Bank Nifty fell on Wednesday, 10 July, trading down 400 points to about 52,150 points ahead of the weekly expiry. The Banking index has fallen 1.82 percent in one week after touching an all-time high of 53,357.7 earlier this month.

According to experts, the zone of 52,250-52,200 was an immediate support level for today's session, which has been breached. The next support is placed at 51,900.

Here's what analysts recommend for trading the expiry today:

Sideways to Bullish View:

Derivatives trader Santosh Pasi said that Bank Nifty has seen some correction at the start of the day and is now near a support level. He believes it will most likely trade bullish to sideways.

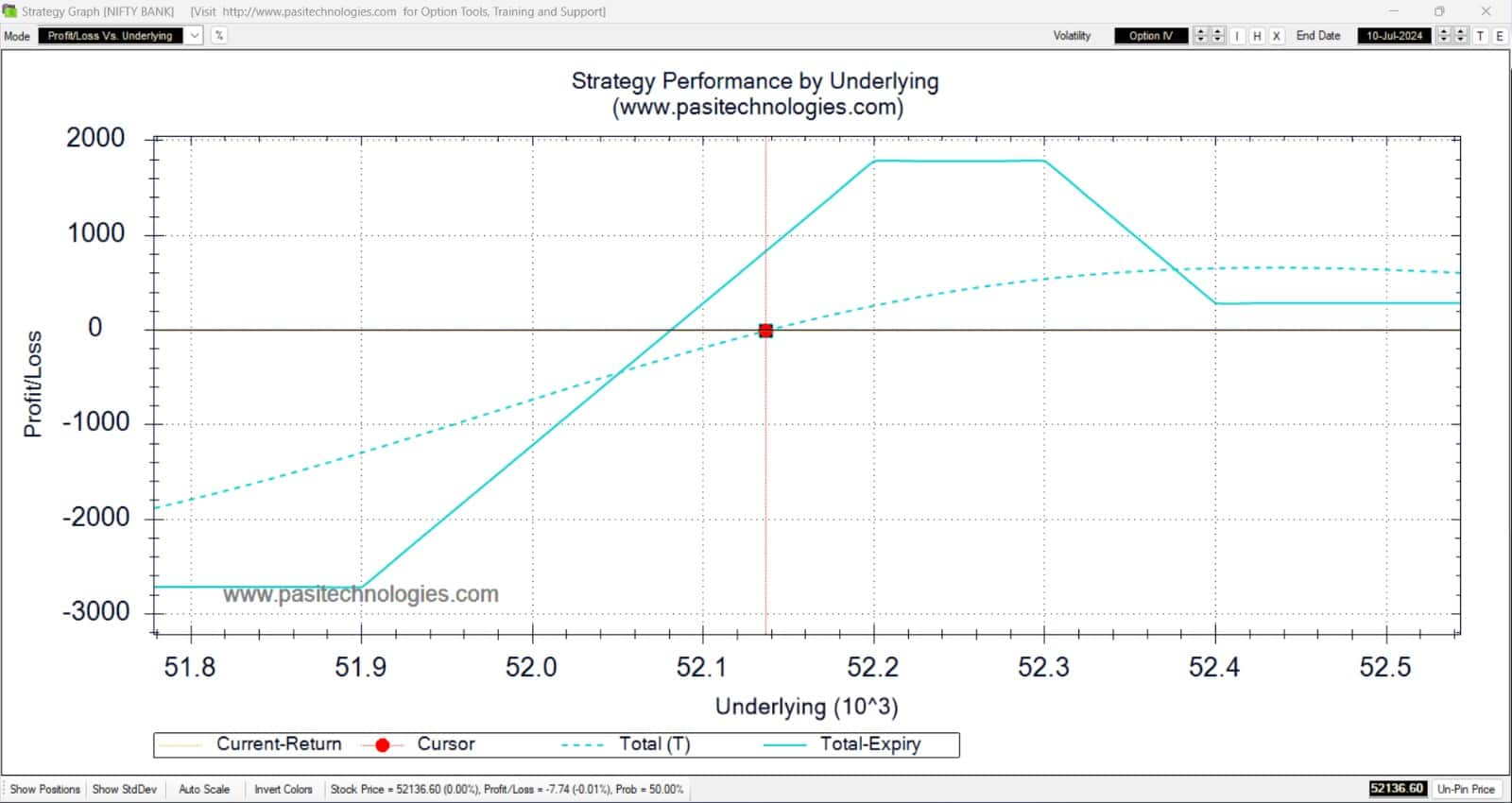

Pasi recommends the following four-legged option strategy for trading Bank Nifty today on weekly expiry

> Sell 52,200 PE (put option)

> Sell 52,300 CE (call option)

> Buy 51,900 PE

> Buy 52,400 CE

> Maximum Profit Potential: Rs 1,785

> Maximum Risk Potential: Rs 2,715

> Lower Protection: 52,081, no risk on the upper side.

Riyank Arora, a technical analyst at Mehta Equities, stated, "The benchmark index is currently trading around 52,261. The 52,000 level is seen as the most important support for today."

