| Magson Retail | 131.50 | 124.20 | -7.30 11.00k |

| Industrial Inv | 184.15 | 175.50 | -8.65 573 |

| Arrow Greentech | 460.80 | 442.20 | -18.60 8.01k |

| Wealth First Po | 416.95 | 402.00 | -14.95 80 |

| ACE Integrated | 40.70 | 39.25 | -1.45 6.37k |

| Tantia Const | 27.35 | 26.40 | -0.95 14.61k |

| WS Industries | 115.00 | 111.25 | -3.75 10.02k |

| Sahaj Fashions | 30.35 | 29.45 | -0.90 - |

| Indo Tech Trans | 650.00 | 632.50 | -17.50 1.63k |

| Company | Price at 11:00 | Price at 11:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| NFL | 84.80 | 92.75 | 7.95 2.02m |

| AARTIPP | 366.00 | 399.65 | 33.65 243 |

| Madras Fert | 103.85 | 113.05 | 9.20 195.33k |

| Ashoka Metcast | 27.00 | 29.30 | 2.30 89.86k |

| Abhishek | 26.05 | 27.95 | 1.90 6.00k |

| GSFC | 231.00 | 244.90 | 13.90 548.80k |

| Euro India Fres | 147.35 | 156.05 | 8.70 146 |

| Dishman Carboge | 163.65 | 173.20 | 9.55 672.35k |

| Gallantt Ispat | 172.10 | 181.65 | 9.55 1.71m |

| Rashtriya Chem | 153.90 | 162.20 | 8.30 1.22m |

Stock Market LIVE Updates | Power Grid Corporation acquires Neemrana II Bareilly Transmission

Power Grid acquired Neemrana II Bareilly Transmission (NIIBTL), the project special purpose vehicle (SPV) to establish transmission system for evacuation of power from Rajasthan REZ Ph-IV (Part-1) (Bikaner Complex): PART-D, on build, own, operate and transfer (BOOT) basis from the bid process coordinator – PFC Consulting, for Rs 18.47 crore.

The project comprises of establishment of a new 765 kV D/C transmission line traversing in Rajasthan and Uttar Pradesh along with associated bay extension works. Power Grid also acquired Bikaner III Neemrana Transmission, the project SPV to establish transmission system for evacuation of power from Rajasthan REZ Ph-IV (Part-1) (Bikaner Complex): PART-A, for Rs 18.82 crore.

Sensex Today | BSE Metal index up 1 percent supported by SAIL, Coal India, NMDC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SAIL | 121.28 | 5.08 | 3.33m |

| Coal India | 374.50 | 2.46 | 272.09k |

| NMDC | 206.00 | 2.28 | 363.83k |

| Vedanta | 257.75 | 2.16 | 390.35k |

| Hindalco | 611.55 | 1 | 155.85k |

| Jindal Steel | 740.35 | 0.96 | 24.30k |

| Jindal Stainles | 563.10 | 0.82 | 40.86k |

| Tata Steel | 138.05 | 0.66 | 1.26m |

| JSW Steel | 880.35 | 0.42 | 125.51k |

Sensex Today | FirstCry parent Brainbees Solutions files IPO papers with SEBI

Online retailer FirstCry's parent Brainbess Solutions has filed for an initial public offering with market regulator SEBI. The company will sell shares worth Rs 1,816 crore, according to the Draft Red Herring Prospectus (DRHP). and existing investors, including SoftBank, will sell up to 54.4 million shares

Stock Market LIVE Updates | Life Insurance Corporation appoints S Sunder Krishnan as Chief Risk Officer

S Sunder Krishnan is appointed as Chief Risk Officer of Life Insurance Corporation of India with effect from December 27. Pratap Chandra Paikray has ceased as Chief Risk Officer of the LIC.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 1,721.00 1.07 | 147.03k | 25.22 |

| Tata Steel | 138.00 0.62 | 1.23m | 16.92 |

| Kotak Mahindra | 1,910.30 0.4 | 83.50k | 15.96 |

| ICICI Bank | 1,004.10 0.23 | 158.54k | 15.96 |

| SBI | 648.70 0.05 | 235.90k | 15.33 |

| Tata Motors | 746.00 0.73 | 201.80k | 14.99 |

| Reliance | 2,601.35 0.58 | 52.80k | 13.71 |

| JSW Steel | 881.50 0.55 | 125.44k | 11.10 |

| Bajaj Finance | 7,248.20 0.17 | 13.92k | 10.11 |

| HUL | 2,612.35 0.12 | 35.83k | 9.36 |

Stock Market LIVE Update | "Made timely payment of interest to debenture holders on debentures worth Rs 2,500 crore," says Vedanta

Stock Market LIVE Update | Hudco surges over 17% to new record high on Rs 14,500 crore MoU With Gujarat government

Stock Market LIVE Update | KEC International stock gains as it bags new order worth Rs 1,566 crore

Sensex Today | Market at 11 AM

The Sensex was up 127.24 points or 0.18 percent at 72,165.67, and the Nifty was up 38.10 points or 0.18 percent at 21,692.90. About 1530 shares advanced, 1616 shares declined, and 92 shares unchanged.

