When Zepto launched in 2021, it came with a big promise — 10-minute grocery deliveries run by two teenagers who had dropped out of Stanford. But, the big proposition came with a big price tag. The company has deep pockets, having raised over $360 million so far. It’s been in existence for a little over two years and continues to need the cash tap running. While it is looking to bag its fifth funding round at a valuation that would make it a unicorn, investors are thoroughly vetting its claims and numbers, especially after Dunzo, a competitor, has been reeling under a cash crunch.

Zepto’s need for money is understandable. It is up against Zomato-owned Blinkit, Swiggy’s Instamart, BigBasket's BBNow from Tata and Reliance-backed Dunzo.

Among these players, Zepto is also the only one to exclusively focus on quick commerce grocery delivery to make its cash registers ring which makes the job tougher.

In its pitch deck to investors, shared around May, which Moneycontrol has reviewed, Zepto said it continues to make headway and leave legacy players behind. The deck not only sheds light on granular details about Zepto but also gives colour on the buzzy but intensely competitive quick-commerce space.

Financial health

While some of Zepto’s dark stores had turned positive on an Earnings Before Income, Taxes, Depreciation and Amortisation (EBITDA) basis, albeit at a low margin of around 2 percent, the larger company still has a negative EBITDA margin.

Zepto’s EBITDA margin stood between -15 and -16 percent in April 2023, an improvement from around -26 percent in January 2023. It was as low as -278.6 percent in January 2022, when it went big on discount coupons and other discounts to acquire customers and make space for itself in a new market.

Zepto declined to comment on the story.

It also told investors that its monthly cash burn had reduced from around Rs 90 crore in September 2022 to about Rs 55 crore in April 2023.

At the same time, Zepto was doing around Rs 370-380 crore in total sales in April 2023, which translates to an annualised revenue run rate of Rs 4,440-4,560 crore. The total sales was a sharp jump from a monthly sales of Rs 200 crore that Zepto was clocking in September 2022, as per its presentation.

A bulk of that improvement in financial health was supported by increasing advertising income for Zepto. The company was now earning around Rs 10-12 crore via ads each month, a significant jump from Rs 2 crore that it was earning in July 2022. Zepto's performance was also better because it was now taking longer to complete deliveries.

Delay in deliveries

Zepto admitted that its median delivery timeline has now moved from 10 minutes, to a more realistic 13 minutes. In the past several large players like Flipkart and BigBasket have said 10-minute deliveries are unsustainable and loss-making, but Zepto had refuted those claims.

Zepto’s 13-minute deliveries compare with Blinkit’s 14-15 minutes and 19-21 minutes for BB Now. Zepto said Swiggy Instamart’s 20-22 minute delivery was the slowest in the industry.

“Zepto leads peers in terms of delivery time, Blinkit close second, while Instamart's delivery time is 8-9 min longer and at a higher last mile cost…Zepto (also) leads peers in terms of share of its customers with a low average delivery time,” one of the slides read.

As per the presentation, Zepto also has the lowest delivery fee per order of Rs 9, which compares with roughly Rs 11 for both Swiggy Instamart and Blinkit, showing there was not a big difference among players.

Helped with that, Zepto’s total costs were also sharply lower than the other players, it claimed. Per order, Zepto spends Rs 40-45 as last mile cost, Rs 28-30 as dark store cost, Rs 18-20 as distribution centre cost and finally Rs 9-10 of wastage per order. Those add up to a total cost of Rs 95-105 per order for Zepto, which is about 40-45 percent lesser than Swiggy Instamart’s Rs 140-145 and about 30-35 percent lesser than Rs 130-135 that Blinkit incurs as cost per order.

Zepto said it had 6,690 stock keeping units (SKUs), and claimed it was highest in the industry, which is more than double of BB Now which has 3,000 SKUs. Even the larger players, like Blinkit and Swiggy Instamart had 4,000 SKUs and 4,750 SKUs, respectively, as per Zepto’s pitch.

