Abhishek Bansal

Precious metals have benefitted from the easy monetary policies adopted by global central banks and mounting geopolitical troubles.

Gold rallied to its highest point since May 2013 to $1,557 per ounce in the first week of September. The ongoing US-China trade war, multiple delays in Brexit, a slowdown in the Euro Zone and dovish central bank policies across the globe were a few reasons for gold climbing nearly 31 percent, from $1,183 per ounce to $1,557, in the last one year.

The September 14 drone strikes on Aramco oil facilities in eastern Saudi Arabia pushed up gold prices, which were on a decline, overnight by 1 percent. The risk premium has increased over fears that Saudi Arabia may take retaliatory action. Precious metals are attracting safe haven demand.

Let us discuss some key factors that have affected gold in the recent past:

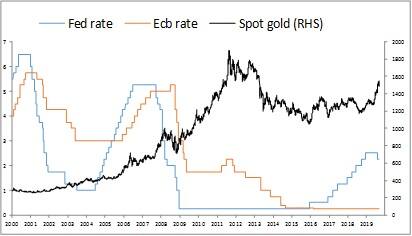

Dovish central banks Spot gold $ per ounce, US fed rate, ECB rate/ Source; Abans Research

Spot gold $ per ounce, US fed rate, ECB rate/ Source; Abans Research

Economic stimulus and interest rate cuts improve liquidity in the system and riskier assets thereby rally. Gold prices rallied above six-year highs in the first week of September following dovish Fed and economic stimulus by China and Europe. In July, the US Federal Reserve lowered interest rates for the first time since the Great Recession of 2008 as an insurance to prevent an economic slowdown.

Along with the Fed rate cut, there were 14 cuts in August and eight in July by other global central banks. Latest one was by the European Central Bank (ECB), which deepened its deposit rate into negative territory. The ECB cut its deposit rate to a record low -0.5 percent from -0.4 percent.

China has lowered by 50 basis points the reserve requirement ratio (RRR) for financial institutions which could release $113.2 billion into the economy. China has cut RRR for the second time this year.

The Reserve Bank of India (RBI) has reduced the repo rate for the fourth consecutive time this year. There is a high possibility that the Fed may cut interest rates by 25bps at a meeting this week. We expect the Bank of England and RBI to remain dovish in upcoming meetings.

Delayed Brexit and eurozone slowdown

Britain's exit from the eurozone could be delayed after dramatic events of the last two weeks. The government lost its majority and parliament passed a bill that would force Prime Minister Boris Johnson to request a three-month Brexit extension from the EU if no deal is reached by October 19.

This uncertainty is supporting gold prices and is one of the main reasons for the slowdown in EU. Eurozone industrial production fell by 0.4 percent month-on-month, and 2 percent on an annual basis in July, confirming a slowdown since December 2017.

Capital goods production is 3 percent and is 3.4 percent lower than what it was in July 2018. ECB has announced a fresh stimulus package to prevent the fragile eurozone economy along with an interest rate cut and plans to pump 20 billion euro (19 billion pound) a month into the financial markets.

Attack on Saudi Aramco

Drone attacks on two Aramco facilities over the weekend forced Saudi Arabia to halve its oil output, and increased geopolitical tensions multifold.

The US has blamed Iran for the attack, which was claimed by Iranian-backed Houthi rebels in Yemen. Iran has denied US’ charge. Gold prices rallied nearly 1 percent at the opening on September 16 and Brent oil 19 percent, but gradually lowered to stay up by 8 percent. The risk premium has increased significantly and could support gold prices in the near term.

US-China trade war

There was a brief respite in the US-China trade dispute after American President Donald Trump announced he was holding back increased tariffs on $250 billion worth of Chinese goods. In response, China exempted some agricultural products ahead of trade talks.

Spot Gold prices dropped from the recent high of $1,557 per ounce after these announcements, though it is unclear how both the countries will resolve their tariff issues.

A lot will depend on the meeting that the US and China will hold in early October. A relaxation in tariffs could support the world economy and prevent a further decline in global growth, which remains a downside risk for gold prices and vice versa.

We expect spot gold prices to trade in a wide range of $1,482 - $1,529 per ounce, with a positive trend supported by dovish central bank policies and various geopolitical and economic concerns across the globe. All eyes are now on the Fed meeting and further dovish action could move gold prices higher towards $1,557- $1,626 in the near term.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.