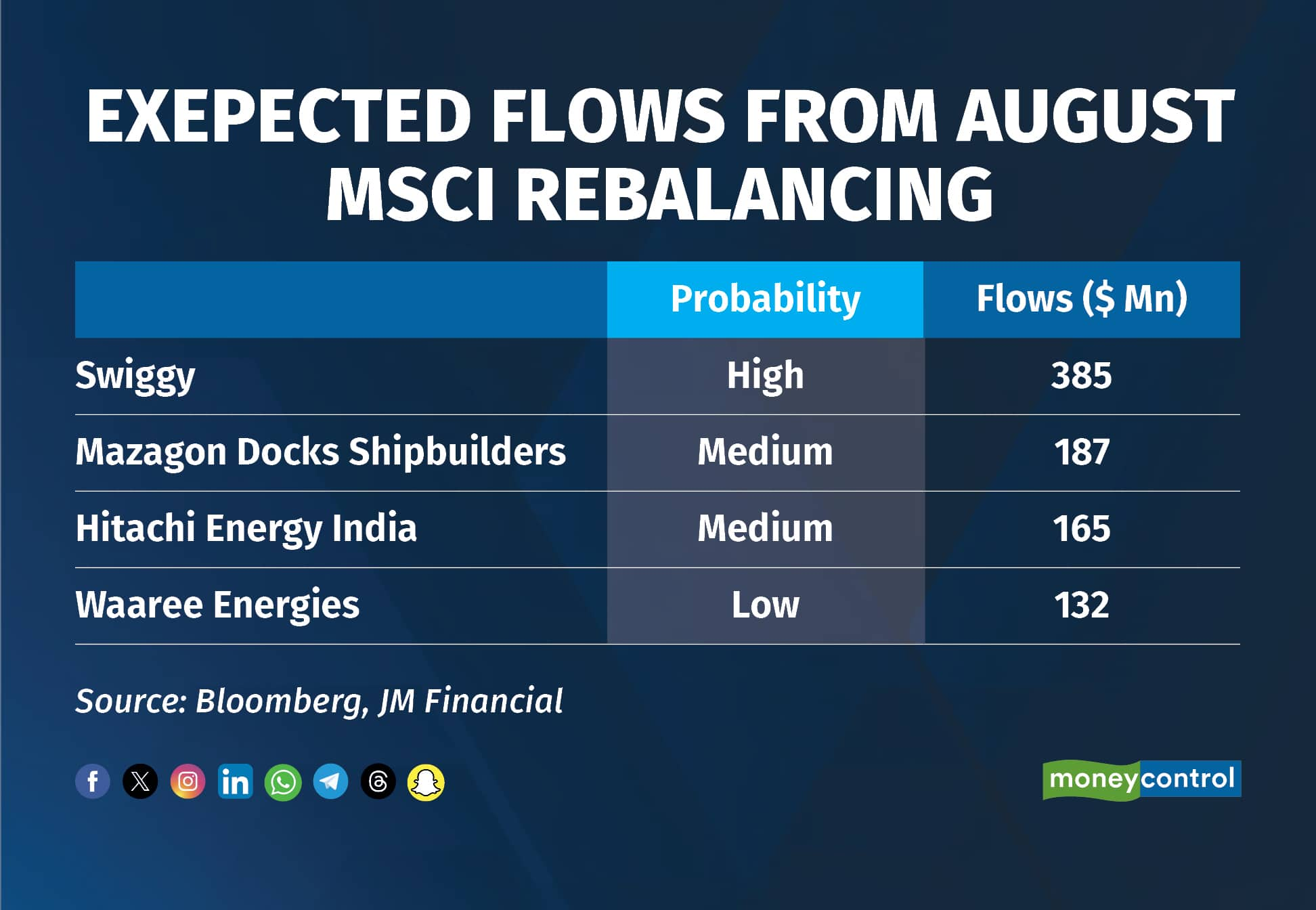

Swiggy Ltd, Mazagon Dock Shipbuilders Ltd, Hitachi Energy India Ltd, and Waaree Energies Ltd are four firms that could see their stocks included in the MSCI India Standard Index during the August rebalancing, according to domestic brokerage JM Financial.

The inclusion of the four stocks could lead to inflows worth $850 million, with Swiggy bringing in flows worth $385 million. The probability of the food delivery player and quick-commerce major being added to the global index provider's gauge is high.

The inclusion of Mazagon Dock Shipbuilders and Hitachi Energy India would likely lead to inflows worth $187 million and $165 million, respectively; the probability of inclusion into the India Standard index is medium. While Waaree Energies has a lower likelihood of being added to the index, it could bring in flows worth $132 million if included.

The MSCI India Standard Index rebalancing announcement is scheduled on August 7, post the market hours. The final changes will be effective from August 27.

Follow our market blog to catch all the live updatesOver the past month, shares of Hitachi Energy India have gained the most, rising 18.9 percent. Mazagon Docks Shipbuilders followed with a 14.4 percent increase, while Swiggy and Waaree Energies saw their share prices rise by 12.7 percent and 10.9 percent, respectively.

During the May rebalancing, Fertiliser company Coromandel International Ltd., and FSN E-commerce Ventures Ltd., parent of of beauty retailer Nykaa, joined the MSCI Global Standard Index as part of MSCI's latest semi-annual review.

In the MSCI India Domestic Smallcap Index, MSCI added 12 stocks and removed 21 counters. Acme Solar Holdings, Authum Investment, AWL Agri Business, Dr Agarwal’s Health Care, Godrej Agrovet, Hexaware Tech (New), International Gemmologic, Le Travenues Technology, Premier Energies, Sagility India, Sai Life Sciences and Sona BLW Precision were added to the index.

On the flip side, Allcargo Logistics, Greenpanel Industries, Orchid Pharma, Godrej Industries, Prince Pipes, Shyam Metalics, TeamLease Services and Patel Engineering were among the stocks that were deleted.

The MSCI India Domestic Index saw two additions, Coromandel International and GMR Airports, and one removal, Sona BLW Precision, the aggregator said in a statement.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.