India-dedicated funds witnessed a significant outflow of $289 million last week, the largest single-week redemption since April 2025. While $167 million was pulled out from ETFs, $122 million was withdrawn from long-only active funds such as ABSL Umbrella and Jupiter India Select SICA, noted Elara Capital.

| India-Focused fund flows last week | ||||

|---|---|---|---|---|

| Fund Name | Weekly Flow ($mn) | AUM ($mn) | Type | Weekly NAV Change (%) |

| WisdomTree India Earnings Fund | -118 | 3,099 | ETF | -2.7 |

| ABSL Umbrella UCITS - India Frontline Equity Fund | -39 | 177 | Long-Only | -0.3 |

| Jupiter India Select SICAV | -26 | 823 | Long-Only | -1.4 |

| Schroder ISF Indian Equity | -20 | 512 | Long-Only | -3.3 |

| Xtrackers MSCI India Swap UCITS ETF | -18 | 627 | ETF | -2.6 |

| Amundi Funds SBI FM India Equity | -16 | 907 | Long-Only | -2.1 |

| Stewart Investors Indian Subcontinent Sustainability Fund | -14 | 700 | Long-Only | -2.4 |

| Goldman Sachs India Equity Portfolio | -10 | 4,905 | Long-Only | -2.5 |

| Chikara Indian Subcontinent Fund | 11 | 144 | Long-Only | -3.1 |

| SMAM High Growth India Mid Cap Equity Fund | 11 | 2,461 | Long-Only | 0.1 |

| Ashoka WhiteOak ICAV - India Opportunities Fund | 7 | 2,175 | Long-Only | -3.9 |

| Kotak Funds - India Midcap Fund | 6 | 3,594 | Long-Only | -1.2 |

| FTIF Franklin India Fund | 5 | 3,328 | Long-Only | -3.1 |

Last week, India-focused funds saw mixed flows, with overall sentiment appearing cautious amid weak NAV performance. The largest outflow was recorded by the WisdomTree India Earnings Fund, which lost $118 million, while other notable long-only funds such as ABSL India Frontline, Jupiter India Select, and Schroder ISF also saw steady redemptions.

On the positive side, modest inflows were observed in funds like SMAM High Growth, Ashoka WhiteOak, and Kotak Midcap, although most of these too posted negative returns for the week.

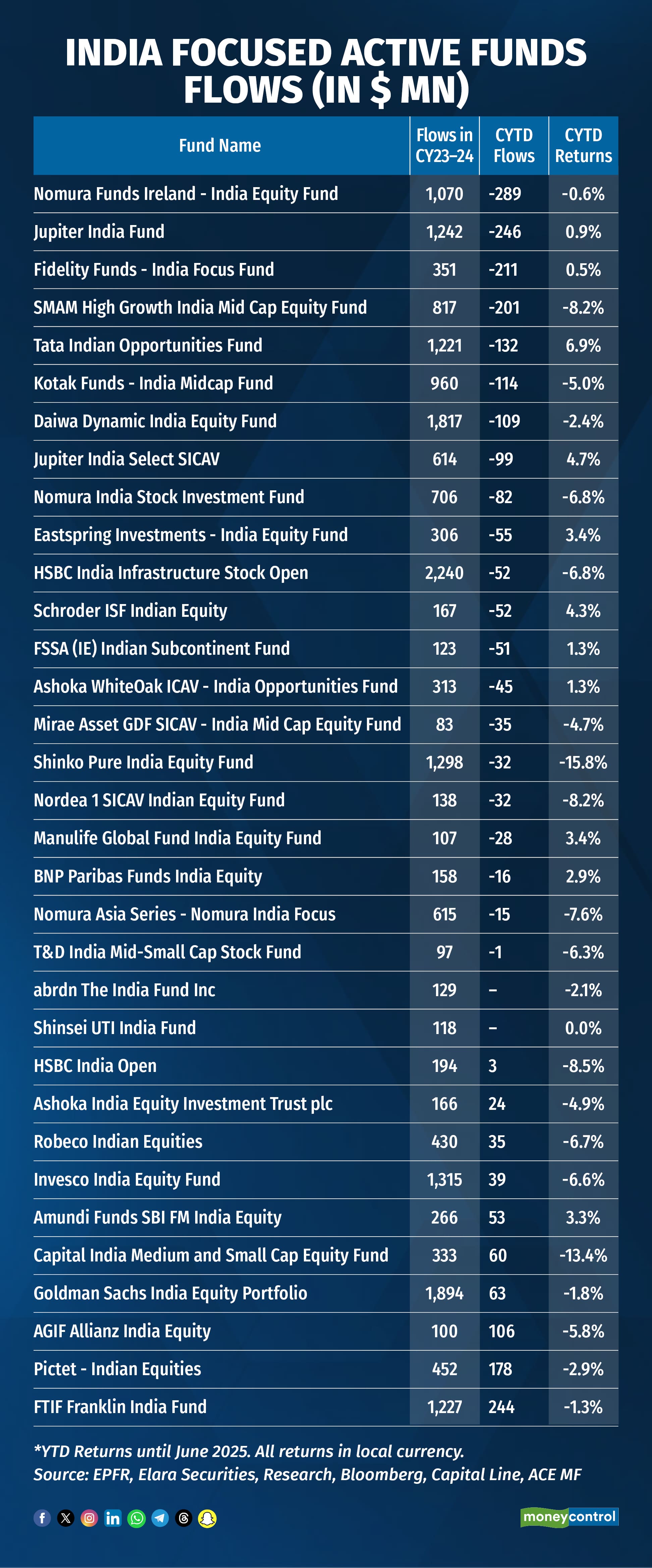

Further, around 65 percent of all India-focused funds have been seeing redemptions since January 2025.

These funds saw strong inflows over 2023 and 2024, with the reversal in sentiment starting from October 2024, after Dalal Street hit its peak. Jupiter Fund Management, Nomura Holdings, and Fidelity are the AMCs that have seen the sharpest redemptions from their India-focused funds.

Additionally, after recording healthy returns last year, the year-to-date (YTD) returns have moderated or turned negative for many funds, as investors reassess India’s near-term outlook. The tilt towards ETFs and the uneven performance across active funds highlight rising caution and portfolio repositioning underway, noted Elara Capital.

This marks a similar trend that played out in 2018. The brokerage noted that the last major phase of investor euphoria in India-focused active funds peaked in January 2018, when assets under management (AUM) touched $47 billion.

This was followed by a steep 60 percent decline in AUM, bottoming out by March 2020. A strong recovery phase began in March 2023 at $28 billion, with AUM surging to $70 billion by September 2024, which marked a near full reversal of the earlier outflows.

"However, recent data suggests another round of AUM decline may be underway. Notably, the $22 billion of net redemptions between 2018–2022 have almost entirely been redeployed over 2023–2024," added the brokerage.

Also Read | Emerging markets could see sharp sell-off if dollar reclaims 100-mark

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.