Investigation into a finfluencer, recently penalised heavily by Sebi for running an illegal advisory, has opened a can of worms!

Mohammad Nasiruddin (Nasir) Ansari, aka Baap of Chart, seems to have also been running an unregistered fund management service called Srpika Financial Services, whose clients are now after him.

Nasir was asked by the Securities and Exchange Board of India to transfer out “illegal gains” of over Rs 17 crore from running an unregistered advisory service. Moneycontrol has now learnt that Nasir used to be the Director of Srpika Financial Services, which allegedly took lakhs of rupees from people, promising sizable returns. This was before 2021; the market regulator’s examination period was between January 1, 2021, and July 7, 2023.

Also read: Baap of Chart asked to refund over Rs 17 crore in fee, banned from securities market

Lawyer Sunil Rai told Moneycontrol that a complaint by his client Vineet Rai has even resulted in a 2022 order by a Judicial Magistrate in Bokaro District Court for Nasir’s arrest under Section 138 Negotiable Instruments Act. According to the complaint, Nasir took Rs six lakh from Vineet Rai and gave him a cheque that bounced.

Sources told Moneycontrol there are several victims of the scam. We spoke to a few complainants, scanned agreements he has signed with them and checked court data.

Nasir has denied all allegations and said that certain individuals are taking advantage of his situation. In an email, he stated, “I categorically deny their claims and assure you that during the mentioned time we never used client money for trading, and we never promised any returns from trading.”

According to him, these individuals had extended personal loans and have received their money back. On the arrest warrant, Nasir simply denied that it exists. He said, “I want to stress that although a client lodged a complaint, the matter was resolved amicably outside the court, and no arrest warrant or legal action was taken.”

Meanwhile, Vineet Rai’s case is still being heard in court, with the next hearing scheduled for January 11, 2024.

Srpika’s Beginnings

Goutam Kumar, a software engineer, met Nasir in 2018. “He came in a BMW… I was impressed,” said Goutam, who, like several other complainants, was approached by Nasir through a common friend or an acquaintance.

At the time, Nasir had just started Srpika Financial Services as an institute that would train people in trading. A newspaper clipping from that year, captures the inauguration day with a photo of Nasir posing with a few friends.

In the email sent to Moneycontrol, Nasir said that he has no current involvement or access to Srpika Financial Services and added that the company didn’t start any business and has been non-operational since the date of incorporation in 2018.

Nasir’s Director Identification (DIN) 08137429 links him to two other companies, besides Srpika Financial Services. The other two are Srpika Landhub Private Limited and Golden Syndicate Ventures. The first two companies’ status shows “strike off”, on Zauba Corp, which pulls out data from the Ministry of Corporate Affairs. Golden Syndicate Ventures is still active and was mentioned in the order issued by the Securities and Exchange Board of India (Sebi) on October 25. It was identified as the beneficiary of the fee collected for the unregistered advice.

Some of the complainants who spoke to Moneycontrol hope to be compensated from the amount that has been impounded, though the regulator’s order makes no mention of Srpika Financial Services.

Anand Kankani, a practicing company secretary who specialises in securities law, said that the aggrieved could approach the Sebi Whole-time Member who signed the order and give a written complaint. Sebi WTM Ananth Narayan Gopalakrishnan signed the October 25 order.

“Their (Srpika’s clients’) complaint has more to do with illegal fund management, while Sebi has passed an order on Nasir’s illegal advisory. But, since it was an interim order, the WTM can decide to add their grievances to the case or the WTM could launch a separate investigation into this. Also, if Nasir challenges Sebi’s order in the Securities Appellate Tribunal (SAT), then Sebi could make their case stronger by making an oral submission that they have received more complaints since the passing of the order.”

Ravishekhar Pandey, who heads the Securities and Capital Market Practice at MDP & Partners, said that since the regulator’s investigation is not complete, Sebi can include complaints from an earlier period as well. Pandey too agreed that if Nasir approaches SAT for a stay of Sebi’s order, then the regulator could submit that more complaints have come forward and therefore the stay should not be granted.

