Activity in the futures and options market (F&O) hotted up amid the sell-off in global markets. Benchmark indices Nifty and Sensex were down by more than 2 percent, the India Volatility Index surged 50 percent to 21.78 and there was a scramble to buy options.

"Massive buying in options by FIIs, coupled with a flaring VIX, indicates heightened fear driving options buying as volatility increases," said Akshay Bhagwat, VP of Derivative Research at JM Financial.

Experts are advising put writers at the 24,500 strike should unwind and shift to lower strikes at 24,000. Intraday respites or pullbacks around the 24,300-24,350 levels can be expected.

Nifty Levels

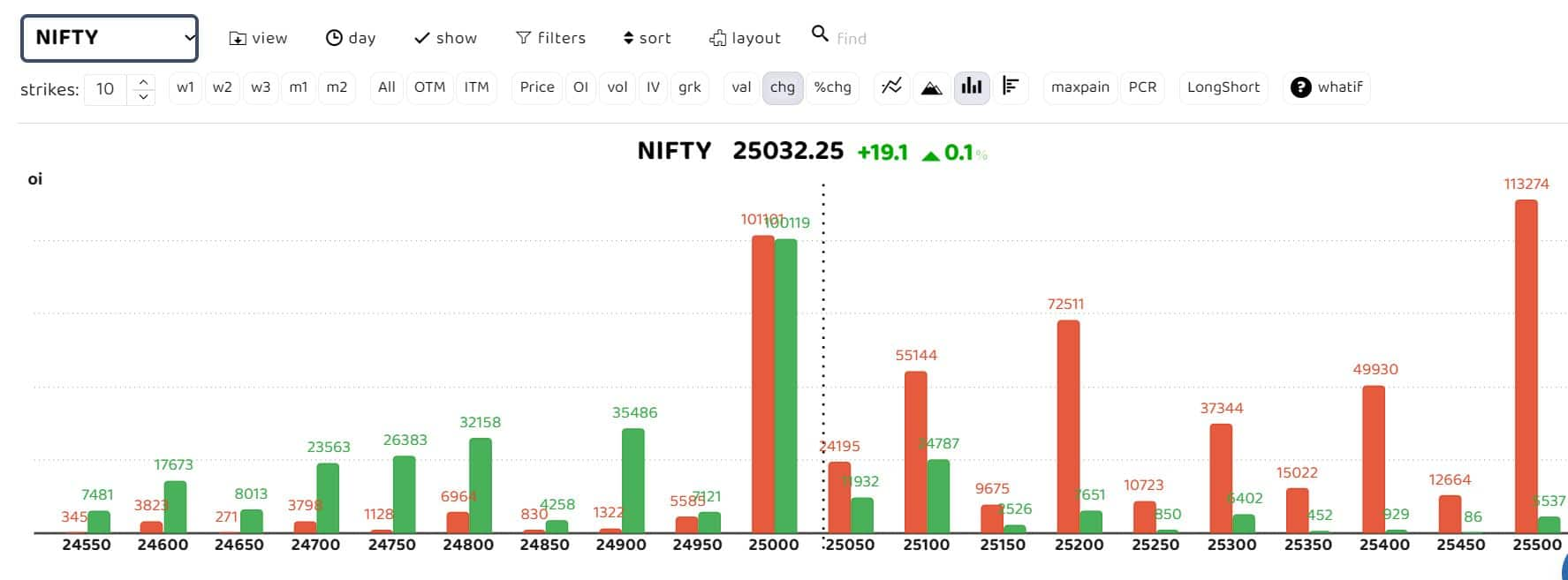

The red bars indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers.

The red bars indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers.

Options data suggests the highest call writing at the 25,500 level, acting as strong resistance for the day. Today's sharp gap-down opening has opened the doors for the 24,000 support zone. Put writers at 24,500 are unwinding their bets and shifting to lower strikes of 24,000 to 23,800.

"Volatility index jumping over 15 to 16.6 percent signals the fear factor triggering the buying of options to hedge the downsides," said Bhagwat.

Bhagwat highlights that intra support is at 24,150-24,200 Nifty spot. "Volatility will be high. If support holds, a respite bounce can see the 24,500-24,600 zone. If support breaks, then 23,900-24,000 is the short-term key support zone to revisit," he added.

The global rub off

ICICI Securities in its report highlighted that global concerns have put pressure on Indian indices. "While the weakness has been largely driven by global cues, some sell-off due to liquidation cannot be ruled out. Moving forward, we believe that global cues may cause some immediate weakness, but domestic liquidity is likely to cushion the markets."

"In the coming session, Nifty is expected to consolidate within the broader range of 24,000-25,000, with stock-specific action continuing. Key to note is that last week’s subdued activity amid overbought conditions signifies a pause in the upward momentum after an 18% rally over the past eight weeks (following the election outcome low). Additionally, negative divergence on the weekly stochastic oscillator suggests a temporary breather in the coming week," said the brokerage firm.

"In a structural bull market, secondary corrections are common. Thus, an extended breather from hereon cannot be ruled out. However, investors should focus on quality stocks with strong earnings as strong support is placed at 24,000," added ICICI Securities.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.