LiveNow

Closing Bell: Sensex up 487 pts, Nifty above 22,550 on another day of gains; PSU Bank outshines

Indian benchmark indices ended higher for the fifth consecutive session on April 25 led by buying across the sectors barring realty. At close, the Sensex was up 486.50 points or 0.66 percent at 74,339.44, and the Nifty was up 167.90 points or 0.75 percent at 22,570.30.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit www.moneycontrol.com/markets/global-indices for all the global market action.

Nifty to remain strong with upside potential of 22750-22800, says Rupak De, Senior Technical Analyst, LKP Securities

The Bulls finally had their day as the Nifty ended with a significant green candle following a series of small candles, suggesting meaningful buying activity during the day. Moreover, the index continues to stay above the 21-day Exponential Moving Average (EMA), which is a critical near-term moving average. Additionally, the momentum indicator RSI is showing a bullish crossover, indicating positive momentum in the index value.

Over the short term, the index might remain strong with an upside potential ranging between 22750-22800. On the lower end, support is placed at 22450.

Bank Nifty may move towards 49000/50000 mark, says Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

In today's trading session, the BankNifty index exhibited significant bullish strength as it surpassed the immediate hurdle of 48300. This momentum reflects a strong comeback by the bulls. The index remains in a buy mode, with robust support noted at 48000, where the highest open interest is observed on the put side. Additionally, during today's session, the index found strong support at its 20DMA, leading to a notable reversal, indicating potential further upside towards the 49000/50000 mark.

Nifty may move towards 22,750, says Aditya Gaggar Director of Progressive Shares

The markets witnessed an extreme volatile session. After a tepid opening, a quick recovery was seen but then a knee-jerk reaction again dragged the Index back into red. However, under the leadership of the banking stocks especially the PSU's, a sharp reversal was seen across the board and Nifty50 settled the monthly expiry day at 22,570.35 with gains of 167.95 points. Except for Realty, all the other sectors ended the day in green with PSU Banks and Pharma being the outperformers. Meanwhile, a mixed trend was observed in the broader markets where Midcaps underperformed and Smallcaps moved in tandem with the Benchmark Index.

With a bullish engulfing candlestick pattern, the Index has filled the bearish gap zone of 22,430-22,500 and is all set to move toward its previous high of 22,750 while the support level has been shifted higher to 22,450.

Bank Nifty may move towards 49000/50000 mark, says Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

In today's trading session, the BankNifty index exhibited significant bullish strength as it surpassed the immediate hurdle of 48300. This momentum reflects a strong comeback by the bulls. The index remains in a buy mode, with robust support noted at 48000, where the highest open interest is observed on the put side. Additionally, during today's session, the index found strong support at its 20DMA, leading to a notable reversal, indicating potential further upside towards the 49000/50000 mark.

Sensex Today | Tech Mahindra Q4 jumps to Rs 661 crore

Net profit rose 29.5% at Rs 661 crore versus Rs 510.4 crore and rupee revenue down 1.8% at Rs 12,871.3 crore versus Rs 13,101.3 crore, QoQ.

Expect positive momentum to continue, says Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The Nifty witnessed a volatile day of trade today. It opened gap down and witnessed volatile price action during the first half of the session. The second half witnessed a range breakout which helped it to close with gains of ~150 points. The hourly momentum indicator has triggered a positive crossover which is a buy signal and thus we expect the positive momentum to continue over the next few trading sessions. On the upside the next immediate hurdle is placed at 22776. The stop-loss for long positions should be trailed at 22430 levels which is the 20-hour moving average.

As far as the Bank Nifty is concerned the knee jerk reaction was bought into and the Bank Nifty witnessed a smart recovery to close with gains of ~300 points post opening down almost ~400 points.

Going ahead we expect the momentum to continue and minor degree pullbacks should be used as a buying opportunity. On the upside, the next hurdle is placed at 49000. Longs should be held with a trialing stoploss at 48200 which is the 20-hour moving average.

Sensex Today | Rupee closes flat

Indian rupee ended flat at 83.32 per dollar on Thursday versus Wednesday's close of 83.32.

Vedanta Q4 Earnings

Net profit down 27.4% at Rs 2,273 crore versus Rs 3,132 crore

Revenue down 6.4% at Rs 35,509 crore versus Rs 37,930 crore

Sensex Today | Coromandel International Q4 consolidated profit down Rs 164 crore from Rs 264 crore, YoY

Sensex Today | Nomura maintains buy rating on Zydus Life, target Rs 988

-USFDA issued 10 observations for Jarod injectable site

-Details of observations are not yet known

-Concerns are there given relatively large number of observations and relatively high risk of compliance failures for injectable sites

-Jarod is one of company’s three injectable manufacturing facilities that caters to US Market

-Jarod also contributes 3 percent of US revenue

Sensex Today | Morgan Stanley keeps overweight rating on Indian Hotels, target Rs 529

-Company’s Q4 EBITDA missed estimate and bloomberg consensus estimates by 5-6 percent

-Core business remains on-track

-Weaker-than-expected numbers in international subsidiaries drove the miss

-Company saw continued demand and muted supply growth in core markets

-Multi-brand portfolio, and strong FCF keep us overweight

Sensex Today | Laurus Labs shares down 2.5% as Q4 profits falls 26%

Net profit down 26.2% at Rs 76 crore versus Rs 103 crore and revenue up 4.3% at Rs 1,440 crore versus Rs 1,381 crore, YoY.

