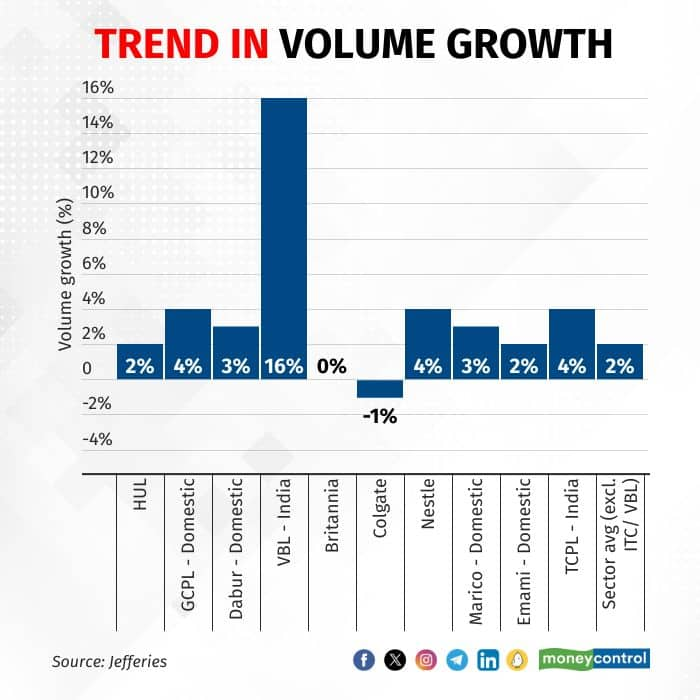

Demand for Indian staple firms remained sluggish through the fiscal second quarter, with competition from smaller, local/regional players on the rise. Pick-up in volume growth for most FMCG companies remained under 5 percent, pointed out global brokerage firm Jefferies.

Many companies highlighted a slight improvement in consumer sentiment towards the second half of September, and they are optimistic about better volume trends during the festive season, hoping for a better third quarter.

Also read | 3 horsemen — easing oil prices, yields, dollar — spell good news for India, says Mark Matthews

Weak volumes, rural demand in Q2 FY24: Here’s how to boost recovery

Volume pick-up slowed down on a sequential basis, from 4 percent in the first fiscal quarter to 2 percent in the second. Weak rural demand, as a result of uncertainty around erratic monsoon and a delayed festive season, along with higher competition, also aided in low volume growth. The improvement seen in the June quarter was mitigated by a “transient spike in food prices”, said Jefferies.

Motilal Oswal noted that rural consumption growth fell to an eight-quarter low in Q2FY24, down 0.5 percent from a growth of 2.7 percent in the first quarter of this fiscal. To see a recovery in demand, Emkay Global said that players should look at passing on raw-material benefits to consumers to accelerate volume growth.

However, in a note, Axis Securities added that most staple companies under their coverage have indicated signs of rural recovery, making it likely that volume growth will pick up in rural areas.

Margins may shrink on ad spends in short term but widen in long term

As demand remains muted while product prices ease, firms have largely maintained product prices, which assisted in better-than-expected gross-margin delivery this quarter, said Emkay Global. The resulting earnings delivery was strong.

Gross margins also saw an improvement, ahead of estimates, as input prices of raw materials turned benign across most commodities, said Jefferies. In Jefferies' coverage universe, the gross margin jumped 5 percentage points on a year-on-year basis.

The EBITDA margin expansion, however, might see a slowdown on increased ad spends as players use the gross margin benefit to boost A&P spending. Companies under Jefferies’ coverage reported ad spends jumping sharply on-quarter, almost back to the pre-inflation period. In the long-run, though, higher A&P spends are expected to boost margins.

Competition hurts FMCG biggies like HUL and ITC

As RM headwinds eased, the competition and media intensity has gone up across categories, said Jefferies. FMCG majors HUL, ITC and Britannia Industries noted that they faced increased competition from smaller and unorganised players, who had retreated as inflation spiked and the pandemic wreaked havoc. However, lower RM prices allowed them to re-enter the market.

Also read | Pharma, IT, banks best poised post-Q2 earnings, says Kunal Shah of Carnelian Capital

Outlook: Revenue, margin, more; check Jefferies’ top stock picks

“Revenue growth however should remain muted, given limited pricing growth. While GM (gross margin) should trend well, higher ad-spends and volume focus from companies would cap near-term Ebitda margin upside,” said the global brokerage.

As volumes still remain sluggish, Jefferies remains selective with GCPL, Marico and Tata Consumer as its top picks.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.