Defence stocks staged a comeback on the charts on September 20, as the once darlings of Dalal Street recorded gains up to 10 percent in trade.

Paras Defence and Bharat Electronics were higher by around two percent, while Hindustan Aeronautics gained 2.5 percent on the bourses by 11 am. Bharat Dynamics jumped four percent to Rs 1,166 and Mazagon Dock along with Garden Reach Shipbuilders sailed eight percent to Rs 4,364 per share.

Cochin Shipyard shares surged 10 percent in trade on September 20. The stock will trade ex-dividend from September 23, making today the last day investors can purchase the counter to be eligible to receive the dividend payout.

Additionally, Cochin Shipyard is set to receive inflows of $30 million, as it has been included in the FTSE All World index. The rebalancing will take place in the final few minutes of trade on September 20.

Follow our live blog to catch all the updates

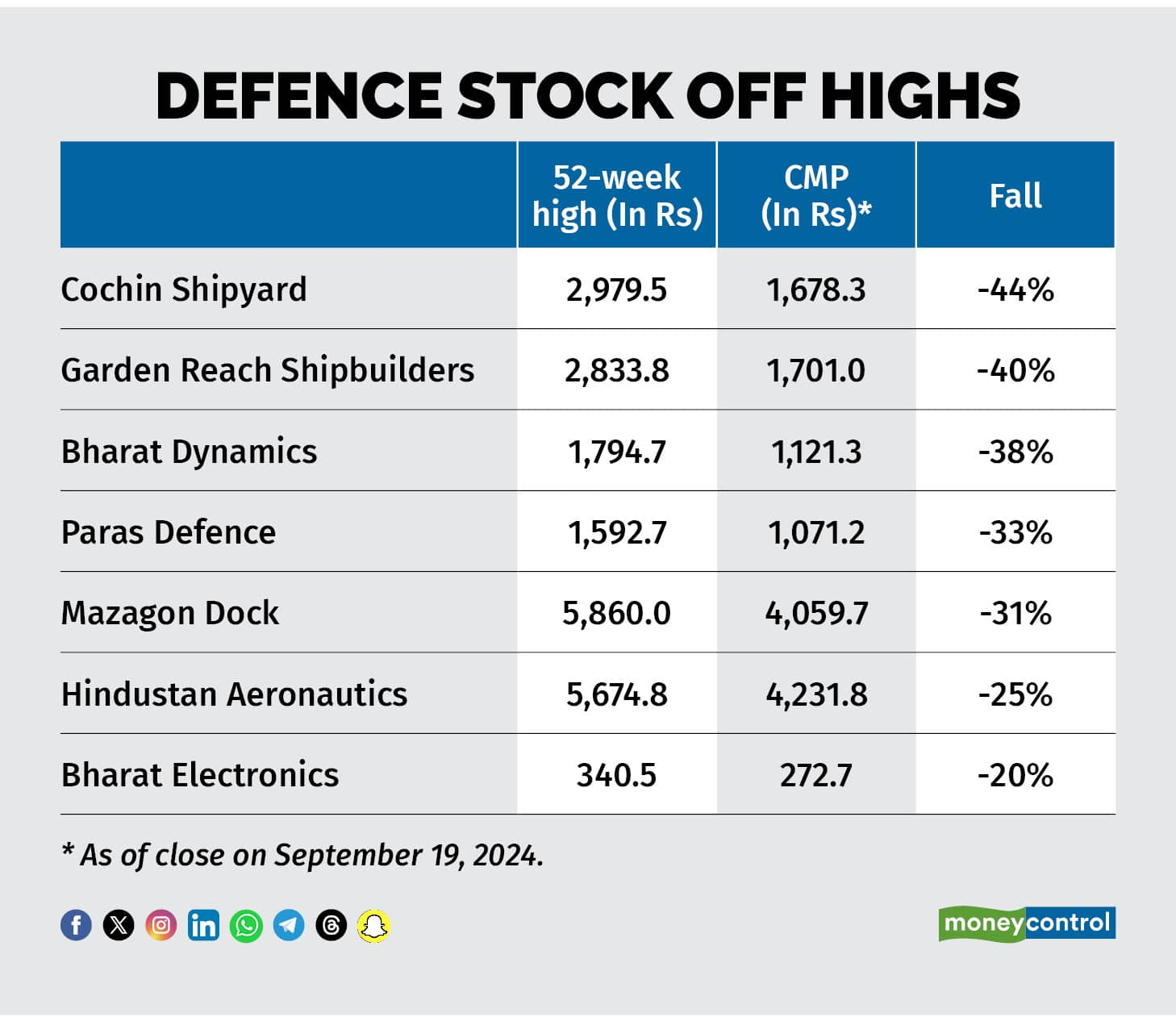

Over the past two months, these PSU defence counters have witness sharp profit-taking. After rallying in triple digits over the past year, counters such as Mazagon Dock, Cochin Shipyard, and Garden Reach Shipbuilders among others have fallen more than 40 percent from their life-time highs.

Investors have been booking their profits en-masse as stretched valuations soured the risk-reward ratio on the stocks.

However on September 4, the Defence Acquisition Council (DAC) approved major procurements worth Rs 1,44,716 crore for the Armed Forces. The approved projects include Future Ready Combat Vehicles (FRCVs) and Air Defence Fire Control Radars for the Army, along with Dornier 228 aircraft, Next Generation Fast Patrol Vessels, and Offshore Patrol Vessels for the Indian Coast Guard.

Antique Broking has maintained a 'buy' call on HAL, BEL, Bharat Dynamics, Mazagon Dock, and Garden Reach Shipbuilders. The firm views the recent approval of defence proposals worth Rs 1.44 lakh crore as feasible, noting that most of these projects will be sourced from the domestic industry. This development presents a significant opportunity for Indian defence manufacturers.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.