Pandey and Kankani suggested that the complainants approach Sebi, either by emailing the intermediaries’ department or the WTM, or through a regional office of the regulator with supporting documents.

Pandey said that approaching individually or as a group would make no difference because the regulator acts on each complaint.

Promises made

Goutam recalled his first meeting with Nasir and how Nasir came across as friendly and humble, despite his apparent affluence. It is a persona Nasir has been using online as well. As Baap of Chart, he projects himself as a benevolent older brother who has done well for himself—buying luxury cars and taking expensive vacations—and wants to help others like him to come up in life.

Goutam said, two to three months after taking Rs two lakh—Rs one lakh transferred online and Rs 50,000 given twice in cash—promising six percent monthly returns, Nasir stopped taking his calls. He said that he got only Rs 50,000 back later.

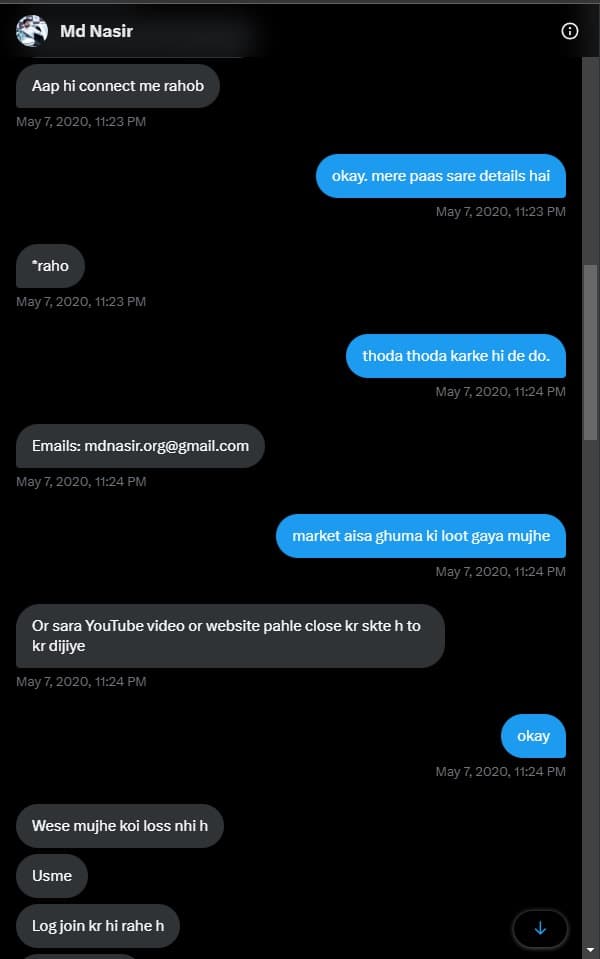

Goutam shared a conversation he had with Nasir in 2020 over Twitter’s Direct Messaging feature, in which Goutam can be seen telling Nasir that the money is needed urgently because there is a wedding in the family.

Nasir replies with an “ok” and asks Goutam and another person to take down the YouTube videos and websites that speak of the fraud.

“Aap hi connect mein rahob (later corrected to raho) (Stay in touch),” messages Nasir, and gives Goutam one of his email IDs. He says that he faced some problem previously because he was trying to get work done through another person and therefore was too busy to take Goutam’s calls. He adds that this does not mean that Goutam and the others who are claiming their money back have been forgotten.

Like Goutam, Sanjay Kumar too said that he was promised six percent return every month.

Sanjay was working as a stationery supplier and earning Rs 15,000-Rs 16,000 a month, when a colleague introduced him to Nasir.