Sensex Today | Morgan Stanley cut target of LTIMindtree to Rs 4,600; shares down

-Kept Equal-weight call

-Expectation of growth returning from Q1

-Continued strong net income conversion to FCF are positives

-Stock has underperformed YTD

-Material uptick in growth in FY25 versus FY24 requires superior execution

-Margin may have more headwinds than tailwinds

Sensex Today | Market at 3 PM

The Sensex was up 552.25 points or 0.75 percent at 74,405.19, and the Nifty was up 175.90 points or 0.79 percent at 22,578.30. About 1814 shares advanced, 1422 shares declined, and 96 shares unchanged.

Sensex Today | Morgan Stanley keeps overweight call on AU Small Finance Bank

-Target Rs 850 per share

-Q4 profit before tax was 14 percent above estimate

-Q4 PBT above estimate mainly led by lower provisions, at 0.7 percent versus estimate of 0.9 percent

-Core PpOP grew 15 percent YoY and was 6 percent above estimate for Q4

-NII was in-line, fee income beat was partly offset by higher opex

-Average LCR stood at 117 percent versus 123 percent last quarter

Sensex Today | Puravankara shares gain 5% after arm secures Rs 1,150 crore investment

Provident Housing, a wholly owned subsidiary of Puravankara, secures Rs 1,150 crore investment from HDFC Capital, with a potential GDV of Rs 17,100 crore.

Sensex Today | AGI Greenpac's furnaces unit shut down temporarily

AGI Greenpac has informed that due to maintenance, one of the furnaces at the company's Hyderabad Plant has been temporarily shut down.

Stock Market LIVE Updates | ACC shares gain as Q4 profit jumps to Rs 748.5cr

Net profit at Rs 748.5 crore versus Rs 236 crore and revenue up 12.7% at Rs 5,398 crore versus Rs 4,790 crore, YoY.

Sensex Today | Nifty PSU Bank index hits fresh record high; IOB, SBI, Bank Of India top gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IOB | 66.80 | 5.61 | 34.14m |

| SBI | 810.75 | 4.87 | 26.73m |

| Bank of India | 151.25 | 4.71 | 22.35m |

| UCO Bank | 56.75 | 4.22 | 20.74m |

| Bank of Baroda | 269.35 | 3.96 | 16.76m |

| Central Bank | 65.80 | 3.7 | 22.64m |

| Indian Bank | 527.90 | 3.52 | 2.29m |

| Canara Bank | 617.50 | 3.44 | 9.18m |

| Punjab & Sind | 62.20 | 2.56 | 4.91m |

| JK Bank | 132.65 | 2.43 | 2.80m |

Sensex Today | Expect rupee to trade with a slight negative bias, says Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas

Indian Rupee fell by 6 paise on Thursday on rising US treasury yields and weak Asian currencies. Continued selling pressure from FIIs also weighed on the Rupee. However, a soft US Dollar and mixed to positive tone in the domestic equities cushioned the downside. US Dollar gained on Wednesday on better than expected durable goods orders from US while the greenback eased today ahead of GDP data.

We expect Rupee to trade with a slight negative bias on recovery in crude oil prices and mixed to weak Asian and European markets. However, a soft Dollar amid easing geopolitical tensions in the Middle East may support the Rupee at lower levels.

Traders may take cues from Advance GDP, weekly unemployment claims and pending home sales data from the US. Investors may remain cautious ahead of inflation data tomorrow. USDINR spot price is expected to trade in a range of Rs 83.10 to Rs 83.70.

Sensex Today | Kotak Mahindra Bank shares down 11.5%; CLSA maintains outperform call

-Target Rs 2,100 per share

-Profit impact due to RBI ban likely to be modest unless ban stays in place for long

-Company’s digital platform ‘811’ has a large customer base

-These are low-value customers in the digital platform

-Digital platform’s contribution to total savings deposits is only 8 percent

-Credit cards is a fast-growing segment, but contributes only 4 percent to the total loan book

-Given it is a higher- ROA business, profit contribution would be in high-single digits

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 22133.75 1.08 | 18.88 2.85 | 5.17 71.52 |

| NIFTY IT | 33611.20 0.5 | -5.36 0.34 | -4.48 24.55 |

| NIFTY PHARMA | 18902.50 1.7 | 12.30 2.03 | 0.46 51.75 |

| NIFTY FMCG | 54192.55 0.48 | -4.90 2.59 | 0.78 15.18 |

| NIFTY PSU BANK | 7413.05 3.91 | 29.75 6.61 | 7.61 83.66 |

| NIFTY METAL | 9209.20 0.76 | 15.43 4.36 | 13.26 60.49 |

| NIFTY REALTY | 957.35 -0.87 | 22.26 2.64 | 9.47 122.59 |

| NIFTY ENERGY | 39976.10 1.05 | 19.45 1.57 | 4.07 70.94 |

| NIFTY INFRA | 8554.25 0.76 | 17.13 2.76 | 5.01 63.67 |

| NIFTY MEDIA | 1883.50 0.21 | -21.13 -0.32 | 1.82 12.63 |

Sensex Today | MCX regains all the losses seen on Apr 24 despite reporting earnings lower than estimate