"Immediate support is placed at the 52,200 mark, with immediate resistance near 52,700 levels. Owing to the overall market trend and chart analysis, we expect Bank Nifty to head higher in today's trading session," he added.

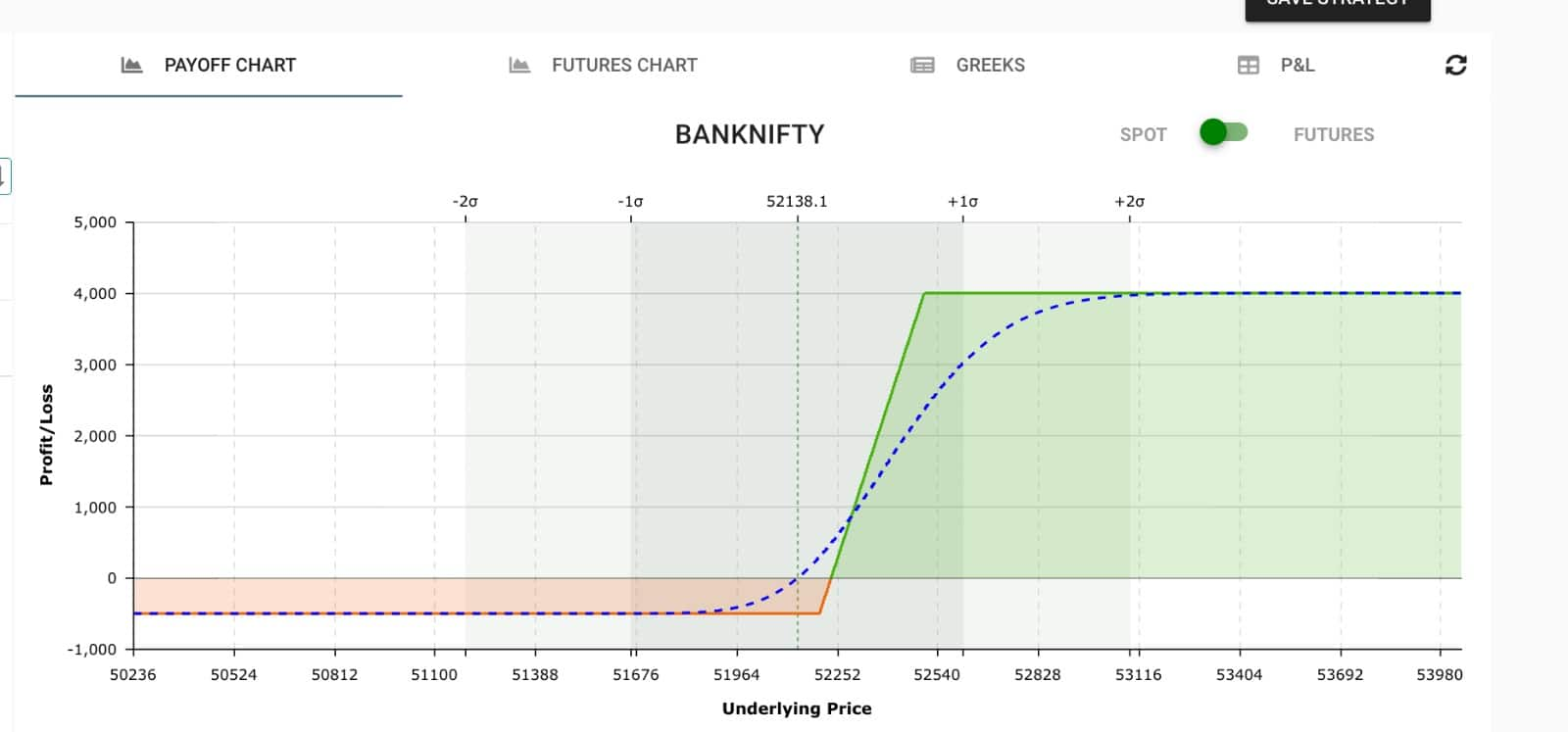

Arora recommends a Bull Call Spread- strategy for today's expiry:

Buy 1 lot 52,200 CE at Rs 46

Sell 1 lot 52,500 CE at Rs 13

> Probability of Profit: 42.1%

> Maximum Profit: Rs 4,005 (25.61%)

> Maximum Loss: Rs 495 (3.16%)

Note: This strategy is like a 'hero or zero' trade and shall make money only if supported by a strong upside movement.

Arun Kumar Mantri, Founder Mantri Finmart stated, "Bank Nifty has taken support at around 52,100 in the today's trade and is still looking good to buy on dips."

"The support for the index is around 52,000-52,100 for the day while 52400 will be the today's resistance. The overall structure of the index seems bullish even for short term period, " added Mantri.

Bullish strategy recommended by Mantri:

> Buy One Lot of Bank Nifty 52,100 CE at Rs 82

> Sell One Lot of Bank Nifty 52,300 CE at Rs 25

> Cost: Rs 57

> Stop Loss: Rs 25

> Targets: Rs 125 - Rs 140

A Bull Call Spread involves purchasing one call option with a lower strike price and selling another call option with a higher strike price. Both options pertain to the same underlying stock and share the same expiration date.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!