With Nifty trading near record high levels, traders are closely tracking the market ahead of the presentation of the full Union Budget 2024 on July 23. An analysis of past data shows that historically, Nifty has moved within a 4 percent range on Budget day.

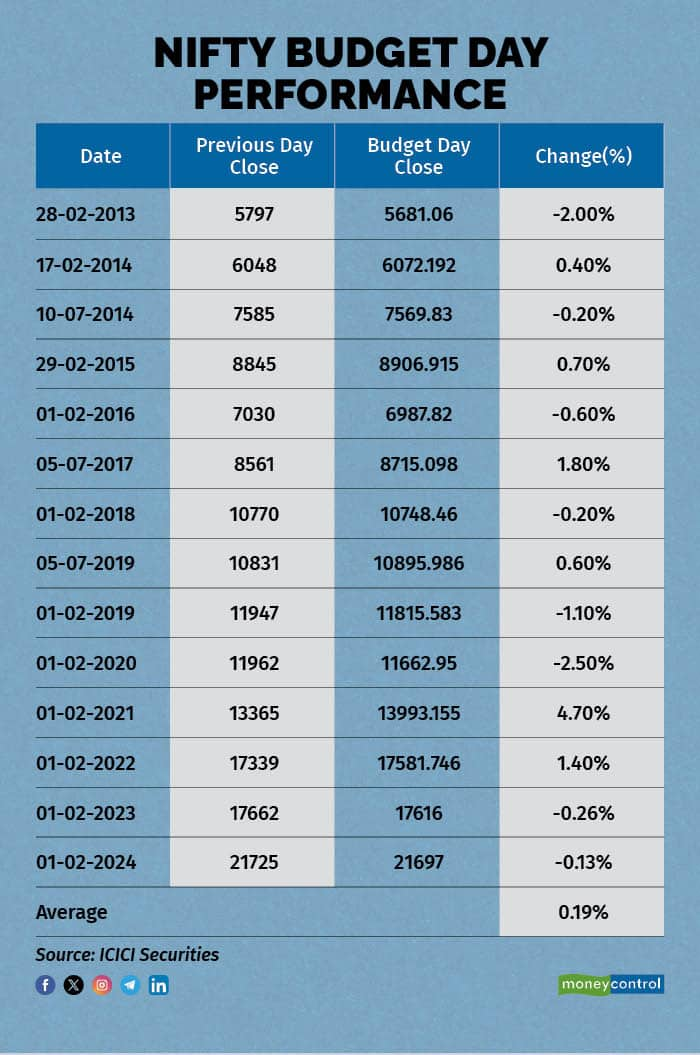

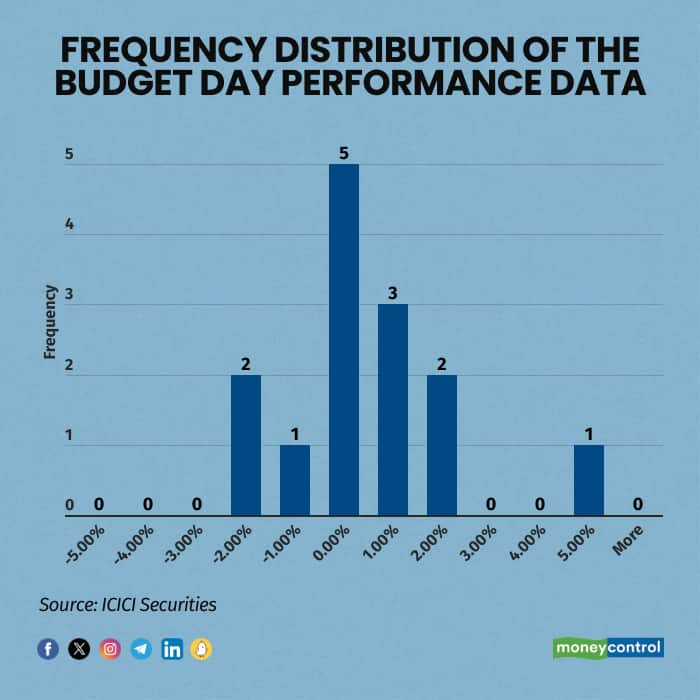

According to Jay Thakkar, Head of Derivative and Quantitative Research at ICICI Securities, “Nifty closes within a range of -2 to +2 percent in 12 out of those 14 budget day sessions, indicating that the 4 percent range is well-defined over the past decade.”

Thakkar said that 2021 was an exception when the Nifty closed 4.7 percent (above) its previous close.

“Generally, ahead of such events, the options' implied volatilities (IVs) increase, and in the absence of significant changes in the Index, the IVs tend to cool down,” Thakkar added.

Implied volatility is a measure of how much the price of a stock or other asset is expected to fluctuate in the future. In simpler terms, it reflects the market's expectations of how unpredictable or risky the asset's price is likely to be.

A high IV means traders expect big price swings (either up or down), and low IVs mean traders expect the price to stay relatively stable.

Thakkar believes that to benefit from the IV momentum ahead of the event, non-directional strategies should be considered, such as the Short Iron Butterfly or Short Iron Condor.

These are four-legged option strategies, involving simultaneously selling and buying of calls and puts.

The data below reveals Nifty's performance during the past 14 Budget sessions and the frequency distribution of the same.

Thakkar recommends the following Options positioning to be taken one day prior to Budget announcement. He says, to trade within the aforesaid range and benefit from the rise in IVs of options, one can initiate a Short Iron Condor strategy. Here, one can sell OTM strike Call options and Put options that are 2 percent away from the ATM (at the money strikes) and, to hedge the risk, buy 3 or 4 percent OTM (out of the money strikes) away from the ATM. This strategy ought be deployed near close between 3-3:29 PM on July 22.

Trade OutlookThis strategy will not only help reduce the margin requirement and increase the return on investment (RoI) if Nifty closes within this range and IVs fall but also hedges the unlimited risks arising from selling options.

Short Iron ButterflyThe Short Iron Butterfly strategy involves four options contracts with the same expiration date but three different strike prices. The goal is to profit from minimal movement in the underlying asset's price. This setup includes selling one at-the-money (ATM) call and one ATM put, while simultaneously buying one out-of-the-money (OTM) call and one OTM put.

Short Iron CondorThe Short Iron Condor strategy also involves four options contracts with the same expiration date but uses four different strike prices. It is similar to the Short Iron Butterfly but with a wider range of strikes, making it a less aggressive strategy. This setup includes selling one lower-strike put and buying one even-lower-strike put, while also selling one higher-strike call and buying one even-higher-strike call.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisionsDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.