In the first five years of Narendra Modi at the Centre, mid and smallcap outperformed benchmark indices. However, in the last 18 months, largecaps have had an upper hand.

Mid & Smallcaps remained under pressure for the last 18 months due to a sharp rise in crude oil prices, corporate governance issues, muted earnings growth and uncertainty around the general elections among other issues.

Experts say the correction in the broader market leaves ample room for further upside, compared to large-cap names. As of May 27, the S&P BSE Midcap index was trading 11 percent below its 52-week peak and the S&P BSE Smallcap index was down about 15 percent from its 52-week high.

“Indian markets are extremely fragmented as the gap between the large and mid-cap stocks is huge. While the largecaps rejoiced during the past year, mid and smallcaps have faced a tumultuous time,” Umesh Mehta, Head of Research, SAMCO Securities told Moneycontrol.

“Hence, as per the mean reversion theory, there can be some growth in the mid and smallcaps going ahead, considering they are available at cheaper valuations. Whereas, largecaps are likely to face some correction,” he said.

Investors should avoid fresh buying into largecaps and get into select quality small and mid-cap stocks if not through direct equity then via mutual funds route as valuations have turned slightly favourable.

After the NDA government came into power in 2014, the Forward PE of Mid Cap Index started to trade at a premium over the Nifty50 Fw PE. This continued for around four years in a row.

“At the peak of January 2018, the Forward PE of Midcap Index had gone into a bubble zone of ~25x while the same for Nifty50 was at ~19x (i.e.>40 percent premium over the Nifty50 Fw PE). The 10-year average discount of Mid Cap Fw PE to that of Nifty50 Fw PE is 8 percent,” Kotak Securities said in a note.

“We feel the Midcap Forward PE, which at present is at 19 percent discount to the Nifty Fw PE, can revert to the 10-year average discount range of ~5-10 percent in the coming months,” it said.

The report further added that even though the Midcap Index is trading at 14.8x Fw PE there are dozens of companies trading below 15x Forward PE and having more than 15 percent RoE profile.

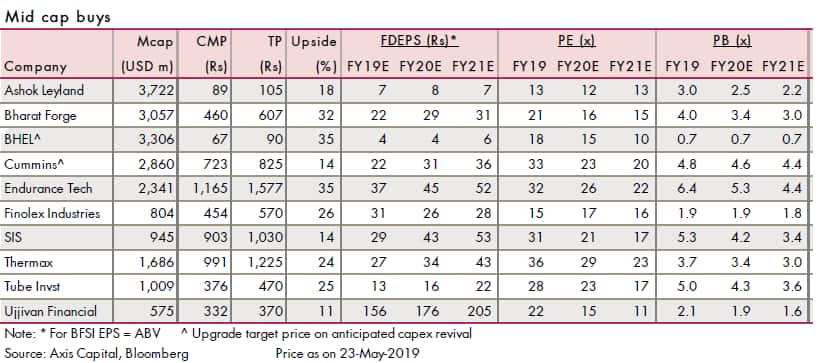

Here is a list of 20 mid and small-cap stocks from two brokerage firms that could be considered as buying opportunities for the long term:

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.