Sensex Today | Kirloskar Pneumatic shares jump 10% as Q4 profit up 87%

Net profit up 87% at Rs 60.2 crore versus Rs 32.2 crore and revenue up 36% at Rs 490 crore versus Rs 360 crore, YoY

Sensex Today | Kotak initiates coverage on Neogen Chemicals; sets target at Rs 1840 a share

Kotak Institutional Equities has initiated coverage on Neogen Chemicals with a buy rating and kept a target price to Rs 1840 a share from current market price.

Kotak views Neogen as a credible growth story in India's specialty chemicals sector due to its esteemed promoters, led by PI’s ex-ED Anurag Surana, a history of rapid growth driven by innovation, and strategic partnerships with Mitsubishi and global clients.

Neogen is poised to lead in battery chemicals with its early entry and technology partnership with MUIS (Japan), targeting over 30 percent market share in India by 2030. Additionally, its core business sees traction in the CSM segment.

Sensex Today | Nomura neutral on AU Small Finance Bank, target Rs 625

-Q4 NIM declines sharply, higher fee income aids pre-provision operating profit

-Build in RoE of 13-14 percent over FY25-26

-Higher fee income offset sharp fall in NIMs

-Strong loan and deposit growth; slippages moderate

Naveen Kulkarni of Axis Securities positive on Nestle from a long-term perspective

We'll have to look at the numbers in depth a little more and we are all structurally positive on the stock from a long-term perspective.

Nestle has seen multiple issues in its history and the biggest was of course what happened in Maggi and they were able to come out of that also very very successfully right. So I think Nestle should be able to manage these aspects (Cerelac controversy) pretty well and address these issues and come out on the stronger side.

Considering the kind of product profile that it has, which is very very unique and also very very strong product proportion. We continue to remain positive on Nestle.

Stock Market LIVE Updates | HSBC keeps buy rating on Nippon AMC, target Rs 665

-Q4 market share gains in new inflows & equity AUM

-Lower than expected income yield compression were positives

-Increase FY25/26 EPS estimates by 5.4 percent/1.6 percent to factor in AUM mix change yield profile

-Revenue pressure could be partly offset by efficiency gains

Sensex Today | ITC's wholly owned subsidiary WelcomHotels Lanka (Private) launches ITC Ratnadipain in Sri Lanka

Sensex Today | Nifty Pharma index up nearly 1 percent; Alkem Lab, Divis Lab, Dr Reddy's top gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Alkem Lab | 4,800.85 | 1.69 | 74.48k |

| Divis Labs | 3,863.35 | 1.3 | 453.67k |

| Dr Reddys Labs | 6,025.65 | 1.26 | 237.68k |

| Sun Pharma | 1,503.75 | 1.21 | 1.89m |

| Lupin | 1,594.95 | 0.95 | 472.19k |

| Aurobindo Pharm | 1,092.85 | 0.81 | 875.01k |

Sensex Today | HSBC maintains hold call on LTIMindtree, target cut to Rs 5,380

-Company reported another weak quarter as both revenue & margin missed expectations in Q4

-Management was slightly more positive on FY25 growth

-Management stayed negative on margin outlook

Expect INR to trade between 83-83.50 in the near term, says Rajani Sinha, Chief Economist, CareEdge Ratings

While concerns regarding Iran-Israel tensions have eased, a strong dollar continues to weigh on emerging market currencies including INR. Markets have trimmed their Fed rate cut expectations following robust economic data and higher-than expected inflation in the US. Moreover, recent commentary from Fed officials has been hawkish. FPIs have so far pulled out of Indian markets in April. Nevertheless, in the year so far, rupee remains a top performer compared to some EM and Asian peers, likely supported by RBI interventions. We expect INR to trade between 83.00 – 83.50 in the near term, though geopolitical tensions may a pose a potential risk.

We expect INR to appreciate marginally during FY25 to ~82-82.50 supported by India’s strong fundamentals in terms of healthy economic growth of around 7%, a comfortable CAD of around 1% of GDP, and expected surge in FPI inflows post India’s inclusion in global bond indices.

Market attention is now focused on the release of US GDP data on Thursday and PCE inflation data on Friday. US economy is expected to show resilience. Headline inflation is expected to inch up slightly while core inflation is expected to show some moderation. Any data surprises may cause market participants to revise their US Fed rate cut bets accordingly.

Stock Market LIVE Updates | Supreme Petrochem shares gain despite Q4 profit declines

Supreme Petrochem has reported net profit at Rs 131.5 crore for quarter ended March FY24, falling 17.5% compared to corresponding period of last fiscal.

Revenue from operations rose by 12.7% YoY to Rs 1,562.8 crore for the quarter.

The board has recommended final dividend of Rs 7 per share for FY24.

