Banking and financials emerged as the biggest sectoral gainer in two consecutive sessions ending September 23 as the sector may likely benefit the most from the corporate tax cuts.

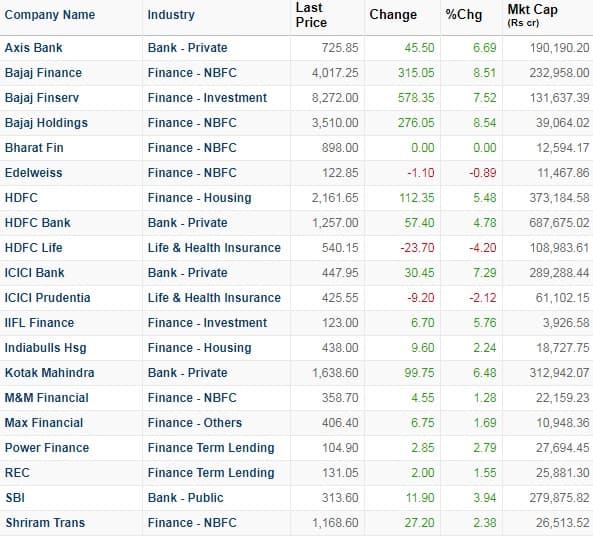

Bajaj Holdings, Bajaj Finance, Bajaj Finserv, ICICI Bank, Kotak Mahindra Bank, Axis Bank, HDFC, HDFC Bank among others gained 5-9 percent.

The Nifty Bank and Financial Services indices were biggest gainers among sectors, rising more than 5 percent each.

Finance Minister, Nirmala Sitharaman, on September 20, reduced the base corporate tax rate to 22 percent from 30 percent. After surcharge and cess, the effective tax rate comes down to 25.2 percent from 35 percent.

"This clearly benefits domestic banks, NBFCs and rating agencies. Banks in the higher tax bracket, such as HDFC Bank, SBI, Kotak Mahindra Bank, DCB Bank, Federal Bank, and RBL Bank, will gain due to the move," Joindre Capital Services said.

"NBFCs and HFCs fall into the higher tax bracket and would also gain. Here Bajaj Finance and some insurance players like SBI Life, HDFC Life will also benefit from the reduced tax rates," it added.

Prabhudas Lilladher retained its overweight rating on NBFC and increased weightage on Bajaj Finance.

"Bajaj Finance is expected to be one of the key beneficiaries of the anticipated demand recovery in the festive season, bountiful monsoons and improving operating leverage. BAF continues to maintain an edge over others owing to 1) less than 2 percent GNPA and 65-70 percent provision coverage ratio across cycles, 2) 40 percent positive ALM gap in short maturity buckets and 3) diversified liability mix," the brokerage explained.

It also retained overweight on BFSI and turned equal weight from underweight on Axis Bank. "We believe post QIP overhang getting over, the stock should report steady recovery," it said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.