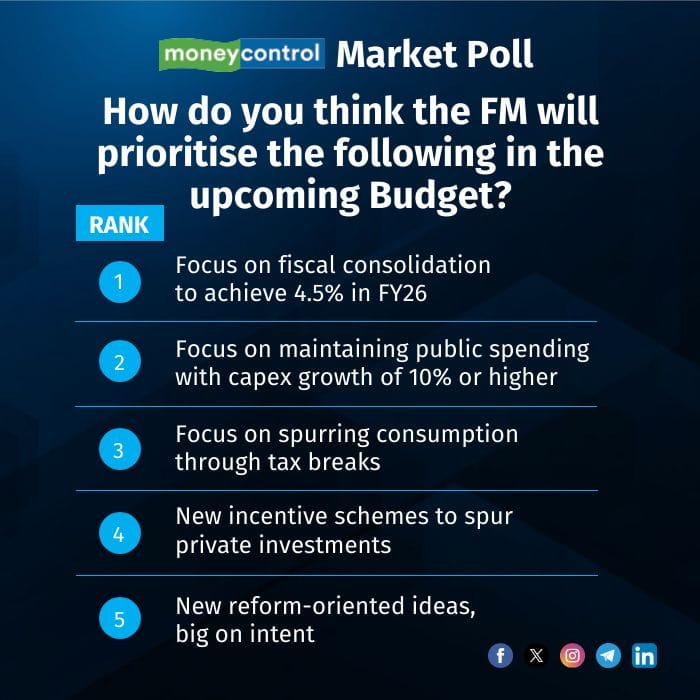

A majority of market experts are of the opinion that the government’s focus on fiscal consolidation to achieve the 4.5 percent target in FY26 will be among the top priorities in the upcoming Union Budget, as per the latest Moneycontrol Market Poll.

The majority believe that the government’s top two priorities should be a sharp focus on fiscal consolidation, followed by a focus on maintaining public spending with capex growth of 10 percent or higher.

On the other hand, few participants believe that the government will focus on new reform-oriented ideas that are big on intent, focus on spurring consumption through tax breaks, or launch new schemes to spur private investments.

The latest Moneycontrol Market Poll saw participation of nearly 45 respondents across categories including broking firms, mutual funds, AIFs, PMS and independent experts.

Meanwhile, many brokerage firms believe that the elevated public debt-to-GDP is likely to keep the fiscal consolidation path intact, as a result, the government will target a fiscal deficit at 4.4 – 4.6 percent of GDP in FY26 (down from 4.9 percent of GDP in FY25).

In a recent note, global financial major Bank of America Securities wrote, “Fiscal consolidation in the last three years has come through without sacrificing growth objectives. However, the economic momentum loss and nominal GDP growth going down to single digits for an extended period can create a much bigger trade-off between growth and fiscal consolidation, going forward.”

On the capital expenditure front, UBS said it expects capex to grow slightly better than nominal GDP at 12-14 percent on-year, with a focus on roads & highways, railways and defence, supported by a higher transfer of interest free capex loans to states.

Urban consumption has slowed down, while the rural economy has improved in FY25. There is, thus, a lot of expectation from the government to boost consumption. However, Motilal Oswal Financial Services says, “This, we believe, is unwarranted. The government needs to focus on improving household income growth rather than consumption.”

“Some course correction, both in terms of capex spending and consumption support can help, and be considered in the upcoming budget,” stated the report by BofA.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisionsDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.