Sensex Today | Tata Teleservices (Maharashtra) shares down as Q4 losses widen

Company’s Q4 losses increased to Rs 309 crore from 307 crore

Revenue jumped to 323 crore versus Rs 296 crore

Stock Market LIVE Updates | Citi keeps neutral rating on Kotak Mahindra Bank; shares down 11%

-Target Rs 2,040 per share

-RBI halts all online onboarding of new customers & credit card issuances

-In Q3, 95 percent of new personal loan, 99 percent of new credit cards were disbursed digitally

-90 percent of new investment & 76 percent of FD/RD accounts were opened digitally

-Credit cards portfolio constituted 3.7 percent of advances, up 52 percent YoY/10 percent QoQ

-RBI actions would adversely impact growth, NIM & fee income

-Pace of branch expansion also needs to accelerate

Sensex Today | Inox Wind approves bonus shares

The company board has approved bonus issue in the ratio of 3:1.

Sensex Today | Canada Pension Plan Investment Board sells Rs 908.6 crore worth shares of Delhivery; shares down

Foreign investor Canada Pension Plan Investment Board sold 2,04,50,000 equity shares (equivalent to 2.77% of paid-up equity) in Delhivery at an average price of Rs 444.3 per share, valuing at Rs 908.6 crore.

As of March 2024, Canada Pension Plan Investment Board had held 5.96% stake in the company. However, Smaller Cap World Fund Inc (35 SCWF/000035) bought 1,38,19,289 equity shares (equivalent to 1.87% of paid-up equity) in the company at same price, which amounted to Rs 613.99 crore.

Stock Market LIVE Updates | Anant Raj shares down despite Q4 profit spikes 73%

Anant Raj has reported consolidated net profit at Rs 84.01 crore for quarter ended March FY24, rising sharply by 73.4% over a year-ago period.

Revenue from operations grew by 58% on-year to Rs 442.6 crore for the quarter.

Sensex Today | Market Update

The Sensex was up 170.24 points or 0.23 percent at 74,023.18, and the Nifty was up 50.40 points or 0.22 percent at 22,452.80. About 1739 shares advanced, 1441 shares declined, and 95 shares unchanged.

Sensex Today | Dr Reddy’s Laboratories appoints Milan Kalawadia as CEO - North America

Dr Reddy’s Laboratories has informed that Mr. Marc Kikuchi has resigned from the role of CEO of North America Generics. He will cease to be a member of the Management Council and Senior Management Personnel of the company, effective from the close of working hours on May 24, 2024.

Mr. Milan Kalawadia, currently Chief Commercial Officer- North America Generics is elevated to the role of CEO - North America and is also inducted as a Member of the Management Council and Senior Management Personnel of the company, effective from May 25, 2024.

Also, company and Nestle India have entered into a joint venture agreement for investment in Dr. Reddy’s Nutraceuticals Limited.

Sensex Today | Sterlite Technologies' fiber optic cable products manufactured in US are compliant with BABA provisions of IIJA

Sterlite Technologies said its fiber optic cable products manufactured in the US are compliant with the Build America, Buy America (BABA) provisions of the Infrastructure Investment and Jobs Act (IIJA). It also unveiled rapid series of products, which will add to its portfolio of fiber optic cables in the US.

Sensex Today | SBI, Eicher Motors touch 52-week high

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| SBI | 794.00 | 794.00 | 790.50 |

| Eicher Motors | 4584.90 | 4584.90 | 4,532.10 |

| Hindalco | 638.00 | 638.00 | 632.35 |

Stock Market LIVE Updates | Deepak Nitrite receives Rs 127 crore towards final settlement

Deepak Nitrite has received Rs 127 crore towards final settlement of insurance claim from the insurance companies. It has received insurance claim for damage caused to certain properties, plant, equipment and inventory as well as the loss of profit due to business interruption post fire incident at its Nandesari ptant in June 2022.

Sensex Today | Axis Bank and SBI recovered 3 percent from day's low

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Axis Bank | 1,124.80 | 1,125.55 1,086.10 | 3.56% |

769.00

1,620.00

7,129.35

1,616.00

1,090.90

2,042.10

3,807.80

349.05

1,420.00

Stock Market LIVE Updates | Jefferies maintains buy call on Axis Bank

-Target Rs 1,380 per share

-Q4 surprised positively with 13 percent beat on profit estimate aided by better NIMs

-Even as loan growth stays softer in FY25, to improve LDR, margin can offset some impact

-Board approved Rs 20,000 crore fun raise, that is 13 percent of networth & 6 percent dilution

-Trim estimate slightly, but valuations at 1.7x FY25 adj PB/ 10x PE are attractive

Stock Market LIVE Updates | Oracle Financial Q4 profit rises 17%; stock trades lower

Oracle Financial Services Software has recorded nearly 17% YoY growth in consolidated net profit at Rs 560.1 crore for January-March quarter of FY24.

Revenue from operations increased by 11.7% to Rs 1,642.4 crore compared to year-ago period.

The board has declared an interim dividend of Rs 240 per share.