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Mohit Paper Mil | 29.59 | 26.82 | -2.77 3.50k |

| Oasis Sec | 104.35 | 95.00 | -9.35 101 |

| Ace Men Engg Wo | 60.90 | 55.60 | -5.30 1.35k |

| Pankaj Piyush | 139.50 | 127.55 | -11.95 583 |

| Dhatre Udyog | 230.00 | 211.85 | -18.15 1.09k |

| Krishna Venture | 79.95 | 74.28 | -5.67 6.31k |

| Global Offshore | 68.42 | 63.89 | -4.53 4.18k |

| Ecoboard Inds | 29.99 | 28.21 | -1.78 978 |

| Cyber Media | 33.11 | 31.16 | -1.95 4.51k |

| Regis | 104.99 | 99.00 | -5.99 76 |

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Nimbus Projects | 35.15 | 40.90 | 5.75 16 |

| Hindoostan Mill | 239.90 | 264.95 | 25.05 35 |

| Balgopal Commer | 30.78 | 33.75 | 2.97 3 |

| Sarla Performan | 52.86 | 57.85 | 4.99 7.47k |

| Arrow Greentech | 419.45 | 454.95 | 35.50 1.22k |

| Nutech Global | 31.49 | 33.87 | 2.38 0 |

| Mercury Ev-Tech | 110.09 | 117.99 | 7.90 173.36k |

| Dhanalaxmi Cote | 70.01 | 75.00 | 4.99 0 |

| Rajdarshan Ind | 38.52 | 41.00 | 2.48 0 |

| Premier Synth | 25.27 | 26.84 | 1.57 200 |

Sensex Today | Shrey Jain, Founder and CEO SAS Online:

Indian stocks are reaching new highs, buoyed by optimism surrounding the nation's macroeconomic fundamentals and robust global market trends. Currently, Nifty is at 21,700, with Bank Nifty surpassing 48,400.

Looking at the technical side, Nifty50 is expected to stay supported between 21,575 and 21,600. The 21,800 Call strike has a lot of interest with about 82 lakh shares. On the other hand, the 21,500 Put strike is also significant with around 135 lakh shares.

For Bank Nifty, a strong support range is between 48,000 and 48,150. The 48,500 Call strike has meaningful interest with about 26 lakh shares. Meanwhile, on the Put side, the 48,000 strike has a considerable interest of around 36 lakh shares.

Overall market sentiments are positive, FIIs have made substantial purchases, once again, adopting a "buy on dip" strategy is advisable.

Stock Market LIVE Updates | PTC Industries in supply chain solutions pact with Nasmyth

Shares of PTC Industries are trading flat on December 28 after it entered into a pact with Nasmyth (UK) with focus on offering solutions to defence and aerospace customers.

Nasmyth and PTC will work together in support of the ‘Make in India’ Atmanirbhar Bharat programme. This collaboration also addresses the growing demand for vertically integrated supply chain solutions.

By increasing capacity in the market, the partnership aims to provide global solutions to original equipment manufacturers (OEMs) seeking to diversify and de-risk their supply chains while offering opportunities for capacity growth. Read More

Stock Market LIVE Updates | Cerebra Integrated Technologies reappoints V Ranganathan as Managing Director

Cerebra Integrated Technologies' board has reappointed V Ranganathan as Managing Director, and P Vishwamurthy as Wholetime Director of the company for three years with effect from January 1, 2024.

Sensex Today | BSE Oil & gas index up 1 percent supported by HPCL, Petronet LNG, GAIL India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HINDPETRO | 398.00 | 4.24 | 123.57k |

| Petronet LNG | 222.00 | 2.64 | 274.67k |

| GAIL | 155.00 | 2.11 | 404.22k |

| IOC | 128.80 | 1.66 | 671.43k |

| BPCL | 461.15 | 1.44 | 68.39k |

| Linde India | 5,632.10 | 1.04 | 1.44k |

| IGL | 413.05 | 0.56 | 55.91k |

| ONGC | 206.45 | 0.54 | 134.50k |

| Reliance | 2,593.00 | 0.26 | 26.07k |

Stock Market LIVE Updates | Oil India skids on payment of Rs 551 cr to Numaligarh Refinery for rights issue

Shares of Oil India had a muted start of the day on the NSE on December 28, a day after the oil and gas major payed Rs 551 crore to Numaligarh Refinery against a rights issue. At 9:20 am, the stock was trading in the red at Rs 380.20.

