Gold prices, which rallied to their highest level of $2,073.41 a troy ounce in August 2020, have had a roller-coaster ride in the first six months of 2021.

Prices dropped to their lowest at $1,707.01 in March 2021 but bounced back to the recent high of $1,916.84 in June 2021 before falling to $1,750.11. Gold suffered the worst monthly loss in June 2021 since 2016.

Demand for gold ETF was also affected by this volatile move in gold prices. Global holding of gold in ETF as of the end of June was 3,624 tonne, down about 7 percent from the October 2020 record high of 3,909 tonne. The value of gold held in ETF vaults was $206 billion in June 2021.

Currently, prices are holding near $1,800 with modest gains from last month's drastic drop. Despite the rollercoaster in the first half of the year, we expect gold to remain positive in the second half on the back of extremely accommodative monetary policy, strong demand due to economic expansion and "transitory" inflation.

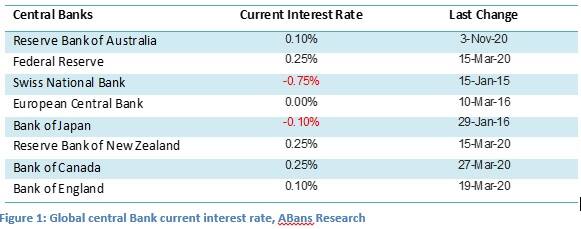

Support from low-interest rate regime

The ECB's 1.85 trillion euro emergency asset purchase scheme is likely to continue until the "crisis phase" of the pandemic is over.

The Fed has continued buying $120 billion in government-backed bonds each month. The BOE, too, continued the bond-buying programme at 875 billion pounds ($1.22 trillion). The Bank of Japan extended the duration of the “Special Program to Support Financing” in response to Covid-19 until the end of March 2022.

Low-interest rate and Covid-19 related monetary assistant is likely to support gold prices for the remaining six months of 2021. Global central banks are likely to be extremely cautious before changing the policy stance and that is supportive for gold prices.

Greater economic activity to fuel strong demand

Expansion in the world’s leading economies is likely to increase demand for physical gold. According to The World Bank estimates, global growth is expected to accelerate to 5.6 percent this year, largely on the strength in major economies such as the United States and China.

As per the US government data, real gross domestic product (GDP) increased at an annual rate of 6.4 percent in the first quarter of 2021, reflecting the continued economic recovery, reopening of establishments and continued government response to the pandemic.

Additionally, China is pursuing a stable and lasting 2021 recovery. Its GDP soared 18.3 percent in the first three months of 2021 from the year-ago period. The surge in growth comes off a contraction in the first quarter of last year when the economy shrank by 6.8 percent.

The World Bank estimates the US growth to reach 6.8 percent during 2021, bolstered by massive fiscal support and widespread vaccination by mid-2021.

China's economy, which did not contract last year, is expected to grow a solid 8.5 percent and moderate as the country's focus shifts to reducing financial stability risks.

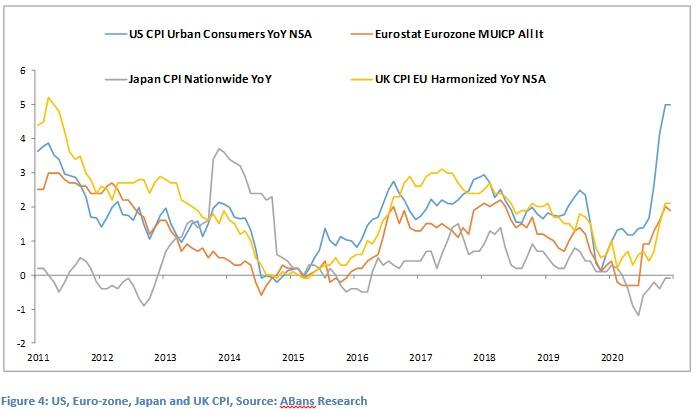

Inflation is 'temporary'

As long as inflation is on the rise and the global central banks don't change their policy stance, it is supportive of gold prices.

ECB, Fed and BOJ at first adopted simple inflation targets of 2 percent. Later on, ECB said it could tolerate temporary moves beyond that point and Federal Reserve officials continued to call the recent rise in inflation “transitory”.

The Bank of England said that inflation would surpass 3 percent but the climb above the target would only be "temporary". The shift in inflation view of global policymakers gives them the flexibility to keep interest rates at historic lows for longer periods and support gold prices.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are his own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.