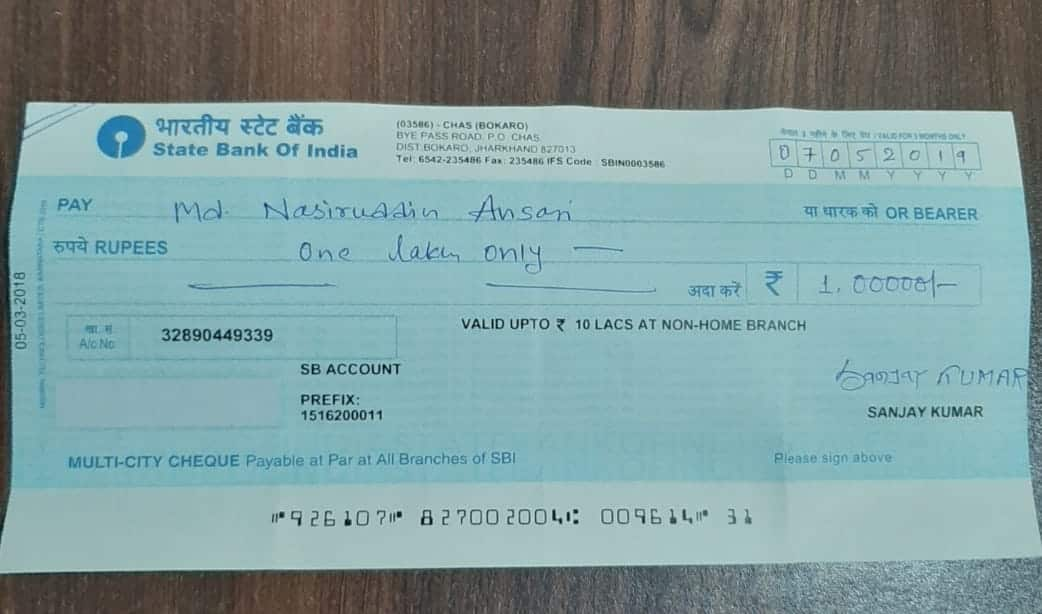

He handed over Rs two lakh—Rs one lakh in cheque and Rs one lakh in cash. It was money Sanjay could not spare—he had taken two years to save the one lakh rupees and taken a loan for the other one lakh rupees. Therefore, he took a photo of the cheque before handing it over.

“I thought with Rs 12,000 some of the expenses at home, like school fees, would be taken care of,” said Sanjay, who has three children.

The agreement that he and several others signed with Nasir, and which Moneycontrol has seen, records a person loaning money to Nasir. It makes no mention of interest payments.

“It wasn’t a loan,” said Sanjay.

Misleading agreement

The agreement Sanjay signed reads, “the Lender has agreed to grant friendly loan to the Borrower, as the Lender and the Borrower have known each other since several years”.

Sanjay had known Nasir only for around two weeks.

Agreements that Nasir has signed with others and Moneycontrol has read, are similar, saying that a person has extended a friendly loan to Nasir with payment due after a year, no mention of interest payments and only talking about payments to be made in installments.

Sanjay told Moneycontrol that he hadn’t read the agreement before handing over the money. In fact, he said, he was given a copy of the agreement only after the money was handed over to Nasir.

The date on the cheque issued to Nasir from Sanjay shows May 7, 2019, while the date of the agreement shows May 8, 2019. According to Sanjay, the money and cheque were handed over even earlier than May 7, 2019, even a week before signing the agreement.

Sanjay said that he got Rs 12,000 for a month and then his calls to Nasir went unanswered, and later blocked.

“Losing the Rs two lakh was like losing Rs four lakh for me, because of the loan I had taken to fund it,” he said.

Sanjay heard of a person, Vineet Rai, who was filing a cheating case against Nasir and contacted him. But soon Sanjay realised that he might just end up losing more money in lawyer’s fees.

Going to court

Moneycontrol spoke to Rai, who filed a case against Nasir in September 2019. Rai said that he too was introduced to Nasir through a friend of a friend.

“He had borrowed Rs one lakh from me before and returned it, so when he asked for Rs 6 lakh later… I trusted him. Our common friend said that this boy (Nasir) is trying to do something big and that he is from our village, so we should support him… so I did.”

Rai said he had given a friendly loan and not capital for investment, like the others. When Nasir stopped taking his calls, Rai went straight to the Judicial Magistrate to file a complaint.

His lawyer Sunil Rai told Moneycontrol that Nasir has not been attending the hearings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.