Sensex Today | Nestle India Q4 net profit up 27%

Net profit up 27 percent at Rs 934 crore versus Rs 736.6 crore

Revenue 9.1 percent at Rs 5,268 crore versus Rs 4,830.5 crore

EBITDA up 21.8 percent at Rs 1,337.7 crore versus Rs 1,098.7 crore

Margin at 25.4 percent versus 22.7 percent

To form JV with Dr Reddy’s Laboratories (DRL) for nutritional health solutions

DRL to hold 51% and Nestle to hold 49% in JV

Sensex Today | Macquarie keeps neutral rating on Kotak Mahindra Bank

-Target Rs 1,860 per share

-RBI ban is a significant setback for the company

-Lot of savings accounts opened are through company’s 811 digital channel

-Majority of the unsecured products is done digitally

-Digital segments have grown at 40 percent YoY in 9MFY24 vs overall growth of 18 percent YoY

-Bulk of FDs & recurring deposits are sourced digitally

-Bank also seemed reluctant in opening branches

-Fewer than 350 branches opened in last 4 years, is also an issue

-Ban on digital on-boarding is bound to affect growth over medium-term

-Expect de-rating for company in medium-term, like it happened for HDFC Bank after RBI’s action

Sensex Today | Zee Entertainment clarifies on NCLT order against Subhash Chandra; shares trade higher

Zee Entertainment Enterprises clarified on news item of "NCLT orders insolvency proceedings against Subhash Chandra" that the news pertains to Mr. Subhash Chandra in his personal capacity and has nothing to do with the affairs of the Company and therefore there will not be any impact on the company.

Stock Market LIVE Updates | 5paisa Capital plunges 6% after Q4 profit tanks 60%

5paisa Capital has registered consolidated net profit at Rs 5.8 crore for quarter ended March FY24, falling sharply by 60% compared to year-ago period.

Revenue from operations grew by 24.6% year-on-year to Rs 112.9 crore during the quarter.

Sensex Today | JNK India IPO issue fully subscribed, NIIs lead from front on last day

JNK India's initial public offering (IPO) worth Rs 649.47 crore saw a subscription of 1.37 times on April 25, the third and final day of bidding. Investors bid for 1.51 crore equity shares against the total issue size of 1.1 crore shares, according to data available from the exchanges.

Non-institutional investors were leading the race, buying 2.12 times the allotted quota followed by retail investors who purchased 1.42 times the reserved portion. QIBs or qualified institutional buyers were yet fully subscribe, buying 68 percent of their quota. Read More

Stock Market LIVE Updates | Embassy Office Parks REIT shares gain as profit rises 23%

The company’s Q4 net profit jumped 23.2% at Rs 283.4 crore against Rs 230 crore and revenue was up 0.7% at Rs 983 crore versus Rs 976 crore, QoQ.

Sensex Today | Nifty PSU Bank index outperformed the other sectoral indices

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 21960.30 0.29 | 17.95 2.04 | 4.34 70.17 |

| NIFTY IT | 33460.45 0.05 | -5.79 -0.11 | -4.91 23.99 |

| NIFTY PHARMA | 18704.80 0.64 | 11.13 0.97 | -0.59 50.16 |

| NIFTY FMCG | 53917.75 -0.03 | -5.39 2.07 | 0.26 14.59 |

| NIFTY PSU BANK | 7272.55 1.94 | 27.29 4.59 | 5.58 80.18 |

| NIFTY METAL | 9113.55 -0.29 | 14.23 3.28 | 12.09 58.82 |

| NIFTY REALTY | 954.20 -1.2 | 21.86 2.30 | 9.11 121.86 |

| NIFTY ENERGY | 39611.70 0.13 | 18.36 0.64 | 3.12 69.38 |

| NIFTY INFRA | 8487.95 -0.02 | 16.22 1.96 | 4.19 62.40 |

| NIFTY MEDIA | 1882.75 0.17 | -21.16 -0.36 | 1.78 12.59 |

Sensex Today | KABIL signs MoU with CSIR-NGRI; Nalco shares trade lower

National Aluminium Company has informed that Khanij Bidesh India (KABIL) has signed a Memorandum of Understanding (MoU) with the Council of Scientific and Industrial Research - National Geophysical Research Institute (CSIR-NGRI) to foster a long-term collaboration in the field of geophysical investigations to bolster its ongoing projects and activities in critical and strategic minerals.

Sensex Today | Syngene International Q4 profit rises 5.5%; shares trade flat

Syngene International has reported consolidated profit at Rs 188.6 crore for March FY24 quarter, rising 5.5% over a year-ago period.

Revenue from operations grew by 7.8% YoY to Rs 917 crore for the quarter.

Sensex Today | BSE Smallcap index up 0.4 percent; Hitachi Energy India, Vimta Labs, Jupiter Wagons among top gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hitachi Energy | 9,345.10 | 13.78 | 13.04k |

| Vimta Labs | 575.05 | 12.88 | 35.22k |

| Jupiter Wagons | 437.50 | 11.84 | 335.20k |

| Yuken India | 1,291.85 | 9.53 | 7.41k |

| Vardhman Steels | 291.95 | 9.34 | 23.56k |

| Neogen | 1,520.00 | 8.93 | 17.20k |

| Excel | 1,008.00 | 8.45 | 21.14k |

| Saint-Gobain | 136.40 | 8.3 | 257.24k |

| Godfrey Phillip | 3,380.00 | 8.09 | 5.86k |

| Orient Cement | 249.00 | 7.98 | 335.76k |

Stock Market LIVE Updates | RITES signs MoU with Damodar Valley Corporation

RITES has signed an MoU with Damodar Valley Corporation (DVC), a statutory body under the Ministry of Power, to collaborate for project management consultancy for rail infra works.

