FMCG and tobacco major ITC is expected to report mid-single digit on-year growth in revenue and a moderate growth in net profit in the December quarter, helped by the FMCG sector and hotels arm. ITC will report its third quarter earnings today, January 29.

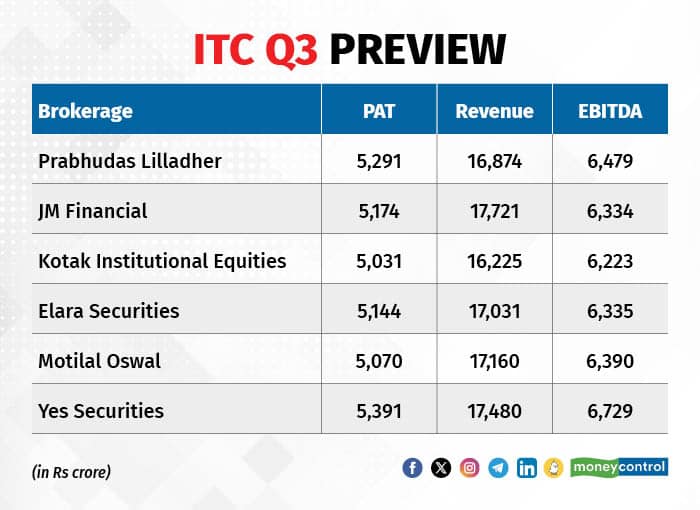

The cigarettes-to-hotels conglomerate is expected to report a net profit of around Rs 5,183 crore, up 3 percent from the corresponding quarter previous fiscal year, according to an average of estimates of six brokerage estimates. Revenue is expected grow to Rs 17,425 crore.

This growth is amid mostly flattish performance of other FMCG majors in the quarter due to low rural demand.

EBITDA is likely to be around Rs 6,482 crore, rising around 4 percent on-year. The EBITDA margin is projected to come in flat on a quarterly basis, at 36.5 percent. EBITDA is short for earnings before interest, tax depreciation and amortisation.

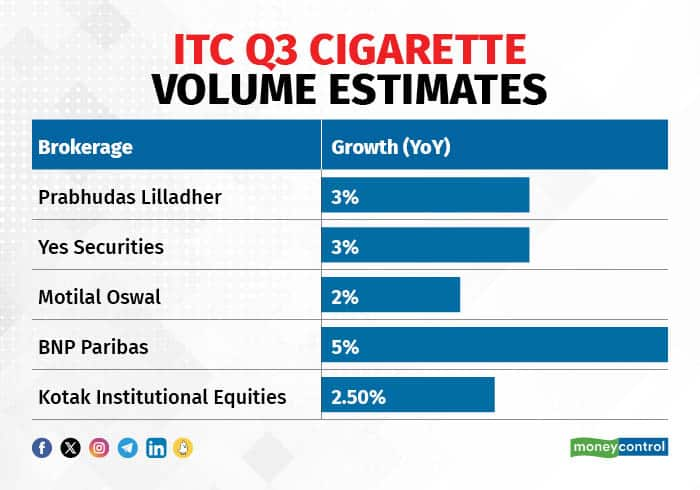

Cigarettes to see 3 percent volume growth

Cigarette volumes will see an expansion of around 3 percent on-year, on account of high base and the impact of the cyclone in strategic markets of south India.

Motilal Oswal said, “The cigarette business continues to deliver volume growth and market share gains in the softening of competition from illicit trade.”

Also Read | Colgate-Palmolive Q3 sparks mixed reactions from brokerages; margins hit all-time highs

Low RM prices to boost FMCG margins

As input prices decline, brokerages anticipate that gross margins will see an expansion. The segment has delivered strong growth across markets and product lines.

“FMCG will sustain margin expansion in a tough demand environment,” said Prabhudas Lilladher.

The tough demand environment is a result of low rural demand, impacting volumes and trailing urban figures for over a year. “Further, low farm income and emergence of small regional firms are dragging large, listed companies,” Elara Securities said.

According to Kotak Institutional Equities, the FMCG segment will see revenue growth of around 7.5 percent on-year compared to the revenue growth of 8.3 percent in the September quarter. The EBIT margin for the segment will rise 180 basis points on-year to around 9 percent.

One basis points is one-hundredth of a percentage point.

Hotels

The ITC Hotels segment is expected to show strong growth, with revenue projected to see a rise of around 15 to 20 percent on-year.

The delayed festive season and the wedding season are likely to result in the segment’s outperformance. The EBIT margin will clock in around 21 percent, rising 160 bps on a sequential basis, per Kotak Institutional Equities.

Also Read | HUL Q3 disappoints Street, brokerages slash target prices amid uncertain outlook

Agri, paperboard segments

BNP Paribas estimated that the agri business might see a 20 percent on-year growth in revenue, while the paperboard business should record a decline of 5 percent. The base quarter for the agri business had seen an impact from the ban on wheat and rice imports. Brokerages added that the outlook on the agri and paper & packaging businesses is a key monitorable for the company.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.