The Nifty closed a percent higher in the week ended August 26 which saw a lot of volatility due to monthly expiry.

Sharp profit booking on August 19 was a precursor to a steady decline after the Nifty shot past the psychologically vital mark of 18,000.

With the US markets ending the week lower, India's monthly expiry week was off to a sluggish start on August 22. The Nifty first slipped below 17,600 and then 17,500 as the selling pressure mounted.

The next day markets were off to a nervous start but strong buying at lower levels saw the Nifty make a V-shaped recovery.

In the remaining week, markets remained sideways with a hint of profit booking at higher levels and the index closed the week a percent higher.

The Nifty retraced nearly 650 points from the recent highs. Since the correction happened in three trading sessions, some sort of time-correction was needed and this is what happened in the second half of the week.

The Nifty has closed around the mid-point of the immediate trading range of 17,750–17,350. As the market has lost its sheen, it will be difficult to predict the immediate path of action amid global nervousness.

One should avoid trading aggressively within the range and as long as the Nifty stays above the key support of 17,350, there is no reason to worry. A break of the support, however, can extend the correction to the major support of 17,100–17,000.

Immediate support is seen around 17,450. On the flip side, 17,700–17,750 are the levels to watch out for. For Nifty to gather strength, it has to surpass the higher boundary with some authority. Till then, it's better to take one step at a time.

Since global markets are showing mixed signs and some events are lined up, it will be good to keep a tab on them. If there is no sudden development during the week, the index may resume uptrend soon.

Here is one buy call and one sell call for the next two-three weeks:

NTPC: Buy | LTP: Rs 163.40 | Stop-Loss: Rs 157.90 | Target: Rs 172 | Return: 5 percent

NTPC is one of the few ‘Maharatna’ companies that have seen a steady move in the last couple of months after forming a strong base at its sacrosanct support of '200-day simple moving average (SMA). On August 26, this counter bucked the trend and saw its highest closing in the last three months.

Volume activity has risen significantly to support the uptrend. We recommend buying the stock for a near-term target of Rs 172. Traders can participate by following strict stop-loss at Rs 157.90.

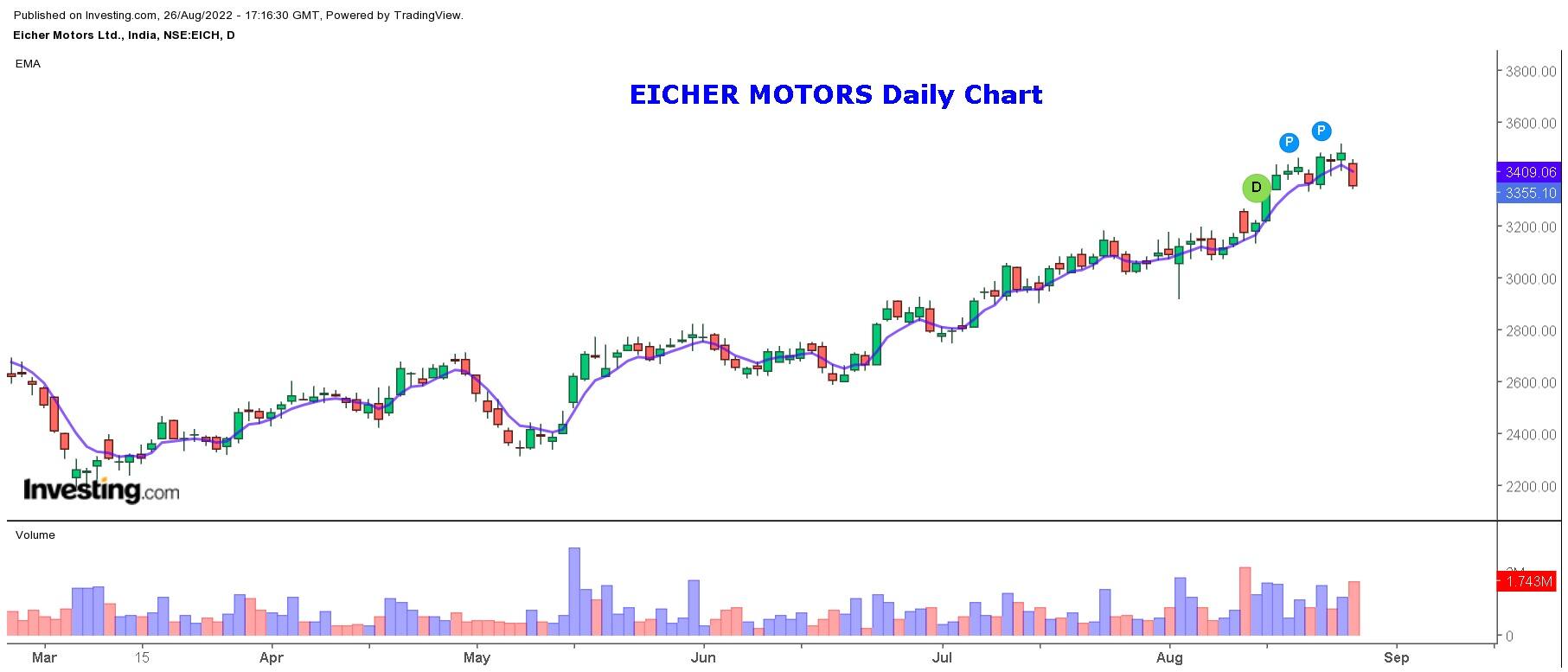

Eicher Motors: Sell | LTP: Rs 3,355.10 | Stop-Loss: Rs 3,460 | Target: Rs 3,260 | Return: 3 percent

The automobile space has given a stupendous move in the last few months and Eicher Motors, too, has contributed to the uptrend. On August 26, the stock prices plunged to confirm a short-term trend reversal.

On the weekly timeframe chart, we see a ‘Shooting Star’ pattern, indicating a correction in the coming days. Traders are advised to sell on a bounce at around Rs 3,380–Rs 3,400 for a near-term target of Rs 3,260. A strict stop-loss needs to be placed at Rs 3,460.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.