The market extended northward journey for third consecutive week ended May 2 despite rangebound trading and elevated volatility. Increasing hope for India-US trade agreement sooner rather than later and recovery of a corporate earnings in FY26, along with subdued US dollar and consistent FIIs buying interest supported market sentiment. However, the fears of escalating India-Pakistan tensions and mixed March quarter earnings capped market upside.

In the coming week, the market is expected to remain consolidative with a positive bias and may attempt to surpass previous swing highs, according to experts. The participants will focus on the next lot of corporate earnings, US Federal Reserve & Bank of England interest rate decisions, and slew of economic data points (including Services PMI). Also, further developments related to India-Pakistan post Pahalgam terror attack as India has gradually been imposing several restrictions on Pakistan, and deals with trade partners (especially China) by US will be watched.

During the last week, the BSE Sensex closed at 80,502, up 1,289.5 points (1.63 percent), and the Nifty 50 rallied 307 points (1.28 percent) to 24,347, while the broader markets underperformed the benchmark indices. The Nifty Midcap 100 index was up 0.25 percent, however, the Nifty Smallcap 100 index fell 0.64 percent.

Siddhartha Khemka, Head - Research, Wealth Management at Motilal Oswal Financial Services expects the market to consolidate in a broad range with a positive bias. "Stock-specific action is likely to dominate the market, although some volatility may be expected due to geopolitical tensions," he said.

Vinod Nair, Head of Research at Geojit Investments expects some caution in the near term amid ongoing geopolitical tensions, but he ruled out a sharp correction.

"Globally, easing trade tensions between the US and China, coupled with a weakening US dollar, are seen as medium-term positives for emerging markets such as India," he said.

Here are 10 key factors to watch out for next week:

The market participants will keep a close watch on the quarterly numbers to get the direction about next quarter and FY26 earnings growth, as so far there has been mixed performance. About 285 companies will release their March 2025 quarter earnings including key ones like Coal India, Larsen & Toubro, Mahindra & Mahindra, Titan Company, Asian Paints, and Dr Reddy's Laboratories.

Further, Britannia Industries, ABB India, Bank of Baroda, Alembic Pharmaceuticals, Hindustan Petroleum Corporation, Godrej Consumer Products, Dabur India, One 97 Communications Paytm, Swiggy, Bharat Forge, Biocon, Canara Bank, Bank of India, Piramal Enterprises, Coforge, Indian Hotels Company, Voltas, Blue Star, CG Power and Industrial Solutions, Mahanagar Gas, Polycab India, Tata Chemicals, United Breweries, Escorts Kubota, Kalyan Jewellers India, MCX India, and Manappuram Finance will also announce their quarterly earnings next week.

FOMC Meet

Globally, apart from global trade deal developments, the focus will be on the Federal Reserve's interest rate decision due on May 7. Economists don't see any fed funds rate cut at least for next two meetings, but Fed Chair Jerome Powell's commentary over the inflation and growth forecast especially amid the ongoing global trade war ignited by the US will be closely watched. The US economy has already seen a 0.3 percent contraction in the first quarter of 2025 (the first negative growth since Q1-2022), against 2.4 percent growth in last quarter of 2024.

BoE

The Bank of England will also hold its policy meeting next week on May 8. According to economists, the central bank is expected to slash interest rate by 25 bps to 4.25 percent and also in upcoming couple of meetings after having a pause in March meeting, given the rising global growth risk after Trump tariffs. The UK's inflation remained above the bank's target of 2 percent mark at 2.6 percent in March.

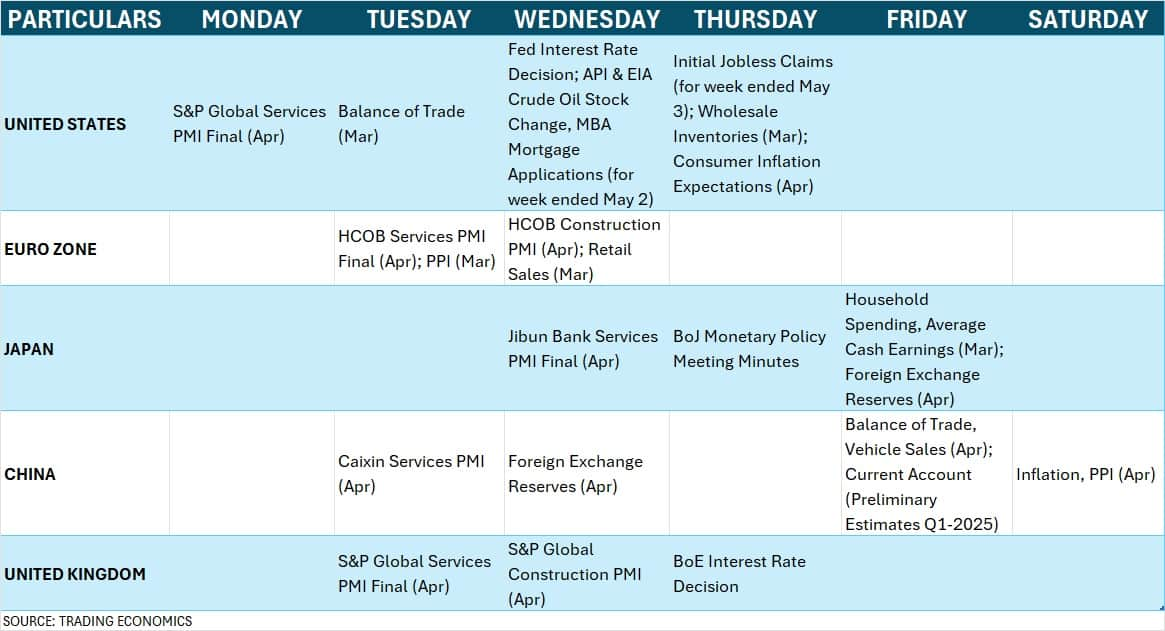

Global Economic Data

Further, the participants will keep an eye on several key economic data points including the services PMI numbers by several nations. Weekly jobs data from the US, monthly PPI & retail sales by Europe, Bank of Japan's monetary policy meeting minutes, and China's inflation and PPI numbers will also be watched.