According to an exchange filing, Oil India has paid the second call of Rs 551 crore to Numaligarh Refinery at Rs 27.50 per equity share. Numaligarh Refinery, according to the filing, has allotted 20,03,44,555 partly paid-up equity shares to Oil India under rights issue allotment. The company holds 69.63 percent in Numaligarh Refinery.

Stock Market LIVE Updates | Antique View on CESC

Buy, target raised to Rs 150 from Rs 93

Company undergoing radical changes

Setting up 3GW of RE generation plants; phase wise contribution will add Rs 6 bn/GW of EBITDA by FY26

Chandrapur–600 MW is selling 70 MW of power in spot—with option to add 230 MW at higher prices

Sensex Today | HDFC Bank market capitalisation crosses Rs 13 lakh crore:

Sensex Today | Shivani Nyati, Head of Wealth, Swastika Investmart:

Azad Engineering, the manufacturer of forged components, made a solid debut on the stock market, listing at Rs 720 per share, a substantial 37% premium over its IPO price of Rs 524. While this performance demonstrates strong investor interest, it falls short of the pre-listing excitement that anticipated a potentially higher rise.

Azad Engineering's successful listing signifies its strong fundamentals and growth potential. For investors seeking exposure to the manufacturing sector with high growth potential, Azad Engineering offers a compelling opportunity, and existing investors in the IPO may consider holding their shares. However, a cautious approach is advised due to the full valuation and potential risks, and thus a stop loss of around 650 is recommended.

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| HUDCO | 129.29 | 129.29 | 128.99 |

| Hind Copper | 255.15 | 255.15 | 252.95 |

| CESC | 132.80 | 132.80 | 132.73 |

| NALCO | 122.60 | 122.60 | 121.50 |

| BHEL | 190.55 | 190.55 | 187.35 |

| HEG | 1940.00 | 1940.00 | 1,935.05 |

| SAIL | 119.68 | 119.68 | 118.50 |

| PNB | 94.20 | 94.20 | 93.85 |

| Hero Motocorp | 4148.90 | 4148.90 | 4,146.00 |

| Sona BLW | 633.00 | 633.00 | 622.55 |

Sensex Today | Azad Engineering lists at Rs 720, over 37% premium to IPO price:

Sachin Tendulkar-backed Azad Engineering saw a strong start on bourses on December 28, listing at 37.4 percent premium against its issue price. The stock began trading at Rs 720 on the NSE and Rs 710 on the BSE, while its IPO price was Rs 524.

The strong listing comes on the back of good interest shown by investors in the company's Rs 740-crore public issue. Qualified institutional buyers took the lead, buying 179.66 times the allotted quota. At the same time, high net worth individuals (non-institutional investors) and retail investors picked shares 87.55 times and 23.71 times the portions set aside for them, respectively.

Stock Market LIVE Updates | L&T Construction wins large orders for its Power Transmission & Distribution (PT&D) business:

The Power Transmission & Distribution business of L&T Construction has secured key orders in the Middle East region.

In the United Arab Emirates, the business has received an order for Engineering, Supply, Construction, Installation, Testing and Commissioning a 400/132kV Substation. The scope also includes associated Transformer, Reactor and Substation Control & Monitoring Systems (SCMS).

In Kuwait, the business has won an order to establish 400kV Overhead Transmission Lines along with associated 400kV Underground Cable interconnections. This transmission segment of more than 100KM route length will help to evacuate and generate power. Additional orders have been won in ongoing substation orders in the region.

| Company | Price at 09:00 | Price at 09:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Wonder Elect. | 442.30 | 407.70 | -34.60 1.81k |

| Global Vectra | 132.95 | 124.15 | -8.80 27.44k |

| Magson Retail | 131.50 | 123.00 | -8.50 0 |

| AksharChem | 321.55 | 303.50 | -18.05 89.57k |

| Gallantt Ispat | 186.65 | 177.15 | -9.50 12.00k |

| Sky Gold | 1,054.05 | 1,001.35 | -52.70 531 |

| Vishnusurya Pro | 423.25 | 402.10 | -21.15 6.40k |

| Starteck Financ | 389.50 | 370.05 | -19.45 23 |

| Sikko Industrie | 102.25 | 97.15 | -5.10 17.70k |

| Times Guaranty | 149.35 | 141.90 | -7.45 181 |

| Company | Price at 09:00 | Price at 09:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| RPP Infra PP | 10.00 | 36.50 | 26.50 36.32k |

