HDFC Limited, India’s largest housing finance company will merge into HDFC Bank, India's largest private sector bank by assets.

HDFC Bank is one of India’s leading private banks and was among the first to receive approval from the Reserve Bank of India (RBI) to set up a private sector bank in 1994. HDFC has come a long way since its inception in 1977.

Today, HDFC Bank has a banking network of 5,779 branches and 17,238 ATMs in 2,956 cities/towns.

Also Read | Once merged, HDFC twins to pop into global club of 100 most valued firms led by Apple

Both the stocks' have seen exponential market cap growth from their initial days of trading on the bourses. Since June 2011, HDFC Bank started outperforming HDFC and now HDFC Bank's market cap is over doubled to HDFC.

Also Read | Why did HDFC decide to merge with HDFC Bank now?

According to ACE Equity data, in January 1992 HDFC was trading at 324 crores and now in March 2022, its market cap stood at Rs 4,44,364 crore. Similarly, HDFC Bank's market cap in April 1996 was Rs 695 crore and now in March 2022, its market cap stood at Rs 8,35,324 crore. In the below-mentioned graph, we have taken a common period to show their performance.

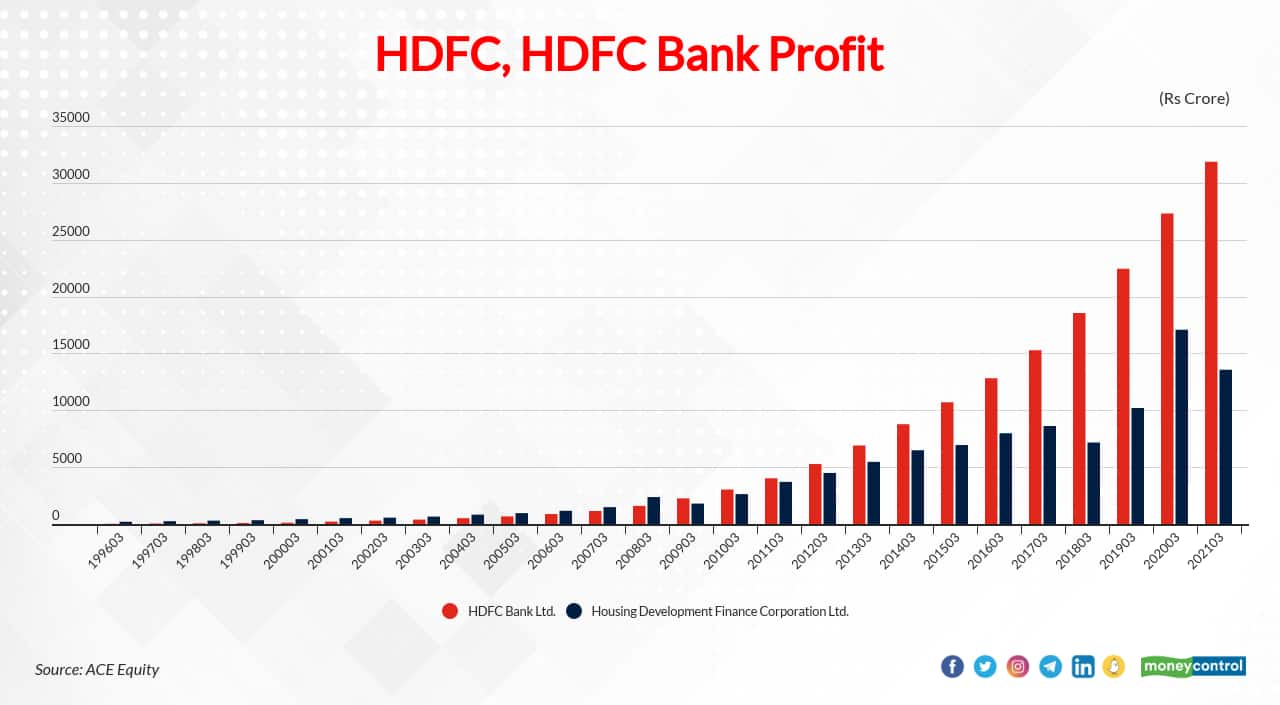

In FY96, HDFC Bank's net profit was Rs 20 crore and in FY21 it went up to Rs 31,856 crore. Similarly, HDFC's net profit in FY96 was Rs 196 crore and in FY21 stood at Rs 13,566 crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.