Bulls charged the markets harder on December 28, sending Nifty 50 to a fresh lifetime high. The headline index topped the 21,700 mark for the first time ever. Positive cues from global markets, easing dollar index and lower crude prices, coupled with expectations of the Federal Reserve's race-cut pivot boosted the investor sentiment in local markets.

Around 12 noon, the Nifty was up 82.40 points or 0.38 percent at 21,737.20. About 1,541 shares gained, 1,633 fell, and 105 traded unchanged.

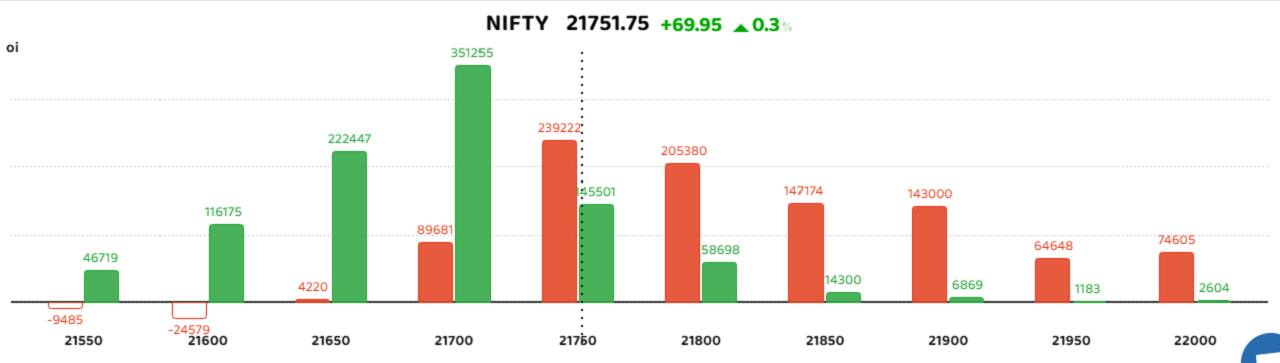

The bars in green represent the change in the put open interest (OI) and the red the change in OI for call options.

The bars in green represent the change in the put open interest (OI) and the red the change in OI for call options.

Bulls provided strong support to the market as they remained heavily active across 21,700, and 21,650 strike prices. This suggests limited downside risks from the current levels. On the upside, call writers added positions across 21,750, followed by 21,800 and 21,850 strikes, hinting at some resistance in the Nifty 50's upward journey.

Follow our market blog to catch all the live action

Some volatility can also be expected in the second half of trade as traders are likely to roll over positions to the January F&O series ahead of the expiry of the December derivatives series, due at market close.

Analysts remain hopeful to see a continuation of the strong momentum seen across the market in recent weeks. According to Sameet Chavan, technical analyst at Angel One, prices may continue the upward move in the near term towards the 22,000 mark, with 21,800-21,850 serving as the immediate resistance.

"On the downside, bulls remain resilient, quickly buying any minor dips. Looking ahead, the bullish gap left on December 27 around 21,500-214,80 is likely to act as a strong support, before that the previous resistance around 21,600 will serve as the immediate support," Chavan said.

As for individual stocks, metal counters like Hindustan Copper, NMDC, SAIL, and National Aluminium Co saw strong addition of long positions amidst a fall in the dollar index. Laurus Labs, Dr Lal Path Labs, Biocon and Delta Corp saw the addition of short bets which hints at a possibility of a downside in the near term.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!