The live blog session has concluded. For more news, views and updates, stay tuned with Moneycontrol.com.

HDFC-HDFC Bank Merger: Mortgage lender Housing Development Finance Corporation (HDFC) on April 4 said its board has approved merger of its wholly owned subsidiaries HDFC Investments Limited and HDFC Holdings Limited with HDFC Bank Limited.

HDFC will acquire 41 percent stake in HDFC Bank through the merger, according to an HDFC Bank filing with the stock exchanges. The merger of HDFC into HDFC Bank is likely to create the third-largest entity in India in terms of market capitalisation. HDFC said that its shareholders will get 42 shares of HDFC Bank for every 25 shares of the non-banking lender held by them.

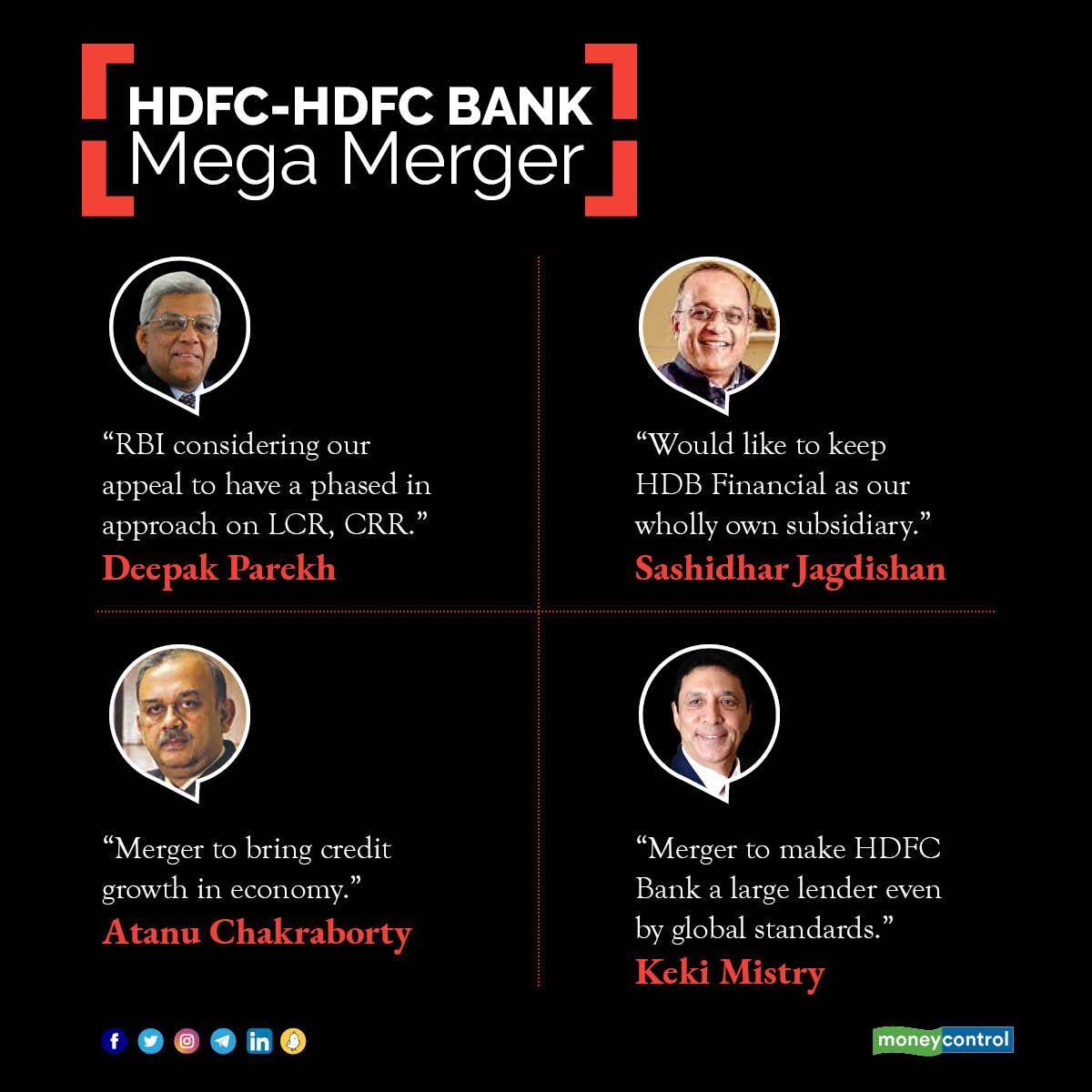

Also Read: Banking Central | Why did HDFC decide to merge with HDFC Bank now?“This is a merger of equals. Over the last few years, various regulations for banks and NBFCs have been harmonised, thereby enabling the potential merger,” Deepak Parekh, chairman of HDFC said in a press statement.

Analysts suggested that the merger will create the biggest stock in terms of weight in the Nifty50 index, easily surpassing Reliance Industries’ current weight of 11.9 percent. As of March 31, HDFC Bank's weight on the index was 8.4 percent while that of HDFC was 5.66 percent.

The live blog session has concluded. For more news, views and updates, stay tuned with Moneycontrol.com.

Top management of HDFC and HDFC Bankas well as industry experts feel the mega-merger is a win-win for the two organisations, stakeholders, customers and even the economy. However,HDFC’sdepositors and borrowers are bound to have certain doubts regarding the future of their long-term contracts.Here's an explainer on what it means for the depositors and buyers.

In FY96, HDFC Bank's net profit was Rs 20 crore and in FY21 it went up to Rs 31,856 crore. Similarly, HDFC's net profit in FY96 was Rs 196 crore and in FY21 stood at Rs 13,566 crore. Here's a timeline of how both the entities have developed over the years.

The HDFC-HDFC Bank merger is expected to be completed by the second or third quarter of of FY24. HDFC said the Proposed Transaction shall enable HDFC Bank to build its housing loan portfolio and enhance its existing customer base. The merger surprised many as the news was kept under wraps and Twitter had a lot to say. “In my 36 years of investing journey, never seen HDFC Ltd rise by 15% and HDFC Bank by 14% in one single session and that too on the same day. phew!” a banker tweeted. “This merger has been discussed among investors for many years. The timing of it is a real surprise. There was zero leak shows the corporate governance of the HDFC group,” another user tweeted. Read More

The party on Dalal Street triggered by the announcement of the merger of HDFC with HDFC Bank could be short-lived given the potential of no entry for HDFC Bank in the MSCI index after the transaction. In an exchange filing on April 4, HDFC announced that it will be merging into HDFC Bank to create one of the largest financial institutions in the country with a likely combined market capitalisation of more than Rs 12.5 lakh crore as of Friday’s closing. The announcement saw shares of both HDFC and HDFC Bank soar over 15 percent at one point before losing a third of those gains at the time of writing. The profit booking seen in HDFC Bank’s stock was likely triggered by a realisation that even after the merger the lender’s stock may not become part of the MSCI indices, which are tracked widely by foreign exchange-traded funds. Read More

HDFC-HDFC Bank merger has been in the news for a while. In fact, back in 2015, HDFC Chairman Deepak Parekh had said his firm could consider a merger with HDFC Bank provided circumstances are in favour. But, the wait for the merger got longer with the parent putting the idea on the backburner saying the regulatory environment is not conducive. Parekh had said that the merger makes sense provided there is no loss of value for shareholders and considering the business synergy between two institutions. But, there is a question on the timing of the merger; why did they choose to do it now? One key reason could be the emerging regulatory approach of the banking regulator to NBFCs. The benefit of continuing as an NBFC is nearly absent now compared with the older times. Read More