Sensex Today | Kotak Mahindra Bank sees biggest intra-day fall since March 23, 2020; shares down 12% intraday

Sensex Today | Orient Cement shares rise 8 percent on reports of Aditya Birla Group in talks to buy stake

Stock Market LIVE Updates | Mas Financial Services shares gain 6% as Q4 profit jumps 23%

Mas Financial Services has reported consolidated net profit at Rs 69.4 crore for January-March period of FY24, rising 23.3% over same period last fiscal. Revenue from operations grew by 24.1% YoY to Rs 345.8 crore during the same period.

Stock Market LIVE Updates | RVNL declared lowest bidder for project worth Rs 239 crore

Rail Vikas Nigam has emerged as the lowest bidder for a project worth Rs 239 crore from Southern Railway. The company will do provision of automatic block signaling system in Jolarpettai junction to erode junction of Salem division in Southern Railway.

Stock Market LIVE Updates | GPT Healthcare enters into agreement for construction of hospital

GPT Healthcare has further entered into lease agreement with Sun and Sun Inframetric Private Limited and Mosaic Infraventure Private Limited on April 24, 2024, for the construction and finishing of a hospital building at Raipur with all amenities and services.

Sensex Today | Ship Building stocks in focus, gain 3-9%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| VMS Industries | 47.02 | 8.94 | 190741 |

| Mazagon Dock | 2412 | 4.54 | 135538 |

| Cochin Shipyard | 1326 | 4.14 | 404083 |

| Garden Reach Sh | 1016.7 | 3.42 | 209202 |

Sensex Today | BSE reduces circuit filters of following securities w.e.f. 25/04/2024

Stock Market LIVE Updates | Jefferies keeps hold rating Kotak Mahindra Bank post RBI action

-Target cut to Rs 1,970 per share from Rs 2,050 per share

-RBI has pointed to material gaps in company’s digital & security platforms over past 2 years

