India’s largest carmaker Maruti Suzuki is likely to report robust Q4 financial results, driven by a sharp rise in volumes and a greater mix of premium Sports Utility Vehicles (SUV) in sales. The four-wheeler major is set to announce its fiscal fourth quarter earnings on April 26.

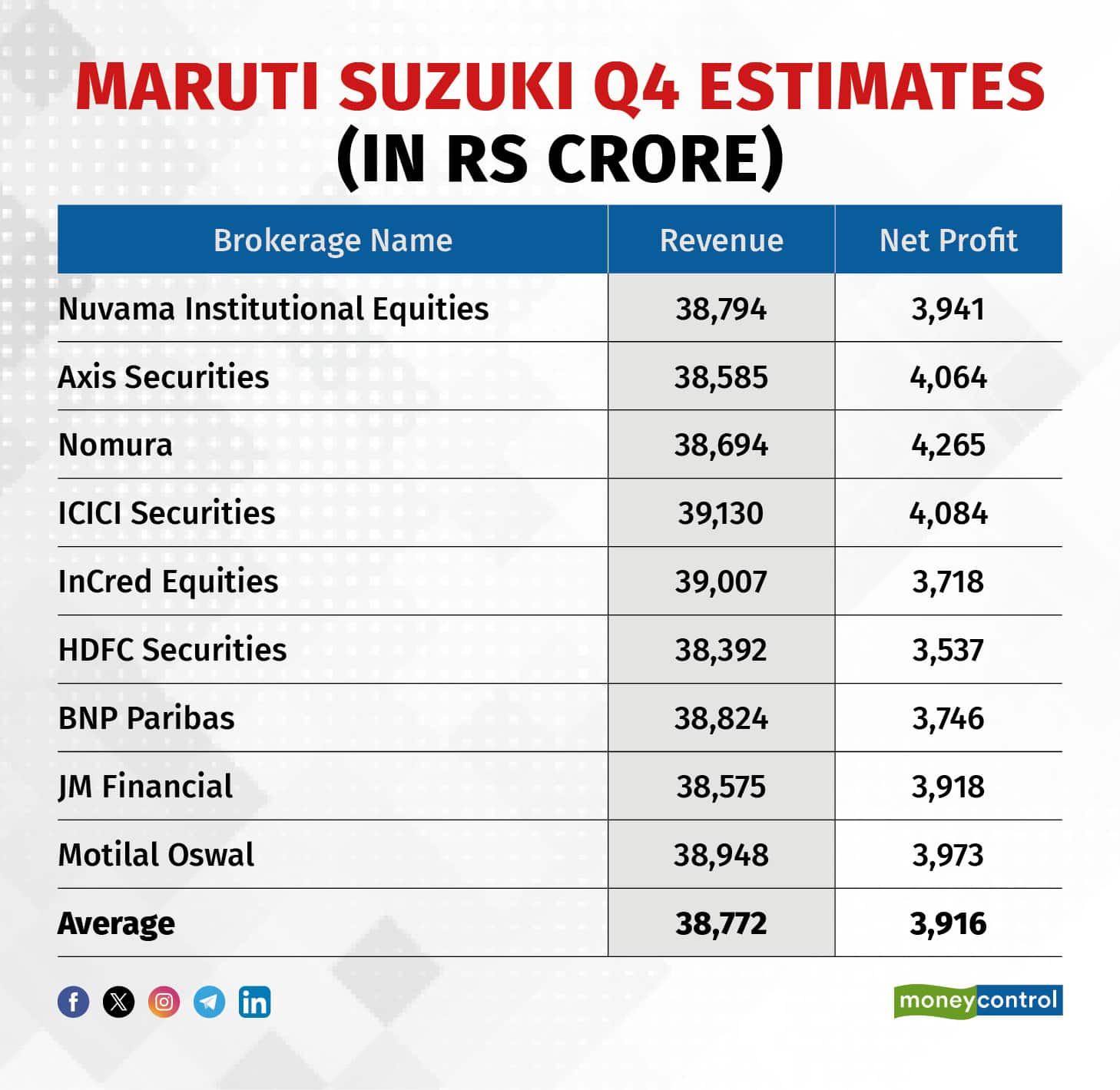

Maruti is expected to see its fiscal fourth-quarter net profit rise to Rs 3,916 crore, up almost 50 percent from the year-ago period, according to a Moneycontrol poll of nine brokerage estimates. Revenue from operations is expected to jump 21 percent to Rs 38,772 crore.

"The rise in revenue (would be) led by higher overall unit sales, better product mix, a higher proportion of SUV and export sales," Axis Securities said in a note. Brokerages estimated that Maruti Suzuki sold 5.84 lakh cars during the January-March quarter. That’s 13.4 percent more than that in the year-ago period.

Follow our market blog for all the live updates

EBITDA is expected to expand 43 percent on-year to Rs 5,047 crore. EBITDA is earnings before interest, tax, depreciation and amortisation. The impressive EBITDA growth would be led by the higher share of SUV sales, price hikes, raw material benefits, and favourable forex movement, said Axis Securities.

Also read: Bajaj Auto plans 6 new launches in next 6 months; bridges gap in 'upper-half' from 10% to 2%

Maruti Suzuki likely to have led SUV sales growth in the quarter at 72 percent on-year, said HDFC Securities.

However, the key things to watch out for is demand outlook, especially for the entry-level segment, where sales may shrink. HDFC Securities predict mini cars such as Alto and S-Presso volumes could plummet 28 percent on-year. Compact car volumes such as Ignis, Celerio and Swift can fall 3-4 percent.

Read more: Bajaj Auto to maintain margins despite ramping up unprofitable EV business

In January, Maruti Suzuki announced a price hike across models to the tune of 0.45 percent, saying that prevailing market conditions have compelled it to pass on some of the hikes to customers. Later, on April 10, the company announced up to Rs 25,000 price hike on Swift and select variants of Grand Vitara Sigma. This is the second such hike in three months.

Maruti shares closed at Rs 12,944, down half a percent from the last close on the NSE. The stock has rallied over 24 percent since January this year, outperforming Nifty’s 3 percent gain.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!