After hitting a high in January 2018, midcaps underperformed largecaps in 2018. In the year 2019 as well, midcaps continue to underperform the Nifty50 amidst concerns around global economic slowdown, decelerated domestic growth outlook for FY19 GDP and enhanced volatility ahead of general elections.

However, as the market has started rallying, Elara Capital expects a revival in midcaps riding on price and valuation comfort based on historical trends, strong flows from FPIs and DIIs and strong earnings revival due to fall in commodity prices and spur in consumption.

The relative valuation of midcaps versus largecaps is at a historically low level, both at an absolute level as well as on a rolling basis, with 7-DMAs at 2014 level. Hence, the brokerage firm believes that valuations are reasonable and a midcap recovery is in the offing.

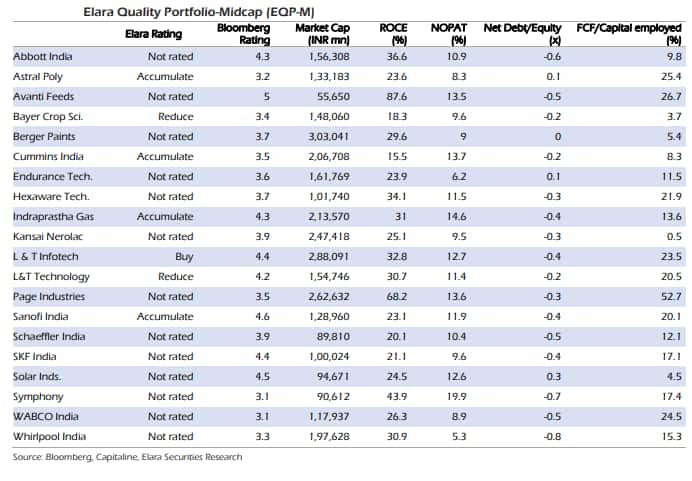

Elara Capital has put out names of 20 midcaps that can be a good buying opportunity at the current level. These stocks are filtered on the basis of Elara Quality Portfolio-Midcap (EQP-M) criteria and earnings visibility.

The 20 stocks include Abbott India, Astral Poly, Avanti Feeds, Berger Paints, Cummins India, Endurance Technologies, IGL, L&T Infotech, Page Industries, SKF India, Solar Industries, Symphony and Whirlpool India.

What are quality stocks?

Elara defines quality stocks as those with a combination of high and consistent ROCE (returns on capital employed), increasing or stable operating margin, positive free cash flow, low leverage and high revenue growth.

The brokerage firm used the below methodology to draw up a list of midcap stocks from a universe of stocks with market capitalisation rank of 100-250.

The brokerages created different filters to select its recommended stocks. The four filters used by Elara include:

1. Companies with ROCE >15 percent in at least four out of the last five years

2. Companies that showed an increasing or stable trend in NOPAT margin. For example, if a company’s NOPAT margin is 10 percent in year 1, Elara expects that company’s margin to be greater than 10 percent in year 2 or at least not below 9 percent

3. Companies with net debt to equity ratio less than 1

4. Companies with positive free cash flow yield in at least four out of the last five years.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.