-Bank has been asked to stop onboarding new customers on online/mobile channels

-Bank has been asked to stop issuing new credit cards

-RBI actions will be reviewed upon audit & resolution

-HDFC bank faced similar action in 2020 & it took 9-15 months to clear issues

-If resolution takes more than 6 months, it could affect revenues & costs

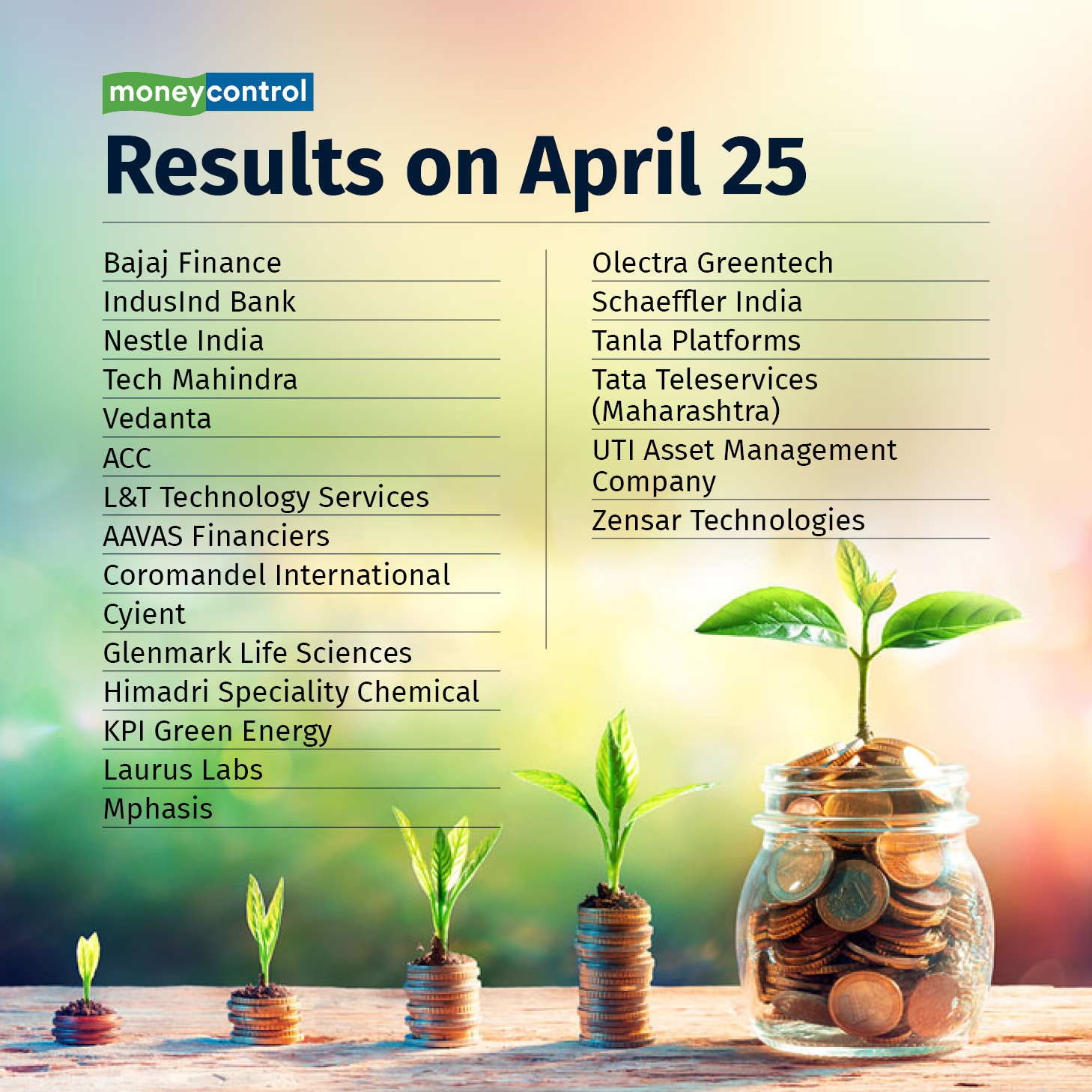

Stock Market LIVE Updates | Earnings Today

Sesnex Tdoay | Tech Mahindra shares trade lower ahead of earnings

Stock Market LIVE Updates | LTIMindtree shares down 2.7% as Nomura keeps reduce rating as Q4 misses estimates

-Target Rs 4,170 per share

-Q4 misses estimates, margin guidance pushed out

-No meaningful recovery in sight

-Sequential growth from Q1FY25, however, growth acceleration unlikely in FY25

-Margin disappoints again in Q4

-Significant improvement hinges on growth revival

-Lower FY24-26 EPS by nearly 4-8 percent

Stock Market LIVE Updates | IHG Hotels signs agreement with Brigade Group to debut InterContinental brand in Telangana

Stock Market LIVE Updates | Schneider Electric gains as global parent indicates double-digit growth of Indian business

"India grew in double-digits with strength across end-markets, supported by capex investments in medium and large-sized projects," Schneider Global earnings release said.

Sensex Today | Divis Labs to expand capacity with an investment of up to Rs 700 crore

The company is in the proces s of entering into a long-term supply agreement with a customer and is planning for capacity addition at its manu facturing facility with an estimated investment between Rs 650 crore to Rs 700 crore, to be funded from internal accruals. The proposed facility is expected to be operational around January, 2027.

Sensex Today | Market at 11 AM

The Sensex was down 86.81 points or 0.12 percent at 73,766.13, and the Nifty was down 38.70 points or 0.17 percent at 22,363.70. About 1634 shares advanced, 1439 shares declined, and 106 shares unchanged.

Sensex Today | MAS Financial Services board approves fund raising

MAS Financial Services board has approved the borrowings of funds by way of issuance of secured/unsecured non – convertible debentures and commercial papers upto an aggregate amount of Rs 1500 crore and Rs 500 crore respectively, in one or more tranches through private placement basis.

Sensex Today | Axis Bank re-appoints Amitabh Chaudhry as MD & CEO till December 2027

Sensex Today | Axis Bank overtakes Kotak Mahindra Bank in terms of m-cap

-Axis Bank becomes fourth largest lender

-Axis Bank m-cap stood at Rs 3.43 lakh crore, while Kotak Mahindra's m-cap stood at Rs 3.32 lakh crore

Stock Market LIVE Updates | EaseMyTrip ties up with Adani Digital Labs

EaseMyTrip.com has entered into a strategic collaboration with Adani Digital Labs (ADL) for seamless access to duty free shopping directly from its platform, providing travellers with a convenient and luxurious experience as part of their travel planning.

Customers can access this service through pre-order directly via the airport services page on the EaseMyTrip website.

Sensex Today | Nifty realty index down 1 percent; Phoenix Mills, Prestige Estate, DLF top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Phoenix Mills | 3,087.40 | -3.21 | 108.81k |

| Prestige Estate | 1,293.05 | -1.37 | 44.13k |

| DLF | 891.10 | -0.27 | 323.37k |

| Hemisphere | 215.15 | -0.23 | 211.31k |

| Godrej Prop | 2,547.40 | -0.15 | 62.95k |

| Sobha | 1,722.35 | -0.15 | 77.86k |

| Oberoi Realty | 1,460.00 | -0.04 | 48.52k |

Stock Market LIVE Updates | Dalmia Bharat shares down 4% as profit plunges 47%

Dalmia Bharat has recorded consolidated net profit at Rs 320 crore for quarter ended March FY24, falling sharply by 47.4% compared to same period previous fiscal, partly impacted by weak operating numbers. Also the base in Q4FY23 was high due to share of profit in associate and joint venture.

Revenue from operations grew by 10% YoY to Rs 4,307 crore for the quarter, with volume growth at 18.5%.

