Artificial Intelligence (AI) is set to transform the Indian IT industry but this impact has not been factored in by the market, wrote analysts at Kotak Institutional Equities in their strategy report.

The brokerage sees a "sharp acceleration in disruptive forces in the near term across sectors such as automobiles 2Ws (two-wheelers), commodity chemicals and IT services". The analysts said that consumer-facing businesses are likely to face "gradual challenges" to their business models.

They stated that the market seems oblivious to these risks and seems enamoured by short-term factors such as higher profitability in automobiles or likely recovery in revenues in the IT sector.

Also read: Sensex zooms 1,000 points, Nifty hits fresh record high; 5 factors fuelling the rally

What's coming in IT?

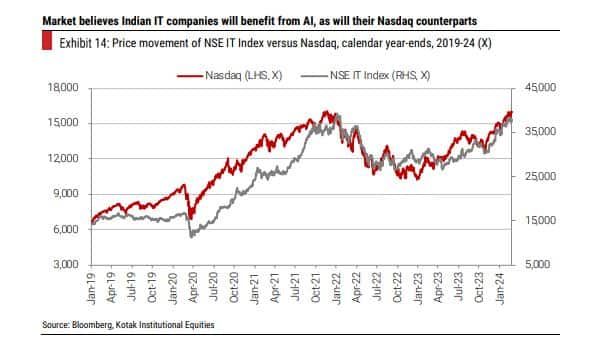

On the IT stocks, the analysts pointed out the oddity of the stocks continuing to move in sync with Nasdaq, despite the coming disruption.

The report said: "The recent progress made by a number of LLMs (large language models), coupled with (1) increasing use-cases and (2) massive computing power, suggests that the entire IT industry may be at the cusp of an AI led transformation. However, the strong correlation between Indian IT companies and the Nasdaq (especially, the Mag7 AI disruptors) is at odds with the current state of Indian companies’ AI adoption."

The analysts wrote that most Indian IT companies are at a training phase in GenAI and listed, in brief, the various stages at which the companies are.

Infosys has 100,000 employees trained in Generative AI areas and has developed a range of use cases and benefit scenarios across different industries for clients; HCL Tech is working on generating early stage opportunities as well train delivery organisation to leverage GenAI for core development, deployment, testing and managed services; TCS has over 100,000 Gen AI ready employees today and investing in deepening their expertise further; Wipro trained as many as 1,80,000 employees in basic Gen AI general principles and also launched new GenAI CoE with IIT Delhi; Happiest Minds has created GenAI business unit (GBS), which will have its own sales and consulting team, coupled with an agile delivery and alliance management team and so on.

Also read: Wipro slips 2% after Kotak Equities downgrades stock to 'sell', sees over 15% downside

The KIE analysts believe that the client budgets may not change materially, but AI projects will see higher allocation.

They wrote, "A number of service lines will see disruption risks, even as medium-term opportunities may rise from system integration... The relative velocity of application and disruption will determine the quantum of opportunity and risk for Indian companies—(1) more projects per client versus (2) lower cost per project (due to higher productivity)."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.