Madhuchanda Dey

Moneycontrol Research

To get a sense of the mess in the Indian banking system, check out this statistic: 11 out of 21 one listed banks in the country are under the Prompt and Corrective Action (PCA) framework of RBI. Huge bad loans, inadequate capital and low return on assets are the tickets that get banks an entry into the PCA club.

RBI’s stance is that the PCA framework is needed to resuscitate weak banks and prevent systemic risks. The argument may be sound, but of late the government has been critical of RBI’s view on the matter. PCA was among the contentious issues between the government and the RBI. Finally a truce was arrived at in yesterday’s board meeting with RBI willing to reconsider some of the clauses in the PCA.

Is the time ripe to relax these norms to allow flow of credit or is it too early? The short answer is it may be premature to ease PCA norms unless the weak banks have access to significant amount of capital.

What is PCA?

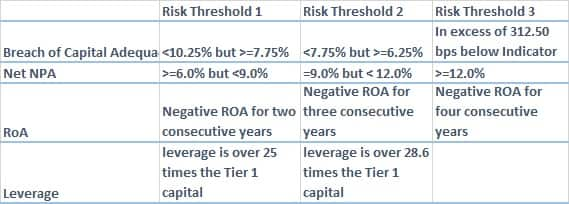

In a nutshell, the trigger for coming under PCA is based on performance with respect to capital position, bad assets, profitability and leverage.

Source: RBI

There are two type of restrictions, mandatory and discretionary. Restrictions on dividend, branch expansion, directors’ compensation, are mandatory while discretionary restrictions could include curbs on lending and deposit taking.

So far eleven banks -Allahabad Bank, Bank of India, Bank of Maharashtra, Central Bank, Corporation Bank, Dena Bank, IDBI Bank, Indian Overseas Bank, Oriental Bank of Commerce, UCO Bank and United Bank of India are under PCA. Government has found an investor for IDBI Bank and a merger of Dena with Bank of Baroda and Vijaya is on the cards. The fate of the rest is still unclear.

Do they pass the CAR test?

If we look at their capital position, even after the latest round of recapitalisation, it remains close to the threshold for PCA trigger.

While RBI has pushed the deadline for reaching Capital Adequacy Ratio (CAR) of 11.5 percent (9 percent CAR plus 2.5 percent Capital Conservation Buffer (CCB)) to March 2020, looking at the profitability parameters of PCA banks, it doesn’t appear that these entities are in a position to comply unless significantly capitalised.

Source: Company

It is pertinent to note that only two out of these eleven comply with the current requirement of CAR with CCB of 10.875 percent.

How bad is the bad asset picture?

With gross non-performing assets of close to Rs 3.5 lakh crore, they contribute close to 1/3rd of system’s gross non-performing assets while their share in total advances is only 16 percent. Clearly, the underwriting expertise of these banks need an overhaul.

Source: Company

None of the eleven banks are out of the PCA threshold (which is net NPA below 6 percent). While RBI’s February 12 Circular expedited the bad asset recognition process and to some extent the bad asset formation phase is peaking out, given the aggregate provision cover (the amount of provision held against bad assets) of 53 percent and tardy pace of resolution, caution is warranted.

Profitability – not yet in sight

The profitability picture is dismal too. From FY16 onwards, these banks as a group have reported a net loss for every single year. In FY16 and FY17, two out of eleven had reported profits, but in FY18 none of them reported profits because of huge provisions towards bad loans. The aggregate loss in FY18 was in excess of Rs 49,000 crore and they reported a loss of Rs 9872 crore and Rs 10197 crore respectively in Q1 and Q2 of FY19.

Going by the criteria of RoA (return on assets), seven out of eleven banks had negative RoA for three consecutive years and two had negative RoA for two consecutive years.

Can they recoup lost market share without denting asset quality?

As NPA (non performing asset) formation is ebbing, in all likelihood the earnings picture would incrementally look better. But the moot question is: can these banks capture lost market share in the competitive market place? Lest, a relaxation at this stage will only prompt them to take exposure to lower quality credit thereby exacerbating the problem. Such lending would warrant more capital (because of higher risk weight) and could lead to resurfacing of the bad asset problem in future.

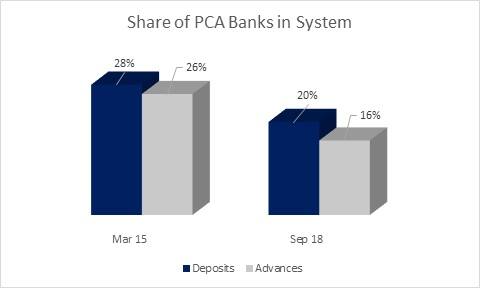

Source: Moneycontrol Research

In the period between FY15 to FY18, the eleven PCA banks as a group has not shown any growth in deposits and individually only four have grown deposits in low single digit. The picture is even more dismal in advances, where some of the well capitalised private banks have been aggressively garnering market share. The group has shown de-growth in advances to the tune of 5 percent CAGR (compounded annual growth rate) with not a single entity showing growth. This isn’t quite bad news for the system because if they had grown their books over this period, the size of the problem could have been even bigger warranting larger dose of capital infusion.

Does the system warrant incremental/directed lending by PCA banks?

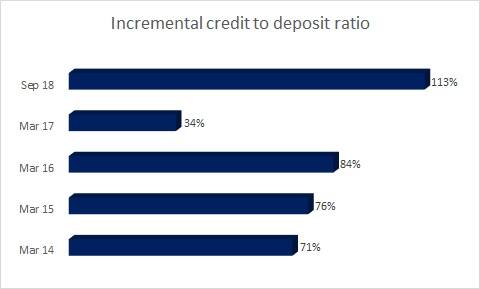

Finally, is incremental lending by weaker entities warranted when the incremental credit to deposit ratio is running above 100 percent. Conventional wisdom suggests that such a push will lead to further upwards pressure on interest rates.

Lending, at the end of the day, should be a commercial decision and is a sole prerogative of the individual entities. It is better left that way in the broader interest of the system.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!