Sensex Today | BSE Capital Goods index up nearly 1 percent; Bharat Forge, Carborundum Universal, GMR Airports Infrastructure among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharat Forge | 1,303.85 | 6.68 | 106.92k |

| Carborundum | 1,372.50 | 2.08 | 3.68k |

| GMR Airports | 83.85 | 1.77 | 302.53k |

| Rail Vikas | 287.75 | 1.16 | 1.30m |

| ABB India | 6,414.30 | 1.12 | 5.51k |

| Bharat Elec | 238.30 | 0.83 | 270.16k |

| Hindustan Aeron | 3,979.85 | 0.73 | 69.01k |

| SKF India | 4,653.00 | 0.71 | 525 |

| BHEL | 265.75 | 0.68 | 251.41k |

| KPIL | 1,182.80 | 0.66 | 5.12k |

Stock Market LIVE Updates | Morgan Stanley keeps overweight call on Axis Bank; shares up 4%

-Target Rs 1,450 per share

-PBT ex-capital gains was 4 percent above estimate helped by beat on NII/ Fee

-Average deposit growth was 5 percent QoQ, a positive amid tight liquidity situations

-RoA remains strong; CET 1 ratio improved QoQ by 4 bps to 13.7 percent

-Deposit growth acceleration is next key re-rating catalyst

Stock Market LIVE Updates | FSIB recommends Rana Ashutosh Kumar Singh as MD of State Bank Of India

Financial Services Institutions Bureau (FSIB) has recommended Rana Ashutosh Kumar Singh for the position of Managing Director in State Bank of India.

Currently, Rana Ashutosh Kumar Singh is Deputy Managing Director, Retail Banking at SBI.

Sensex Today | FSIB recommends Asheesh Pandey as MD & CEO of Indian Bank

Financial Services Institutions Bureau (FSIB) has recommended Asheesh Pandey for the position of MD & CEO of Indian Bank.

Stock Market LIVE Updates | Happiest Minds shares gain after buying 100% stake in PureSoftware Tech

Shares of Happiest Minds Technologies were trading higher after it said in a notice to exchanges that it will acquire 100 percent stake in PureSoftware Technologies for Rs 635 crore.

"We wish to inform you that the company has executed a share purchase agreement to acquire 100 percent of the equity interest in the share capital of PureSoftware Technologies Private Limited, subject to the terms and conditions set out in the agreement," Happiest Minds said in a notice to exchanges.

The firm announced upfront payment of Rs 635 crore at closing, with a potential additional Rs 144 crore upon meeting FY25 performance targets. The acquisition is expected to close by May 31. Read More

Sensex Today | This is a fresh lease of life for the company, KM Birla says post Vodafone Idea FPO listing

Shares of Vodafone Idea Limited opened at a 7.2 percent premium at Rs 11.80 on April 25 morning after its follow-on public offer shares listed on the bourses.

After securing a substantial investment from institutional investors, the country's third-largest telecom operator managed to raise Rs 18,000 crore, marking it as the largest FPO in India's history. Read More

Sensex Today | Market at 10 AM

The Sensex was up 29.95 points or 0.04 percent at 73,882.89, and the Nifty was up 0.60 points or 0.00 percent at 22,403.00. About 1799 shares advanced, 1088 shares declined, and 116 shares unchanged.

Stock Market LIVE Updates | AU Small Finance Bank Q4 profit drops 12.7%; shares gain 1%

AU Small Finance Bank has recorded net profit at Rs 370.7 crore for March FY24 quarter, falling 12.7% compared to same period previous fiscal due to one-time exceptional impact of Rs 77 crore towards Fincare merger related expenses, and higher provisions for bad loans. Net interest income grew by 10% year-on-year to Rs 1,337 crore for the quarter. Asset quality saw improvement with the gross NPA declining 31 bps QoQ to 1.67% and net NPA falling 13 bps to 0.55% for the quarter.

Sensex Today | Nifty PSU Bank index up nearly 1 percent; Bank of Baroda, PNB, SBI top gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of Baroda | 261.15 | 0.79 | 687.11k |

| PNB | 133.90 | 0.68 | 2.54m |

| SBI | 775.40 | 0.3 | 575.42k |

Sensex Today | Nifty Bank index recovers nearly 400 pts from day's low

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Axis Bank | 1,099.70 | 3.43 | 4.96m |

| Bank of Baroda | 261.15 | 0.79 | 687.11k |

| PNB | 133.90 | 0.68 | 2.54m |

| SBI | 775.40 | 0.3 | 575.42k |

| HDFC Bank | 1,513.60 | 0.13 | 1.04m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Kotak Mahindra | 1,658.55 | -10 | 15.79m |

| ICICI Bank | 1,095.00 | -0.16 | 1.16m |

Stock Market LIVE Updates | Macrotech Developers Q4 profit falls 10.6%; share price down nearly 2%

Macrotech Developers has reported consolidated net profit at Rs 665.5 crore for the quarter ended March FY24, declining 10.6% compared to year-ago period despite higher topline and operating numbers, impacted by tax cost.

Revenue from operations grew by 23.4% YoY to Rs 4,018.5 crore for the quarter.