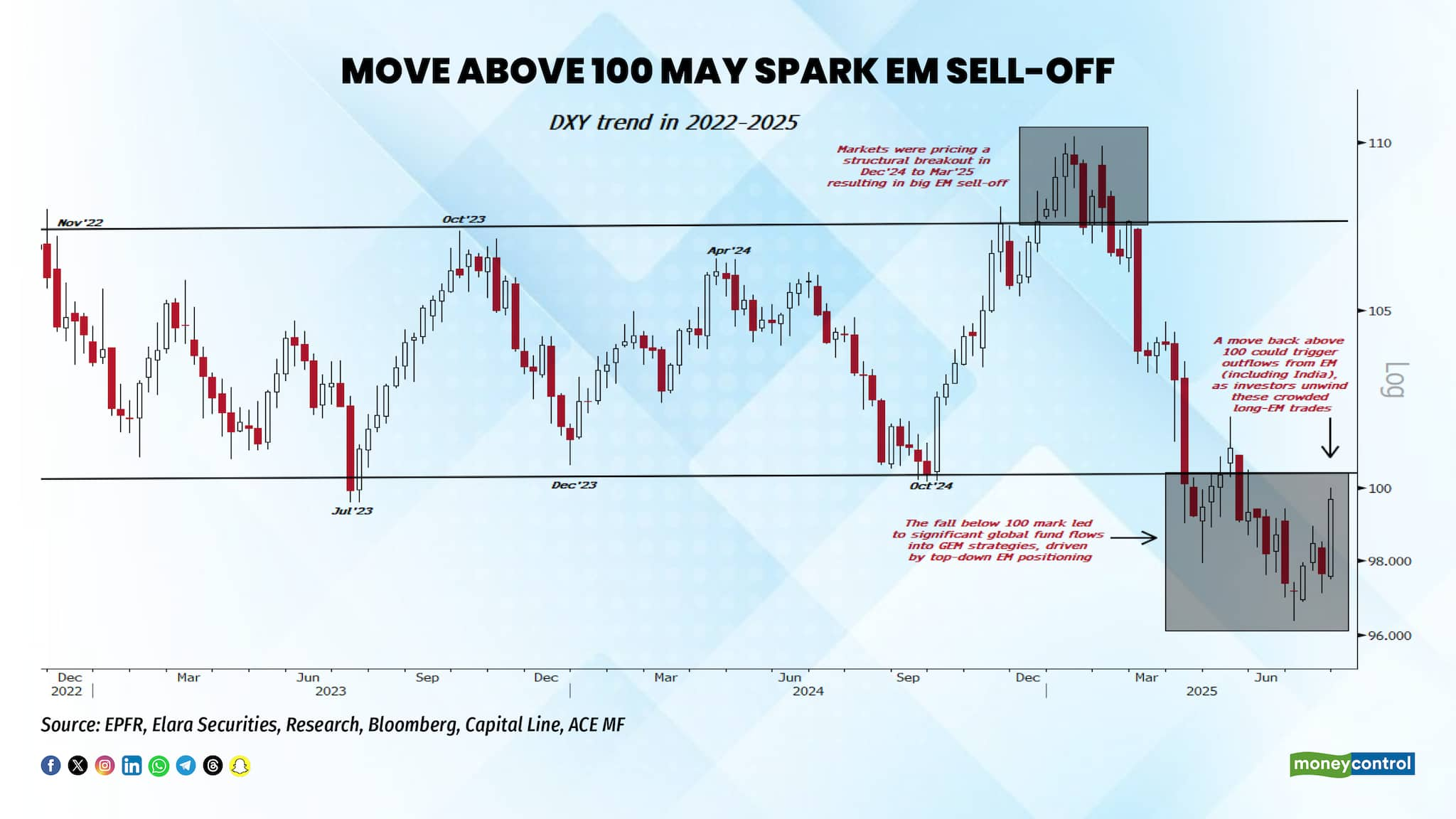

Since April, the U.S. dollar index has remained solidly under the 100-mark as investors sold-off their holdings following President Trump's tariff announcements in April. The greenback slid to multi-year lows, sparking a wave of global-fund inflows into emerging markets (EMs) which was driven by a bearish consensus on the dollar, noted Elara Capital.

However, the brokerage noted that if the Index charts a sustained move to reclaim the 100-mark, it could risk the unwinding of these crowded long-EM positions, potentially triggering outflows from EMs, including Indian equities.

On a fundamental level, more and more analysts are penciling in an "imminent breakdown" in the Dollar index, driven by growing concern around the U.S.'s trade and economic policies. The technical charts tell a different story.

On the charts, the index is hovering near a major long-term support and the bulls will stage a tough fight to defend it. If the support is successfully defended and the Dollar rebounds, it could weigh heavily on emerging market assets.

The brokerage noted that a similar pattern was observed between December 2017 and February 18, when a breakdown in the Dollar Index sparked strong optimism and a rally in EM and Indian equities. "However, once the Dollar Index began to recover from its lows, markets quickly reversed, triggering a sharp sell-off in equities," said Elara Capital.

Not just 2017-2028, but the same trend was earlier witnessed in 2010-2011. After hitting highs in June 2010, the index broke down to hit lows in April 2011, reinforcing market expectations of sustained dollar weakness. "However, the index soon rebounded sharply, triggering volatility and nervousness across emerging market equities," the report added.

Despite a sharp rebound in the Dollar Index, global emerging market (GEM) funds continued to attract positive net flows, although the pace has clearly slowed. Over the past three weeks, average weekly inflows have declined to $700 million, down from a previous average of $2.3 billion.

In the latest week, EM funds saw inflows of $990 million, driven by strong allocations to the JPMorgan EM Fund ($733 million), Lazard EM Fund ($572 million), and Vanguard FTSE EM ETF ($392 million).

However, this was offset by strong outflows from the Invesco Developing Markets Fund ($1.1 billion), iShares MSCI EM ex-China ETF ($375 million), and Vontobel EM Fund ($160 million).

Also Read | Smart money making a smart exit? India-dedicated active funds retreat after 3 years

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.