Foreign Institutional Investors (FIIs), which were net sellers in Indian markets both in equities as well as debt segment for the December quarter, raised stake in nearly 400 companies in the same period, data from Ace Equity showed.

Foreign investors raised stake in as many as 387 companies from previous quarter which includes HDFC, Bharat Financial Inclusion, Indiabulls Housing Finance, IndusInd Bank, Shriram Transport, Bharti Infratel, ZEE Entertainment and Hero MotoCorp.

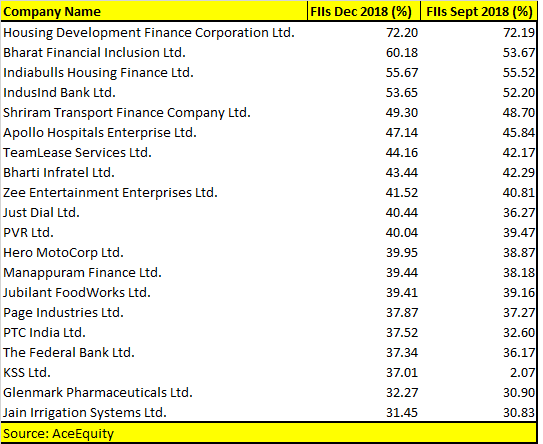

Here is a list of top 20 stocks according to percentage holding from the list of 387 companies:

According to data from SEBI, foreign investors were net sellers in October 2018 but then poured money in the following two months i.e. November and December to the tune of Rs 21,000 crore. But, on net basis, FIIs were net sellers in December quarter in both equity and debt, selling assets worth approximately Rs 17,000 crore.

During 2018, they pulled out more than Rs 75,000 crore, including both debt and equity, data showed. FPIs were not just net sellers in India markets in 2018, but they pulled out money from other emerging markets also on the back of strengthening dollar and increasing yields in the US. Specifically for India, higher crude oil prices and fall in rupee added to FIIs' woes.

Despite recent selling by FIIs, analysts are hopeful that foreign investors will return as India still commands higher growth rate when compared to other emerging markets, and further fall in crude oil will only strengthen the macro case for India.

Piyush Goyal in the Interim Budget speech reiterated that India is poised to become a USD 5-trillion economy in the next five years and aspires to become a USD 10-trillion economy in the next 8 years thereafter.

Stating that India is solidly back on track and marching towards growth and prosperity, he said the last five years have seen India being universally recognised as a bright spot of the global economy, he said.

Last month, IMF in a report said that India will further build its lead as the world’s fastest-growing major economy as it picks up pace next year while the global economy is forecast to slow.

India’s GDP is forecast to expand 7.5 percent in FY20 and 7.7 percent in FY21. China’s growth is seen at 6.2 percent in both years. However, there is still election overhang which could mean that flows could remain tepid till some clarity emerges.

“The political arena is wide open and most political pundits have been talking about 3 likely outcomes. However, the markets may still prefer a stable government so that the economic reforms process is not dented. It would be presumptuous to imagine that India would be totally immune to a global slowdown,” Mayuresh Joshi, Fund Manager, Angel Broking told Moneycontrol in an interview in January.

“However, considering its low dependence on exports and a fairly large trade deficit, the slowdown should work in India’s favour. Any global slowdown is likely to hit oil prices and that would benefit India’s trade deficit. It must be also said that Indian markets may be best equipped to decouple from the global volatility in the medium term,” he said.

The IMF cut the global growth forecast from last October’s estimate. The global economy is projected to grow 3.5 percent in 2019 and 3.6 percent in 2020, 0.2 and 0.1 percentage points below last October’s projections.

FIIs reduced stake in 568 companies in the December quarter which include names like Axis Bank, KPIT Technologies, ICICI Bank, UPL, Cox & Kings, HDFC Bank, Tech Mahindra, NIIT Technologies, Yes Bank, Infosys, IDFC, MindTree, Cyient, M&M, RIL, Cipla etc. among others.

They kept their holding constant in as many as 384 companies in December quarter which include names like Tata Steel, Visa Steel, Globus Power, DFM Foods, Kirloskar Industries, Voltamp Transformers, Camson Bio Technologies etc. among others.

Note: The above report is for information only and not buy or sell ideas. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.