| Banka Bioloo | 73.05 | 87.65 | 14.60 55.50k |

| SecMark Consult | 110.15 | 127.05 | 16.90 20.32k |

| HUDCO | 114.00 | 128.30 | 14.30 16.15m |

| Greenpanel Ind | 392.20 | 432.85 | 40.65 108.29k |

| Gujarat Apollo | 245.15 | 269.65 | 24.50 26.65k |

| VLEGOV | 49.90 | 54.85 | 4.95 124.19k |

| Suprajit Eng | 371.70 | 405.50 | 33.80 17.48k |

| Hind Copper | 235.25 | 254.10 | 18.85 2.01m |

| P E Analytics | 250.00 | 267.85 | 17.85 1000 |

Stock Market LIVE Updates | CCI approves acquisition of stake in Reliance Capital by IndusInd International Holdings, IIHL BFSI (India), and Aasia Enterprises LLP

The Competition Commission of India (CCI) has approved acquisition of the stake in Reliance Capital by IndusInd International Holdings Limited, IIHL BFSI (India) Limited, and Aasia Enterprises LLP. Reliance Capital is undergoing insolvency resolution proceedings initiated under the Insolvency and Bankruptcy Code.

Sensex Today | BSE Metal index up 0.6 percent supported by SAIL, Jindal Stainless, JSW Steel:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SAIL | 118.71 | 2.85 | 1.19m |

| Jindal Stainles | 564.70 | 1.11 | 22.80k |

| JSW Steel | 885.00 | 0.95 | 73.67k |

| Vedanta | 254.40 | 0.83 | 144.39k |

| Hindalco | 610.45 | 0.82 | 95.44k |

| Coal India | 367.70 | 0.6 | 59.95k |

| NMDC | 202.35 | 0.47 | 93.17k |

| Jindal Steel | 735.50 | 0.3 | 10.56k |

| Tata Steel | 137.55 | 0.29 | 704.12k |

Stock Market LIVE Updates | BofA Securities Europe picks 0.7% shares in Droneacharya Aerial Innovations

Foreign investor BofA Securities Europe SA has acquired 1.67 lakh shares in Droneacharya Aerial Innovations at an average price of Rs 187.65 per share.

Stock Market LIVE Updates | India VIX up nearly 3 percent, after hitting 9-month high in the previous session:

Stock Market LIVE Updates | Hypnos Fund offloads 1.2% stake in Swan Energy

Foreign portfolio investor Hypnos Fund sold 32,82,958 equity shares in Swan Energy via open market transactions. These shares were offloaded at an average price of Rs 500.58 per share, amounting Rs 164.33 crore. The fund held 32,92,758 equity shares or 1.25% stake in Swan as of September 2023.

Sensex Today | Nifty Bank index up 0.4 percent led by Punjab National Bank, Federal Bank, Bank of Baroda:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 93.65 | 2.02 | 28.62m |

| Federal Bank | 155.30 | 0.84 | 1.78m |

| Bank of Baroda | 233.50 | 0.65 | 4.21m |

| Kotak Mahindra | 1,912.70 | 0.54 | 641.38k |

| ICICI Bank | 1,007.30 | 0.5 | 1.88m |

| HDFC Bank | 1,711.05 | 0.45 | 2.96m |

| Bandhan Bank | 239.00 | 0.42 | 891.28k |

| IDFC First Bank | 89.20 | 0.39 | 3.98m |

| SBI | 650.00 | 0.22 | 2.19m |

Stock Market LIVE Updates | Tamil Nadu Pollution Control Board says no further leakage from Coromandel International liquid ammonia pipeline

The Tamil Nadu government had temporarily suspended the operation of the Coromandel International plant at Ennore near Chennai after an ammonia leak at its facility late at night on December 26. Tamil Nadu Pollution Control Board said no further leakage as found from the pipeline. The government has directed the company to identify and rectify damages before resuming ammonia transfer.

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The rally looks set to continue supported by the leading banks which are witnessing institutional accumulation. Strong cues from the mother market US, steadily declining US bond yields and the dollar index below 101 augur well for the continuation of the rally. It is important to note that high quality large caps have taken the leadership in this rally which has taken the Sensex above 72k.

A significant market indicator is the volatility index VIX rising above 15. Investors should take this as an indication of high volatility ahead. Remaining invested is important in a bull market. But chasing the market at high valuations would be highly risky.

Stock Market LIVE Updates | KP Energy to consider the issue of bonus shares on December 30

The company said the Board of Directors will meet on December 30 to consider the proposal for issue of bonus equity shares to the shareholders of the company.