The market resumed its rally on May 4 after a brief pause as the traders started taking large bullish trades despite expected volatility as the weekly contracts expire later in the day.

As of 12pm, the Nifty traded up 67 points or 0.376 percent to 18,156. The Nifty Bank also edged up 0.15 percent.

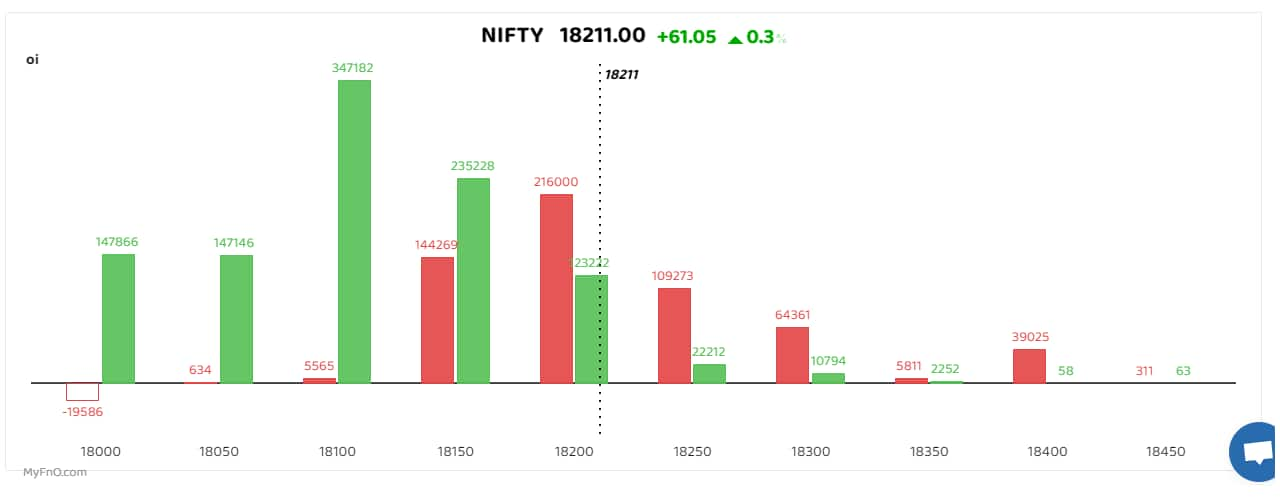

As the nervousness over US Fed decision wanes, the 18,100 level sees heavy Put writing on the expiry day and thus emerged as the key support level for the index. Maximum Call writing was seen at 18,150, which may be the upper bound of the trading range today.

At the same time, call unwinding was seen at lower levels as bears shifted their positions to higher strikes.

“It would be a challenging task for the Nifty to surpass the sturdy wall of 18,200-18,260 in the ongoing run. (However) the overall trend remains strongly bullish and, hence, we would continue with our buy on declines strategy in the near term. Meanwhile, traders can continue focusing on a stock centric approach,” said Sameet Chavan, Head Research, Technical and Derivatives, Angel One.

Financial services stocks such as M&M Financial Services, Cholamandalam Finance, Muthoot Finance and LIC Housing Finance saw heavy long build-up as bullish traders converged. Long build-up happens when share price and open interest rise in tandem.

On the other hand, petroleum and gas names like Petronet and Mahanagar Gas saw heavy short build-up, which happens when open interest rises but stock price declines. This is indicative of stocks in a downward trend.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.