Taking Stock | Rate hike worries sink market; Sensex crashes 928 points, Nifty slips below 17,760

All the sectoral indices ended in the red... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,673.02 | -277.93 | -0.33% |

| Nifty 50 | 25,910.05 | -103.40 | -0.40% |

| Nifty Bank | 58,899.25 | -63.45 | -0.11% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Bharti Airtel | 2,149.20 | 37.00 | +1.75% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,739.50 | -133.50 | -2.27% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Bank | 58899.30 | -63.40 | -0.11% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 35975.20 | -400.00 | -1.10% |

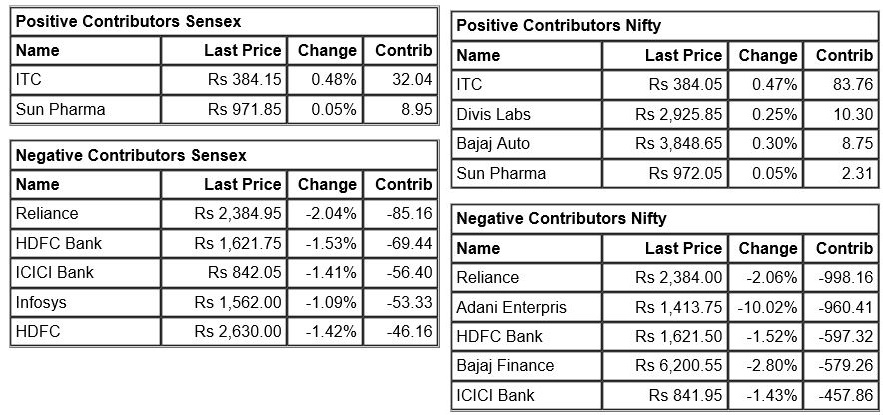

Overnight slump in the US markets shook the Indian stocks badly as heavy selling across the board saw Sensex crash nearly 1,000 points and plunge below the crucial 60,000 mark. Markets were already range-bound with a negative bias in the last few sessions and today's sharp fall could further accentuate the pressing concerns of rising interest rate going ahead, higher inflation, and slowing global growth.

Technically, the Nifty has formed a long bearish candle on daily charts and lower top formation on intraday charts, which indicate further weakness from the current levels. However, since the market is in an oversold zone, we could see a sharp pullback rally, if the index trades above 17,600.

For the traders now 17,600 would be the key level to watch out for and above the same the pullback move will continue till 17,700-17,750. On the flip side, below 17,600 the index could slip till 17,500-17,475. Contra traders can take a long bet near 17,475 with a strict support loss at 17,440.

Resurgence of cold war between US & Russia has brought apprehension in the market. Although it should be a short-term effect, the fear of sanctions against Russia and its degree of implication on the economy, especially on food and oil exports, is adding to the anxiety.

The market is just recovering from the pandemic, and high interest & inflation are the headwinds in the background.

It is presumed that this war will be fought on an economic front, limiting its effect on strong economies like the US & India. Awaiting the release of Fed and RBI minutes are the other major elements that kept investors on the side lines.

The Nifty opened gap down and continued to witness selling pressure throughout the day to close deep in the red down ~272 points for the day. On the daily charts we can observe that the Nifty has closed decisively below the 61.82% fibonacci retracement level (17,650) and is currently trading below the 40 week moving average (17,594) which is a sign of weakness.

The daily momentum indicator has triggered a negative crossover from the equilibrium line which is a sell signal. Thus, both price and momentum indicator is suggesting a further decline in the coming trading session.

On the way down we expect Nifty to retest the recent swing low of 17,350 which coincides with the 200-day simple moving average and the recent swing low it touched on the day of Budget. On the upside the hourly moving averages and the gap area formed today in the range 17,775 - 17,820 shall act as a stiff resistance.

Indian rupee closed lower at 82.85 per dollar against previous close of 82.79.

Benchmark indices ended lower for the fourth consecutive session on February 22 with Nifty around 17,550.

At Close, the Sensex was down 927.74 points or 1.53% at 59,744.98, and the Nifty was down 272.40 points or 1.53% at 17,554.30. About 928 shares have advanced, 2451 shares declined, and 127 shares are unchanged.

Adani Enterprises, Adani Ports, Grasim Industries, JSW Steel and Bajaj Finance were among the major Nifty losers, while ITC, Bajaj Auto and Divis Laboratories gained the most.

All the sectoral indices ended in the red.

BSE midcap and the smallcap shed 1 percent each.

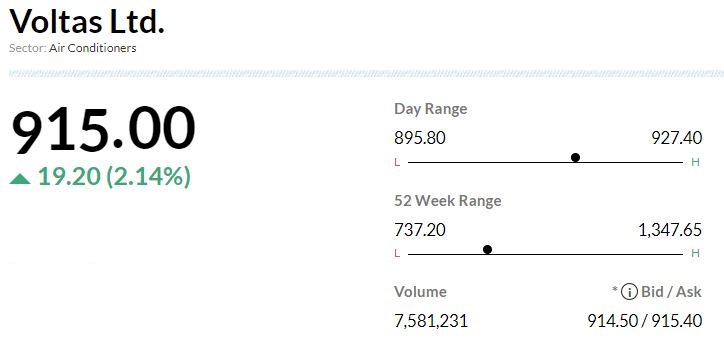

-Buy rating, target at Rs 1,050 per share

-IMD recently issued first heat wave alert of 2023

-Dealers are highlighting that lower commodity prices have not been passed on in pricing

-This points to improved volume & margin outlook for Voltas ahead

-Believe FY24 estimate should see both AC & engineering segments of Voltas being in a sweet spot

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Aditya Birla F | 234.10 | -5.05 | 107.74k |

| Adani Power | 162.60 | -5 | 4.18m |

| ACC | 1,755.05 | -3.98 | 35.10k |

| Delhivery | 335.40 | -3.88 | 184.23k |

| IRCTC | 619.80 | -3.56 | 249.79k |

| IDBI Bank | 48.60 | -3.28 | 525.18k |

| Godrej Prop | 1,106.15 | -3.26 | 30.42k |

| Indian Hotels | 299.75 | -3.18 | 77.77k |

| Ashok Leyland | 143.30 | -3.04 | 399.07k |

| SAIL | 84.60 | -2.98 | 2.22m |

The meeting of equity shareholders of Hindustan Zinc is scheduled to be held on March 29, in the matter of Scheme of Arrangement between the company and its shareholders. The National Company Law Tribunal on February 6 has passed the order in the said matter of Scheme of Arrangement.

Hindustan Zinc was quoting at Rs 316.00, down Rs 5.75, or 1.79 percent on the BSE.

The Indian rupee was the median performer among Asian currencies amid suspected central bank dollar supply in the OTC market. However, the direction for the rupee remained down on the back of a stronger greenback of FOMC meeting minutes.

Ahead of the monthly expiry, we could see the rupee hold the 83 levels amid huge derivative positioning.

In the near term, spot USDINR is expected to trade between 82.50 to 83.

-Buy rating, target at Rs 550 per share

-Management aims to double overall sales by FY26 & multiply lease income 7x in 5 years

-The latter will entail USD 2 billion in capex and debt could treble in interim

-Success in unfolding cycle could deliver strong returns

Benchmark indices are trading lower with Nifty below 17600.

Sensex is down 792.71 points or 1.31% at 59,880.01, and the Nifty is down 241.60 points or 1.36% at 17,585.10. About 815 shares have advanced, 2431 shares declined, and 106 shares are unchanged.