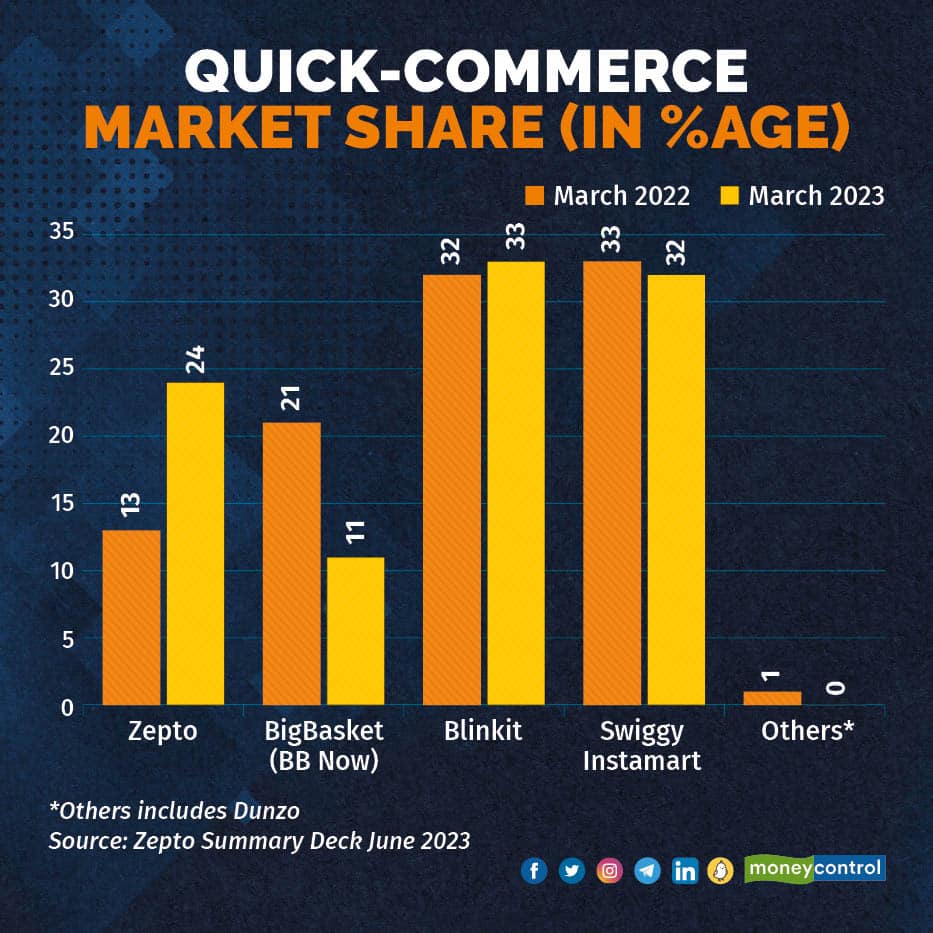

At the same time, Zepto said its market share in the quick-commerce space had jumped from around 13 percent in March 2022 to about 24 percent in March 2023. The presentation showed Zepto gained primarily at the expense of BigBasket (BB Now) which has seen its share reduce from 21 percent in March last year to around 11 percent as of March 2023.

As per estimates, which were prepared along with Boston Consulting Group (BCG), Blinkit was the market leader with a 33 percent share. Swiggy Instamart was a close second with a 32 percent share. Both Blinkit and Swiggy keep swapping spots as the market leader frequently, showing they have not ceded much ground to the newcomer. In none of the 30 odd slides has Zepto considered or mentioned Dunzo as a competitor in the space.

Quick-commerce market share

Quick-commerce market share

Market shares were calculated on the basis of order volumes as of March 2023. To be sure, these were estimates that Zepto prepared internally along with BCG, which pushed some industry players to dismiss the market share split because they were naturally tipped in Zepto's favour. The market shares may move slightly if other metrics are used, they said.

“Zepto clearly seems to have shown an improvement in performance. But I would also be a tad bit cautious because which company would not paint a rosy picture in its pitch deck?” a person who closely tracks the quick-commerce space said.

Blinkit was doing around 4-4.2 lakh orders a day, just ahead of 3.7-3.9 lakh orders that Swiggy Instamart was clocking. While Zepto’s 2.7-2.8 lakh daily orders were far from those, it was more than double of BB Now which delivers 1.2-1.3 lakh orders a day, it told its prospective investors in a slide. Industry watchers said all companies have grown from there, including BB Now which was doing around 1.8 lakh orders currently.

Dark store footprint

Dark store footprint

Concerns flagged

Zepto operates about 220 dark stores in total and continues to open about 10-15 stores each quarter but its business is still heavily reliant on existing stores to drive scale. The company said about 90-95 percent of its total sales came from existing stores while new ones contributed just 5-10 percent.

“Zepto’s new stores accounting for just 5-10 percent of its overall sales is not a healthy sign. When a business is as new as Zepto’s, the newer stores should be responsible for a much larger chunk. Newer stores being responsible for a larger share of total sales means that the business is adding new customers, and its reach is increasing, but that does not look like the case with Zepto,” an investor in the quick-commerce space said.

“The over dependence on existing has to be reduced, especially when the number of dark stores Zepto has is half of what the others operate,” the analyst added.

Zepto agreed that it did not service too many new pincodes. The company said it had “almost no new geographic expansion” and spent “limited money” on marketing in the year. The Mumbai-based startup added that it was growing 7-10 percent per month, driven largely by its loyal customer base.

“Since Zepto has been depending too much on select pincodes for now, tomorrow another player can slash prices in those areas and take away market share – that poses a big business risk for Zepto,” an internet sector analyst said.

In fact, Zepto’s fixed costs – which includes dark store rents, security, housekeeping and the like – also hardly moved on a month-on-month (MoM) basis, likely signifying that it was going slow on its dark store expansion. Its fixed costs totaled to around Rs 20 crore in April 2023, almost flat from Rs 18 crore in September 2022.

Typically, fixed costs and order volume growth are both inversely proportional. As order volumes grow, store-level fixed costs tend to reduce on the back of a higher denominator – but Zepto has not seen that happen in the recent months. It was likely because Zepto was still investing in growing its business.

Zepto’s approach is in stark contrast to the route market leaders are taking. During its earnings call this month, Blinkit said it would be opening 100 new stores this financial year, a majority of which will be in existing locations, further cementing its leadership position.

Zepto has been engaging with investors for over three months now and is expected to close its fundraise this month which will increase its valuation from around $900 million likely putting an end to the unicorn drought that the Indian startup ecosystem is currently experiencing. Founded by Aadit Palicha and Kaivalya Vohra, Zepto counts Nexus Venture Partners, Y Combinator, Contrary Capital, Glade Brook Capital, 2am VC and Lachy Groom as its investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.