Consumer durable stocks have been on a tearaway rally, as strong demand and an intense summer led to volume growth.

Over the past three months, the NSE Consumer Durables has jumped over 20 percent, with constituents like Dixon Tech, Crompton Greaves, Whirlpool and Voltas gaining the most.

The intense heatwave, the ongoing government-led capex thrust, rural recovery, and focus on premiumisation are all likely to be contributors to the rally in the durables index, ensuring the current outperformance continues.

Surging temperatures, surging demand

As the country battles an intense heatwave, the traction for room air conditioners (RACs), fans or air coolers has driven the shares of players like Whirlpool, Voltas, Hitachi Air Conditioning, and Blue Star over 15 percent higher in the past month.

The significant demand for RACs and commercial refrigeration products is likely to sustain, with the north providing tailwinds in Q1 FY25. Rising mercury levels heated up air-cooler sales across regions and channels, as well.

Fan makers such as Crompton Greaves and Havells have also reported increased demand, especially in their premium offerings.

Also Read | Voltas, Blue Star, Havells shares sizzle in summer as demand for cooling heats up

Rural recovery

Once the mercury begins to dip, a rally on account of the summer-led portfolio will give way to demand for other durables, noted Deepak Jasani, Head of Retail Research, HDFC Securities. A stronger-than-forecasted monsoon will boost rural income, driving growth in the mass-end of the portfolios.

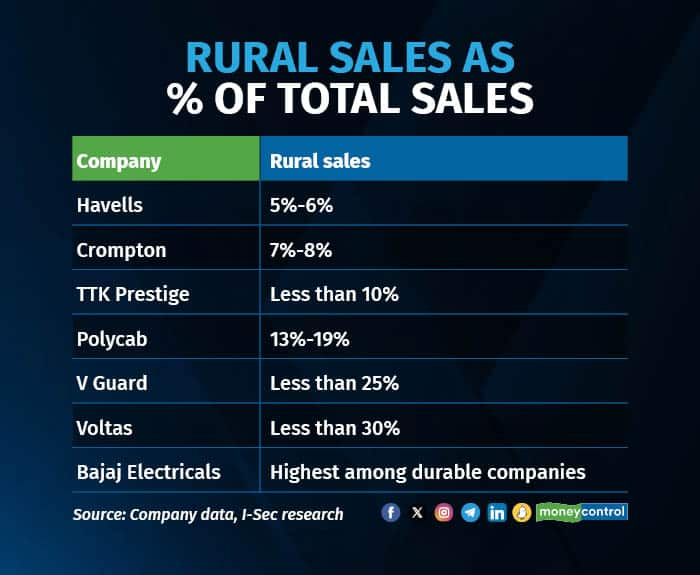

So far, durables companies have been largely focussed on the urban markets. Excluding Bajaj Electricals, most durables companies generate less than 25 percent of their revenue from the rural markets, giving them much room to grow.

However, ICICI Securities noted that certain firms have invested aggressively in expanding rural distribution. Havells has introduced a Rural Vistaar project to expand its reach in rural markets, while Crompton is working on growing its rural reach in FY25. Polycab, V Guard, and Orient are also likely to increase penetration in semi-urban and rural markets.

Out of all the available products across companies and portfolios, the brokerage suggested that small domestic appliances (water heater, air cooler, water purifier, pumps, switchgear, mixer) have the potential to grow at a faster rate compared to the rest of the durables in rural markets.

Government measures

As a result of the coalition government, certain experts believe the government might resort to populist measures and focus on welfare-led growth. Any populist measures, such as farm loan waivers, direct benefit transfer of subsidies, increase in MNREGA allocations or increase in PM Kisan spends may provide some stimulus to consumption of durables in rural markets.

“Populist measures will also help drive premiumisation i.e., shift from unorganised/smaller brands to premium brands in rural markets,” said ICICI Securities.

Private capex picks up

Apart from populist measures, the infrastructure-led capex thrust and healthy demand from the government has led to the cables and wires segment of consumer durables outperforming.

Additionally, the government’s capex is expected to spur private players into action. Robust domestic demand is propelled by substantial investments in public infrastructure projects such as highways, metro systems, railways, and hospitals.

The market leader in cables and wires, Polycab, has planned capex totalling Rs 1,000 crore for FY25 and FY26, to expand domestic cables, special-purpose cables and optical fibre cables to capture the mounting demand.

KEI has planned Rs 900-1,000 crore capex for LT and HT cables for greenfield expansion in Sanand (Gujarat) in the next two years.

Havells targets Rs 800 crore capex in FY25, to be funded via internal accruals. It is expanding its underground cable capacity by 25 percent, to be operational by June 2024. Finolex has planned Rs 500 crore capex for the next two years, noted analysts at Anand Rathi.

Outlook

For the consumer durables universe, Anand Rathi expects PAT CAGR at 29 percent and EBITDA margin expansion of 102 bps over FY 24-26. Among the various sectors, cable and wire companies will continue to outperform, led by strong industrial/construction demand from the government and private companies.

The brokerage expects healthy volume growth and better margins in RAC/Unitary Cooling Products to continue in Q1 FY25, led by strong seasonal demand. Also, companies like Voltas and Bluestar are expected to gain market share.

In consumer electricals, it likes Crompton Consumer due to its strong near-term growth prospects, led by continued healthy demand for fans.

Among all in the consumer durables space, ICICI Securities said it's top pick is Havells, as it has the most diverse product portfolio and thrust on premiumisation.

While Dixon Tech has been the outperformer in the Nifty Consumer Durables index, its valuations are lofty. The firm is expected to see a CAGR of 44.6 percent in its net profit over FY24-26, leading to a P/E ratio of 87.5x. ICICI Securities has an 'add' rating on the player.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.