Domestic investors kept the markets buoyed in 2024, with mutual funds and retail participation lifting the benchmarks and broader markets to fresh lifetime highs. As a result of the bullishness seen, especially in the first half of the calendar year, private equity (PE) and venture capital (VC) firms, along with insiders, capitalized on the market momentum and made some part exits from their listed holdings.

2024 marked an record-breaking year in India's equity history for a variety of reasons, among with the selling of PE/VC and insider (promoter & group) as one of them.

PE/VC exits

So far in the year, PE firms took a partial or complete exit of their stakes in 103 firms, which totalled Rs 1.14 lakh crore. In 2023, PE firms exited 78 companies, for a total of Rs 97,500 crore, noted Nuvama Institutional Equities in a report.

The buoyancy in the markets, as a result of strong domestic participants, fuelled the smooth exits for many early investors and promoters. "This robust domestic inflow is expected to continue, providing ample liquidity and creating a cascading effect, where capital raised by PE/VC firms and promoters is reinvested in private or secondary markets," added Nuvama.

Nuvama noted that out of the 166 deals in 103 unique firms, 65 percent of the firms are seeing their stocks trade above the deal price, with healthy double-digit gains, averaging at 22 percent. In CY23, 80 percent of 133 deals (in 78 unique companies) showed positive returns, with average gains of 31 percent.

Some of these gainers after PE/VC exits are Paytm (up 155 percent after Ant Financial's stake sale in March) and Prudent Corporate Advisory Services (up 140 percent after TA Associates sale in February 2024).

According to the brokerage, this challenges the myth that exits by existing investors cap stock prices going ahead. "The outcome is largely influenced by the individual company and sector interest, with an overall bullish sentiment playing a key role," said Nuvama.

In 2025, the pace of PE/VC exits might slow as the market sees a sideways trend, but the deal momentum should gradually pick up as the year progresses.

Some stocks that saw significant exits:

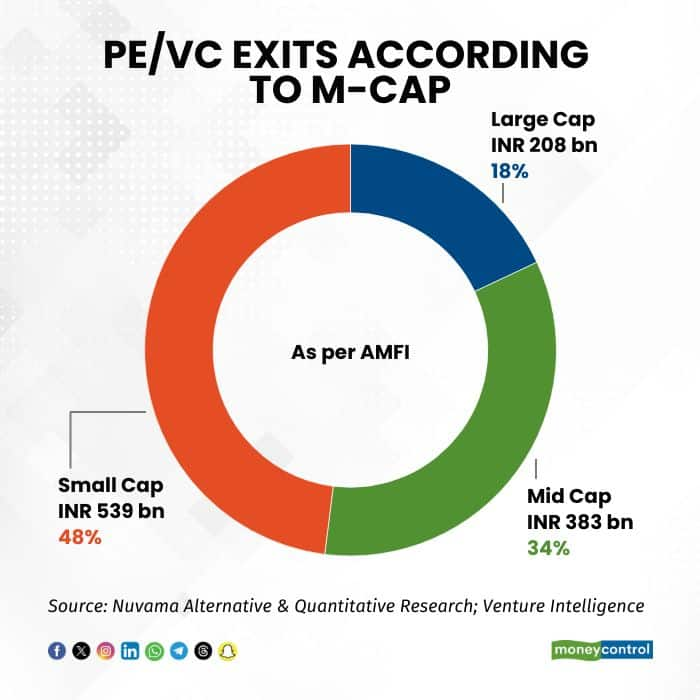

The stellar rally in mid-cap and small-cap companies provided golden opportunities for investors to exit, as 81 percent of the deals in 2024 were from this category. Small-cap stocks saw the highest selling at Rs 53,300 crore, while large-caps saw selling to the tune of Rs 20,800.

Foreign investors did the bulk of the selling at RS 72,600 crore. India-dedicated PE/VCs sold off their holdings to the tune of Rs 13,700 crore, while co-investments (foreign + local) sold Rs 26,600 crore in the public markets.

Also Read | This fund manager explains how tactical sector allocations led to strong large-cap performance

Insider Deals (Promoter + Group)

In 2024, 447 firms saw Insider Deals, which resulted in net selling of Rs 1.3 lakh crore.

Some of the major sales included:

To calculate these figures, Nuvama Institutional Equities excluded strategic holders, such as PE/VC firms, to avoid any duplication.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!