Nifty is trading positively near fresh lifetime high levels, touching 23,441.95 in early trade today. The near-term support for Nifty is placed around 23,250-23,200, followed by 23,000. According to experts, the trend continues to be positive with no signs of reversal.

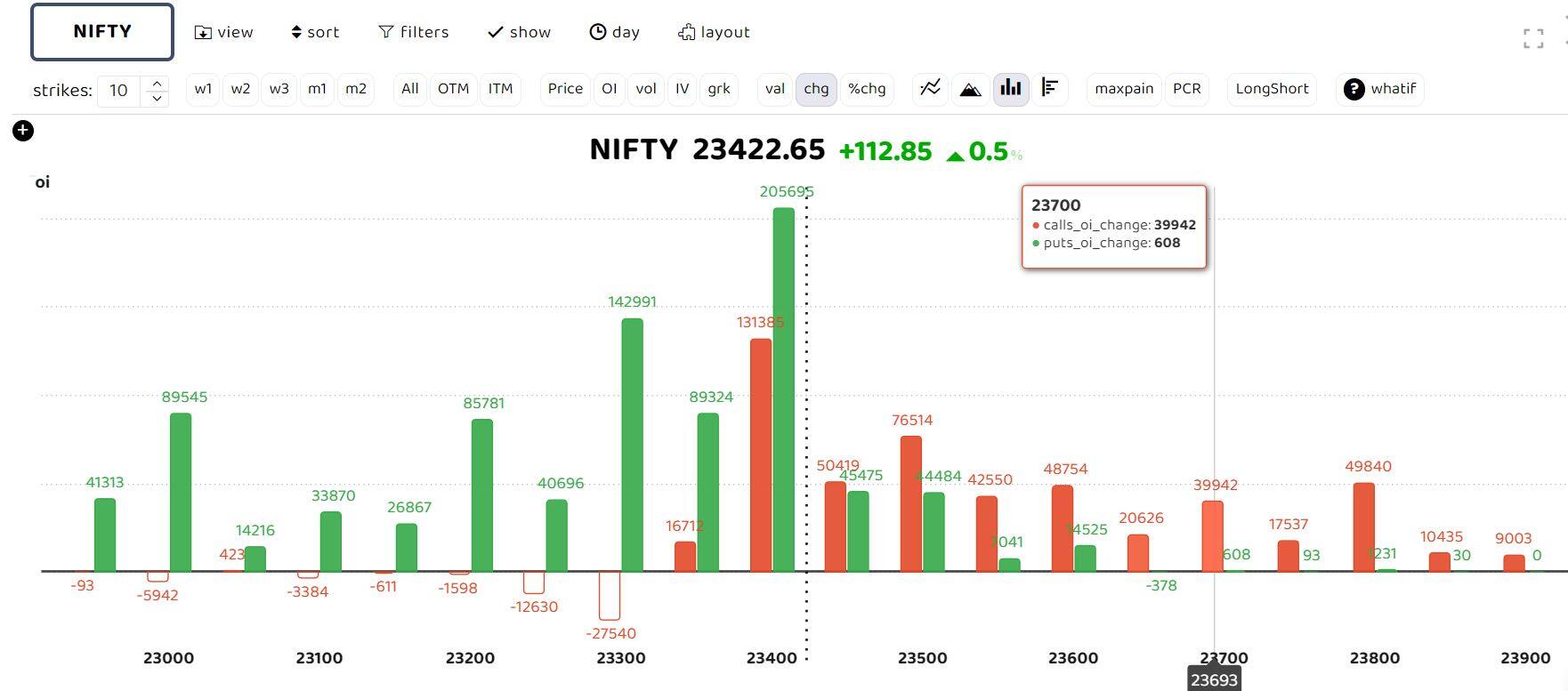

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests heavy call writing at the 23,700 and 23,800 strikes. "The trend continues to be positive with no signs of reversal. The near-term support for Nifty is placed around 23,250-23,200, followed by 23,000. As long as these supports are intact, one should continue to trade with a positive bias and use any intraday dips as buying opportunities. On the higher side, we expect the index to rally towards 23,550-23,600 initially, and positionally around 23,900," said Ruchit Jain, Lead Researcher at 5paisa.com.

Riyank Arora, Technical Analyst at Mehta Equities, believes that Nifty has given a good breakout above its recent resistance mark of 23,411.90 and has successfully managed to close above it. "Technically, the overall structure now looks extremely bullish with potential targets of 23,500 and above. Minor support is placed near 23,350, below which the next support levels would be near 23,250 and 23,200, respectively," he said.

Strategy recommended by Arora:

On any declines, our strategy for Nifty would be to write put options below 23,250 and simultaneously sell call options above 23,550 and 23,600, creating a short strangle strategy for the upcoming weekly expiry tomorrow.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!