When inflation storms, equities lie low - that's the way the market functions. As prices begin to soar, consumers shy away, and gold gathers glint as a safe heaven for parking money.

In such times, according to Abhishek Bansal, the Founder Chairman of Abans Group, investors should keep gold assets at least 10-15 percent in their portfolios.

In an interaction with Moneycontrol, Bansal shares his thoughts on the investment roadmap in the backdrop of geopolitical uncertainties and surging inflationary environment. Excerpts from the interview:

Happy Akshaya Tritiya! Is it better to stick to the traditional way of buying physical gold or one should go for other options?

Also read - Germany, India sign $10.5 billion green development deal

For generations, the only and best way to invest in gold has been to purchase physical gold in the form of coins, bullions, or jewellery. However, as time passed, more sophisticated forms of investment emerged, such as gold ETFs (exchange-traded funds) and gold mutual funds. Gold coins are also available online, banks, the MMTC-PAMP (a government-authorised public sector entity for the selling of gold and silver), and certain non-banking financial firms in the contemporary period.

On the other hand, the minimum denomination of gold coins varies across organisations. Sovereign Gold Bonds (SGB) are another option for long-term investors who do not want to hold physical gold. Investors must pay the issue price in cash, and the bonds must be redeemed in cash when they reach maturity. The Reserve Bank of India issues the bond on behalf of the government. The Bonds pay interest at a fixed rate of 2.50 percent per year on the initial investment. Interest will be credited semi-annually to the investor's bank account, and the final interest will be payable along with the principal at maturity.

Would you suggest equity instead of buying gold on this Akshaya Tritiya?

Also read - LIC IPO: Here's how you can max out bidding for the mega public issue

MCX Gold future is a barometer to track spot gold prices in India, which have corrected nearly 10 percent from their all-time high of Rs 56,191 per 10 grams (comex $2121.7 per troy ounce) registered in August 2020, and are now hovering at Rs 50,500 per 10 grams (comex $1863 per troy ounce), providing a better bargain as gold is considered a safe haven during uncertain times and also a hedge against inflation.

When inflation is on the rise, equity underperforms. Input prices rise as a result of higher inflation, consumers may lose purchasing power, unless their incomes rise, and monetary policy measures to control inflation can harm growth and employment. During such times, gold becomes a safe haven asset. It is always recommended that investor should keep gold assets at least 10-15 percent in their portfolio.

Where do you see gold prices by the end of this calendar year?

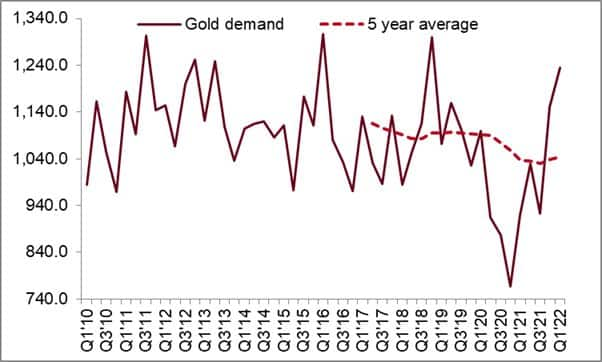

According to the World Gold Council report for Q1-2022, gold demand (excluding OTC) increased 34 percent on-year to 1,234 tonnes, the highest level since Q4 of 2018 and 19 percent higher than the five-year average of 1,039 tonnes. The invasion of Ukraine and rising inflation were major factors driving both the gold prices and the demand.

The gold ETF's holdings increased by 269 trillion, more than reversing the 174 trillion annual net outflow from 2021. As long as the uncertainty surrounding Russia-Ukraine persists and the Covid-related threat remains, gold prices will continue to benefit from safe-haven demand.

Figure 1: World gold demand excluding OTC, Source: Respective ETP providers, Bloomberg, ICE Benchmark Administration, World Gold Council

Figure 1: World gold demand excluding OTC, Source: Respective ETP providers, Bloomberg, ICE Benchmark Administration, World Gold Council

Do you expect black gold to trade above $100 a barrel in the rest of the calendar year?

Also read - Delhivery IPO may open on May 11, close on May 13; issue size reduced to Rs 5,235 crore

The conflict between Ukraine and Russia pushed Brent oil to $139.13 per barrel in March, but it is still consolidating above the critical $100 per barrel threshold. In these uncertain times, India's import bill will rise, since the country is the world's third-largest oil user and importer, with imports accounting for 85.5 percent of domestic consumption.

As per the oil ministry's Petroleum Planning & Analysis Cell (PPAC), India imported 212.2 million tonnes of crude oil in 2021-22, up from 196.5 million tonnes in the previous year, marginally lower than pre-pandemic imports of 227 million tonnes in 2019-20.

OPEC+ is under pressure to raise supply due to the prospect of future decreases in Russia's oil output. OPEC+ missed its production objectives by 1.45 million barrels per day (bpd) in March, as Russian output began to decline as a result of Western sanctions. Russia produced almost 300,000 bpd less than its target of 10.018 million bpd in March. As long as supply is short, China and India, two of the world's major consumers, will have difficulties. Under current conditions, crude oil prices are unlikely to fall below $70 per barrel very soon.

What are your thoughts on Nickel, which is down more than 30 percent from recent high, aluminium, down around 9 percent, and copper, down around 9 percent, prices in this market condition?

China is the world's largest user and manufacturer of metals, but its stringent measures to combat Covid-19 infections are wrecking the economy and disrupting global supply networks. In April, manufacturing and services sector activity reached its lowest point since February 2020. China's PMI for April was 42.7, down from 48.8 in March, according to the National Bureau of Statistics of China.

In April, the separate Purchasing Managers Index for the service sector fell even more to 41.9. Base metal prices have fallen following a drop in manufacturing activity in China. The correction in base metals is only temporary, and once the uncertainty subsides, we may see bullish momentum return to the market.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.