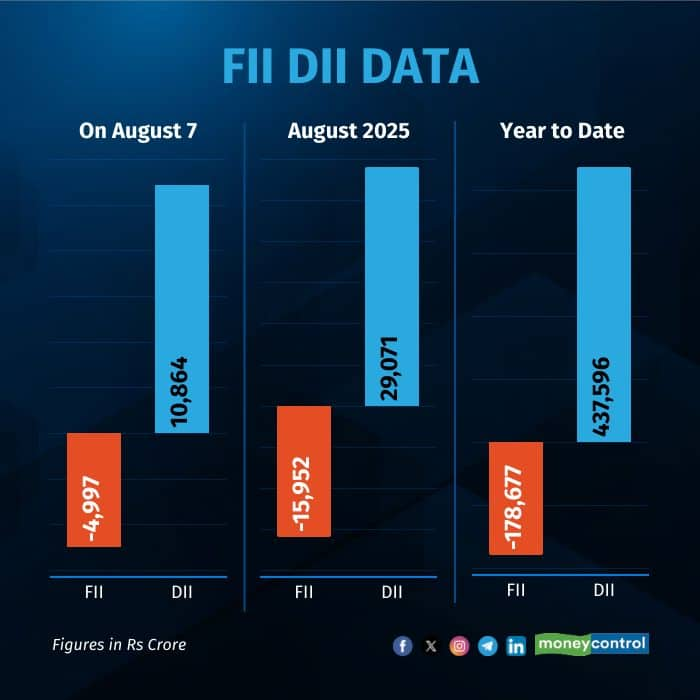

On August 7, Foreign Portfolio Investors (FPIs) were net sellers to the tune of Rs 4,997 crore worth of shares in Indian equities, while domestic institutional investors (DIIs) saw their highest net buying, picking up shares worth nearly Rs 10,864 crore worth of shares, according to provisional NSE data.

On April 7, DIIs net bought shares worth Rs 12,000 crore. The latest round of buying by domestic investors comes amidst President Donald Trump’s escalation of tariffs against India, helping the domestic market remain buoyant despite the volatility and continued foreign selling. On August 6, Trump announced an additional 25 percent of tariffs on India, increasing the total tariffs to nearly 50 percent. The US President had justified this decision on count of "India's continued buying of oil from Russia."

DIIs purchased equities worth Rs 19,629 crore and offloaded shares amounting to Rs 8,765 crore. FPIs, on the other hand, bought stocks worth Rs 10,567 crore while selling Rs 15,564 crore.

For the year so far, FIIs have been net sellers of equities worth Rs 1.78 lakh crore and DIIs were net buyers worth Rs 4.37 lakh crore.

Market View

Indian benchmark indices, the Nifty 50 and Sensex, recovered sharply in the final hour of trade on Thursday, August 7, erasing steep losses to finish slightly in the green. The rebound came as investor sentiment improved on renewed hopes of diplomatic engagement between the U.S. and Russia. Market optimism was also buoyed by reports hinting at possible peace talks involving US President Donald Trump, Russian President Vladimir Putin, and Ukrainian President Volodymyr Zelensky, raising the prospect of a softer U.S. tone on global trade.

The Nifty opened weak and extended its slide through the first half after US President Trump announced an additional 25% tariff on Indian exports, effectively doubling the duty to 50 percent. The move, seen as retaliation for India’s continued purchases of Russian oil and defense gear, weighed heavily on sentiment. However, the index reversed course later in the day, helped by broad-based buying.

By the close, the Sensex had gained 79.27 points, or 0.10 percent, to finish at 80,623.26. The Nifty rose 21.95 points, or 0.09 percent, to end at 24,596.15 — nearly 1 percent higher from its intraday low of 24,344.15.

Most sectoral indices trimmed early losses, with IT, media, and pharma stocks leading the rebound, each rising between 0.5 percent and 1 percent. The midcap index advanced 0.3 percent, while the smallcap index ended flat.

During the session, the top Nifty gainers were Hero MotoCorp, Tech Mahindra, Wipro, Eternal, JSW Steel, while losers included Adani Enterprises, Adani Ports, Trent, Tata Motors and Grasim Industries.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.