The Indian market trading at near-record highs is likely to pick up momentum, as anecdotal evidence of the past 11 years suggests that December belongs to the bulls.

The Sensex and the Nifty hit a record high of 41,163 and 12,158, respectively, on November 28, and are less than a percent away from breaking into a new territory.

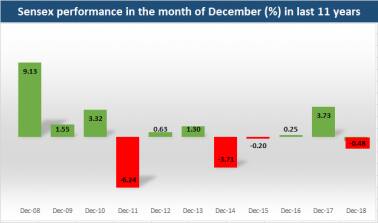

Data suggest that the Sensex closed in the green in the month of December in seven of these 11 years.

The Sensex saw its worst fall in 2011 when it fell by over 6 percent, followed by 2014 when it declined 3.7 percent, and in 2018, the index fell by 0.48 percent.

The index rose in seven of the last 11 years. It rose over 9 percent in 2008, followed by a 3.7 percent rally in 2017 and 3.3 percent gain in 2010, data from AceEquity shows.

With the Reserve Bank of India policy out of the way, all eyes will now be on the trade negotiations between the US and China. Hence record highs are possible, which could be followed by some consolidation, experts say.

“The markets made a new record high last month but the bias was largely on the consolidation side. This month, too, weak macroeconomic data combined with not so encouraging global cues have triggered marginal profit-taking of late and indications are pointing towards further consolidation in the index,” Ajit Mishra, VP Research, Religare Broking, told Moneycontrol.

“The outcome of RBI monetary policy may result in a further up move but upside seems capped, considering hurdle at 12,300 in the Nifty. Besides, signals are mixed from the global front. In such a scenario, it is likely that markets may conclude the month marginally higher.”

Historically, the Indian benchmark is known for walking over the setups provided by global markets, which no doubt are performing well. But, given there are no additional triggers, consolidation is likely on the positive side in December.

“Testing the statistics, it is well known that the probability of performing positive in December stands at 0.63 and reduction of corporate taxes to 23% this year is going to act as a catalyst for advancing towards 12,500 levels,” Kaushlendra Singh Sengar, Founder, Advisorymandi.com, told Moneycontrol.

“But, the continuous slippage in GDP of India, easing by an average of 11.31% from the last five quarters, has re-awakened the threat of losing the grip of the bulls over December. So, stagnancy in the 50-stock bundle should be expected in December,” he said.

Institutional activity

Institutional activity has remained strong in December. Anecdotal evidence suggests that foreign institutional investors (FIIs) were net buyers in Indian markets in seven of the last 11 years.

FIIs poured in over Rs 24,000 crore in December 2012, followed by over Rs 15,000 crore in 2013 and more than Rs 10,000 crore in 2009.

However, FIIs have, so far, remained net sellers in Indian markets in December after pouring in more than Rs 20,000 crore in the previous month. But, experts remain confident of December 2019 turning out to be a net positive month for the Street.

“The FIIs’ interest in Indian equities has improved in the last two months, which was driven by stimulus measures by the government as well as corporate tax rates cut which led to limited downgrades in Q2 earnings. FIIs’ invested to the tune of ~Rs 21,000 crore in the last two months,” said Mishra of Religare Broking.

Mutual funds, too, have been net buyers for eight of the 11 years in December. They poured more than Rs 9,000 crore in 2016, followed by over Rs 8,000 crore in 2017, and about Rs 7,000 crore in 2014, AceEquity data shows.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.