Domestic Economic Data

Back home, the fiscal deficit for March will be released on May 5, followed by HSBC Services PMI numbers for April on May 6. As per preliminary estimates, services PMI rose to 59.1 in April, against 58.5 in the previous month.

Further, the bank loan & deposit growth for fortnight ended April 25, and foreign exchange reserves for week ended May 2 scheduled on May 9 will also be watched.

The market participants will also focus on whether the foreign institutional investors (FIIs) will continue or reverse the flow to India. FIIs have been buyers in the cash segment for all last three weeks (Rs 42,882 crore), resulting into turning net buyers for April (Rs 2,735 crore), especially after a 90-day pause in reciprocal tariffs by US and weakness in US dollar. They net bought Rs 7,680 crore worth shares last week, including Rs 2,770 crore of buying on May 2.

The US dollar index was up 0.45 percent at 100.036 last week, but corrected 11.1 percent from its high of January 13, while the rupee appreciated by 1.03 percent to 84.4790 against the US dollar during the last week and 3.97 percent from all-time low.

Meanwhile, the domestic institutional investors (DIIs) have net bought Rs 28,228 crore worth shares in April despite intermittent profit booking, and Rs 3,290 crore on May 2

The primary market will remain active in the coming week too, with two public issues from the SME segment - Manoj Jewellers and Srigee DLM - opening on May 5, while Kenrik Industries, and Wagons Learning will close their IPOs on May 6.

Iware Supplychain Services, Arunaya Organics, Kenrik Industries, and Wagons Learning shares will be available for trading on the bourses next week.

Meanwhile, the mainboard segment will be quiet with no fresh issue launch. Ather Energy, which closed with 1.43 times subscription, will list on the BSE and NSE on May 6.

Technical View

Technically, the Nifty 50 is expected to consolidate further with hurdle on the higher side at 24,550 (61.8 percent Fibonacci retracement of April low to high) as decisively clearing the same can open doors for 24,850-24,900 (December 2024 swing high) and support of 24,000 as below it can bring the index down to 24,850, according to experts. Overall, the trend remains positive with index trading well above all key moving averages on all major timeframes with healthy volumes, while the RSI (Relative Strength Index at 57.93) and MACD trended upward with positive histogram.

F&O Cues, India VIX

The weekly derivative data indicated that the Nifty is expected to be in the broad range of 23,500-25,000 and immediate range of 24,000-24,500.

The maximum Call open interest was observed at the 25,000 strike, followed by the 24,500 and 24,800 strikes, with the maximum Call writing at the 25,000 strike, and then the 24,500 and 24,600 strikes. On the Put side, the 24,000 strike holds the maximum open interest, followed by the 23,500 and 24,300 strikes, with the maximum writing at the 24,000 strike, followed by the 24,300 and 23,500 strikes.

Meanwhile, the India VIX, the fear factor, has been inclining higher for the last two weeks, making the bulls cautious. It increased by 6.41 percent last week to 18.26 levels. Until it falls and sustains below 15, the bulls need to be cautious.

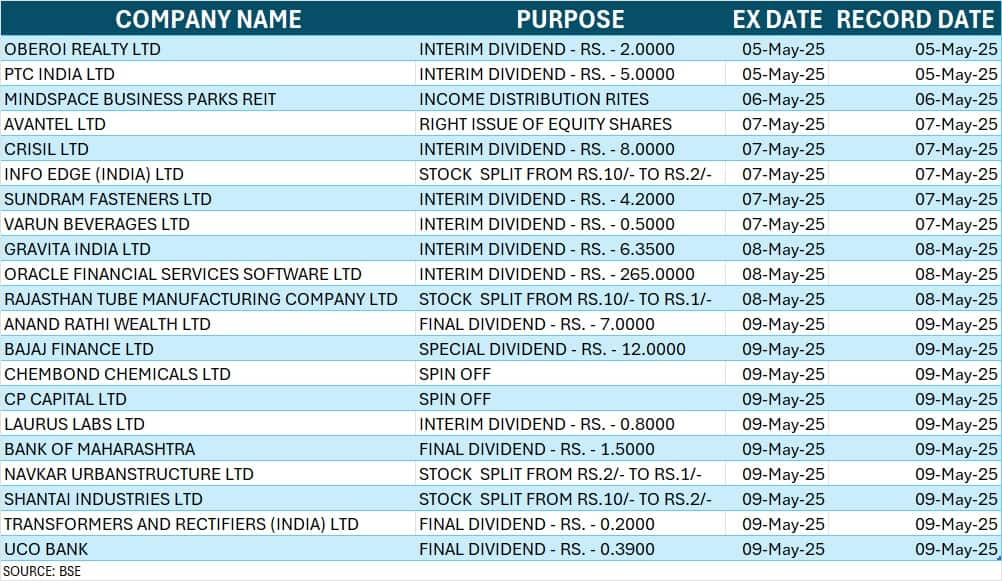

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.