March 13, 2023 / 16:08 IST

Prashanth Tapse, Research Analyst, Sr VP Research at Mehta Equities

Neither bear nor Bulls, Indian markets are stuck in the hands of kangaroos. In a kangaroo kind of market mood, the market changes value and “bounce up and down” over a period without any stable rising or declining trends. If this continues, technically the fall could extend its slide down toward the 17000 mark and any close below 17000 we can see 16800 levels.

Looking at the market mood, there are few factors resulting from the selloff with low to no positive triggers in Indian markets, global uncertainty in banking sector after SVB issues and El Nino effect for 2023 which could raise concern over rural demand and Nifty earnings.

As per market reports, El Nino, whenever it has occurred, has left a considerable impact on rains in India, leading to below normal rainfall across the country. The probability has been set at a fairly high level approximately 55-60% and it’s expected to set in between June-December 2023 as per market reports and this stands true, there would be drought like situations too due to the phenomenon leading to crop loss, resulting in rising food prices and inflation again.

March 13, 2023 / 16:02 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Domestic indices witnessed renewed selling pressure on account of issues within the US banking space. Nifty opened positive but soon came under intense selling pressure to close with loss of 257 points (-1.5) at 17156 levels. All sectors ended in red with banking and auto facing the major burnt, down 2% each.

India Vix jumped sharply by 19% to 16 levels, indicating heightened volatility. Emerging uncertainty around several mid and small size (Silvergate Bank, Sillicon Valley Bank, Signature Bank and First Republic Bank) have created nervousness among global investors about the health of the US banking sector.

Expect elevated volatility until clarity emerges on the potential extend of the crisis. The US Fed’s emergency meeting to control the damage would be crucial for the markets. Apart from this release of India and US inflation data along with ECB meeting during the week would be keenly watch.

March 13, 2023 / 16:00 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets started the week on a feeble note and lost nearly one and a half percent, in continuation to the prevailing trend. After the initial uptick, the Nifty index gradually drifted lower as the day progressed and finally settled at 17,154.30 levels. The selling pressure was widespread wherein banking, auto and IT majors were beaten down badly. The broader indices too plunged sharply lower and lost nearly 2% each.

The move shows that participants are not comfortable, citing the US banking crisis and reducing positions, ignoring the news of the bailout. Banking and financials were acting as saviors earlier but the tone has changed completely now, which is further adding to their worries. We reiterate our negative view and eyeing the 17,000 level as immediate support in Nifty. Traders should align their positions accordingly.

March 13, 2023 / 15:53 IST

Vinod Nair, Head of Research at Geojit Financial Services

Bloodbath was seen in the global market as the fallout of Silicon Valley Bank was followed by turmoil at Signature Bank, keeping investors worried about the strength of the US banking system.

Importantly, the Fed’s decision in the upcoming meeting will have a crucial impact on the market sell-off, as the consensus is reversing to no rate hike trajectory. Also, the US inflation due on Tuesday will have a vital impact in the short-term as the market anticipates a cool down from January levels.

March 13, 2023 / 15:51 IST

Dilip Parmar, Research Analyst, HDFC Securities

Indian rupee becomes the worst performer among Asian currencies on the back of worsening risk appetite, fall in bond yields and foreign funds outflows.

In the short term, spot USDINR is expected to consolidate between 81.70 to 83.

March 13, 2023 / 15:32 IST

Rupee Close:

Indian rupee ended lower at 82.12 per dollar against previous close of 82.04.

March 13, 2023 / 15:30 IST

Market Close:

Benchmark indices ended lower in the third consecutive session on March 13 with Nifty below 17,200

At close, the Sensex was down 897.28 points or 1.52% at 58,237.85, andNifty 50 was down 258.60 points or 1.49% at 17,154.30. About 768 shares advanced, 2745 shares declined, and 144 shares unchanged.

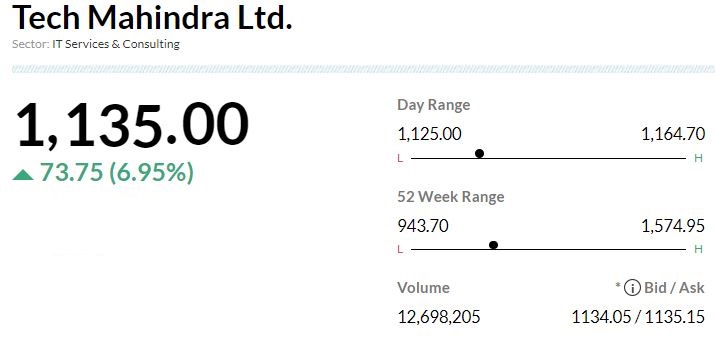

IndusInd Bank, SBI, Tata Motors, M&M and Eicher Motors were among the major losers on the Nifty, while gainers were Tech Mahindra and Apollo Hospitals.

All the sectoral indices ended in the red.

The BSE midcap index shed 1.8 percent and smallcap index fell 2 percent.

March 13, 2023 / 15:26 IST

Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

Indian Rupee strengthened on Monday on weak US Dollar index amid collapse of three banks in the US. Rupee touched a high of 81.6775 in early trades in the spot markets trcking weakness in the greenback. However, the domestic currency lost early gains on weakness in the domestic equity markets. Dollar also declined on Friday on softer than expected labour market data which led to expectations that Fed may go slower in its pace of rate hike.

We expect Rupee to trade with a negative bias on risk aversion in global markets amid and fresh FII outflows. However, weak dollar and declining US Treasury yields may prevent sharp fall in Rupee.

Traders may remain cautious ahead of inflation data from India and US. We may see some recovery if the banking crisis in the US is contained. USDINR spot price is expected to trade in a range of Rs 81.50 to Rs 82.80.

March 13, 2023 / 15:23 IST

Jefferies View On IndusInd Bank

-Buy rating, target at Rs 1,550 per share

-RBI extended term for CEO by twoyears versus three years as approved by board

-This may reflect on RBI's desire to see improved internal controls, funding & underwriting

-See this as reasonable time to demonstrate progress

-This may mean slight pullback on growth (trim EPS slightly) & defer re-rating

-Valuations are attractive at 1.4 timesFY24 Price to Book

IndusInd Bank was quoting at Rs 1,060.50, down Rs 85.00, or 7.42 percent.

March 13, 2023 / 15:19 IST

Nifty Bank index shed 2 percent dragged by IndusInd Bank, AU Small Finance Bank, PNB, SBI

Top Stock Losers (Intra-day)

March 13, 2023 / 15:18 IST

Citi View On Tech Mahindra:

-Neutral rating, target at Rs 1,120 per share

-Appoints Mohit Joshi as CEO

-In near-term, expect a favourable stock price reaction

-Real test of performance will start next calender year once Mohit Joshi assumes CEO role

-Industry view is cautious in a tough macro

-Company has room to improve margin in medium-term; positions it better than peers

-Market will again focus on pace of turnaround, which can potentially take time

March 13, 2023 / 15:16 IST

Advance/Decline (Intra-day)

58,242.61 -892.52(-1.51%)