Indian benchmark indices were trading range bound amid volatility on 6 May, with Nifty 50 trading at the mid-point of its short term support and resistance range. At around noon, Nifty was marginally in green at 22,505 points.

The derivatives open interest data suggests a potential bounce-back from current levels, said experts, adding that the sustainability remains uncertain. The open interest put-call ratio shows oversold positions on Nifty.

A strong resistance is observed in the 22,700-22,800 zone. Momentum on the long side will only gain traction once the index surpasses 22,800. Meanwhile, Nifty has a support at 22,400 on a closing basis, with crucial support for the week at 22,200.

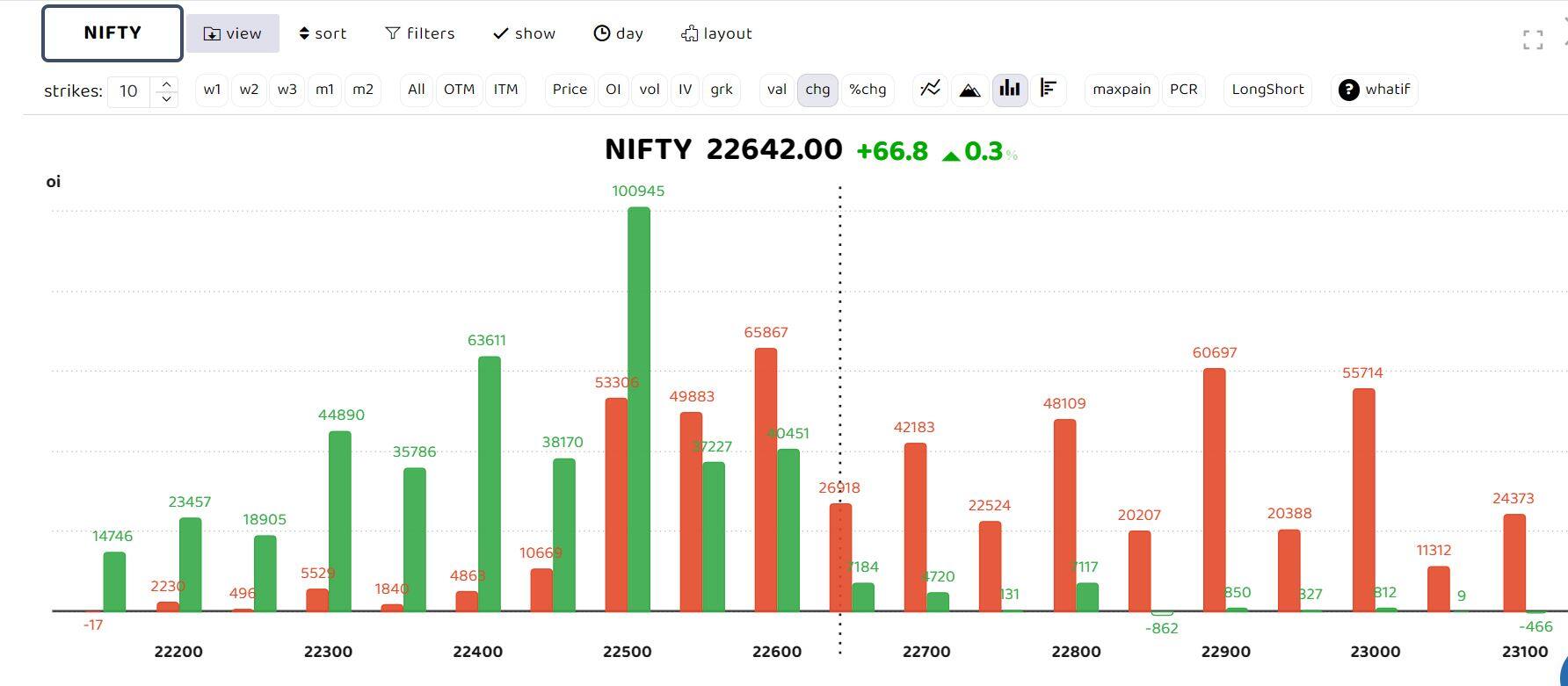

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

"The immediate swing low of the 22,350-22,300 subzone is likely to provide a firm cushion for any intra-week blip, followed by the 50 DEMA of 22,230 and the bullish gap around the 22,200 zone,” said Sameet Chavan, Head Research, Technical and Derivative - Angel One.

“On the higher end, the record-high zone of 22,750-22,800 seems daunting for the bulls and until we witness a decisive breakthrough, the next leg of rally toward the 23,000 mark seems demanding,” he added.

Bank Nifty

Bank Nifty was trading up 170 points or 0.35 percent on 6 May to 49,093, and is not far away from its near-term resistance. “Bank Nifty was clearly an outperforming sector as compared to Nifty during the last week. However, it is likely to find resistance around the 49,500 to 49,600 levels on an immediate basis,” said Tejas Shah, Vice president - Technical research at JM Financial.

“On the downside, the support zone lies at 48,650-700 / 48,300-400 while the resistance is seen at 49,500-600 / 50,000,” he said.

Among individual stocks, long build up is seen in Grasim, Dr Reddy's, GodrejProp and Coal india. While short build up is seen in Coforge, MRF, GMR Infra and LTTS.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.