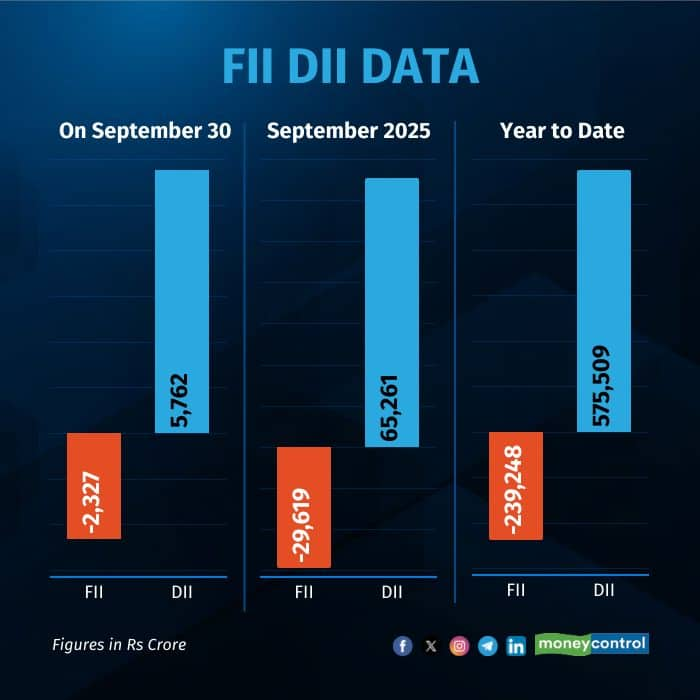

On Tuesday, foreign institutional investors (FIIs) were net sellers of Rs 2,328 crore, while domestic institutional investors (DIIs) were net buyers of Rs 5,762 crore, according to provisional exchange data.

During the session, DIIs purchased shares worth Rs 16,949 crore and sold Rs 11,187 crore while FIIs bought Rs 18,730 crore but sold Rs 21,057 crore.

Year-to-date for 2025, FIIs have withdrawn Rs 2.39 lakh crore, while DIIs have invested Rs 5.75 lakh crore.

Market Performance

Reflecting on today's market performance, Vikram Kasat, Head - Advisory, PL Capital, said, "Indian equity markets remained largely range-bound, with the BSE Sensex closing slightly lower at 80,267 and the NSE Nifty50 finishing at 24,611. Sectoral performance was mixed — banking and metals outperformed, buoyed by robust corporate earnings and positive domestic cues, while IT and consumer discretionary stocks underperformed amid global demand concerns and profit-booking."

Market volatility was elevated, with indices oscillating between gains and losses as participants adopted a wait-and-watch approach ahead of the Reserve Bank of India’s Monetary Policy Committee (MPC) meeting scheduled for tomorrow.

In commodities, silver stood out, reaching a record Rs 1.51 lakh/kg in India. Globally, it gained 18.2% over the month, supported by strong industrial demand, a weaker dollar, and safe-haven buying.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!