The Indian markets had a sluggish opening on Friday after the US recorded weak trading overnight. The benchmark indices went downhill as the day progressed. Among sectors, information technology, oil and gas, metal and realty were down 0.5-1 percent, while power indices were up 0.5 percent.

At 11am, the Sensex traded 300.33 points or 0.46 percent lower at 64,850.69, and the Nifty was down 92.60 points or 0.48 percent to 19,272.70. About 1,388 shares advanced, 1,575 shares declined, and 106 shares remained unchanged.

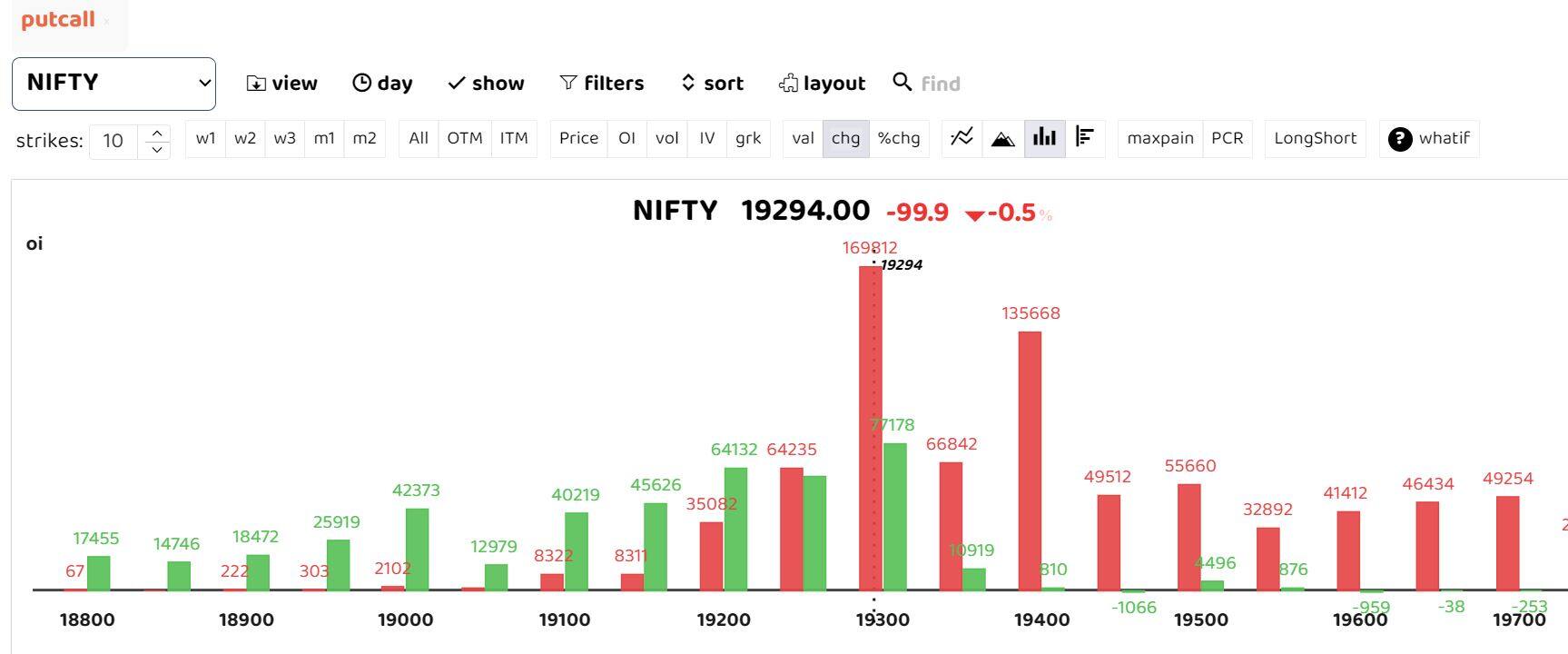

The bars reflect the change in open interest (OI) during the day. The red show call option OI and the green put option OI.

Options data suggests that call writers are dominant for the day with heavy call writing at the 19,400 strike, which forms a key resistance level for the day, followed by 19,500 and 19,700. Key straddle positions can be seen at 19,200 and 19,250 levels. Analysts see the support zone at 19,000-19,100 levels with the bias remaining cautious till 19,450 is not breached decisively. The significant 50EMA level lies near 19,270 and a decisive breach below that zone would weaken the trend to anticipate further slide, according to Sameet Chavan, Head of Research in Technical and Derivatives at Angel One Ltd.

"We remain hopeful that the 19,250 to 19,300 zone will be upheld in the context of the weekly closure. However, a breach beneath this range could potentially trigger further weakness in the short term, directing prices towards levels around 19,000 to 18,925. Conversely, the range of 19,500 to 19,650 poses a significant resistance, requiring a breakthrough to reignite a broad-based rally," added Chavan.

Follow our live blog for all market action

Among individual stocks, Manappuram, PageInd and Astral saw a bearish setup, while Escorts, Bandhan Bank and AdaniPort saw a long build-up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.