The Hindustan Unilever Limited (HUL) stock fell 3 percent on January 20, a day after the FMCG major's third quarter earnings came in below Street's estimates.

Brokerages have cut their target prices on the stock, citing the company's low volume recovery and uncertainty ahead.

HUL reported a standalone net profit of Rs 2,519 crore for the December quarter of FY24, an increase of just 0.55 percent from the year-ago period. A poll of six brokerages had expected the company to report a net profit of Rs 2,678 crore.

At 10.04, the stock was trading at Rs 2,496.10 on the National Stock Exchange, down 2.04 percent from the previous close.

Also Read | HUL Q3 results: Net profit flat at Rs 2,519 crore, revenue falls marginally, misses estimates

The management said that delayed winters, subdued festival season and increased competition reflected in the weak consumer sentiment.

Volumes disappoint

HUL reported flat revenue, with a 2 percent increase in underlying volume growth. The overall performance was subdued across various categories, primarily due to the sluggishness in rural markets. However, there was consistent demand in urban markets and the modern trade channel.

The demand environment in the near-term remains challenging as the competitive intensity is high and HUL is not seeing green shoots in the rural markets, the management said.

“We believe in ensuing quarters, price growth would remain marginally negative and HUL would focus on volume led growth,” Dolat Capital said.

Home and personal care and beauty and personal care segments experienced a mid-single-digit increase in volume delivery, benefiting from favourable response to price corrections. In contrast, the food and refreshments (F&R) segment volumes saw a low single-digit decline due to the ongoing price hikes.

According to the company, low single-digit decline in the F&R segment was due to higher commodity prices, leading to consumers down-trading.

The management commentary on demand remained unexciting, Emkay Global said. “Demand recovery remains a hope on the emergence of tailwinds. Reinforcing the general trade moat is now an added pressure, with changes in distributor margin structure,” it said.

Gross margins impress on low RM costs

The gross margin saw an expansion of 400 basis points from the year-ago period following benign raw material prices and easing input costs. If commodity prices remain at the current level, the management said the pricing growth would be negative in the upcoming quarters.

The EBITDA margin remained flat at 23.3 percent due to higher advertising and promotional spends.

Outlook

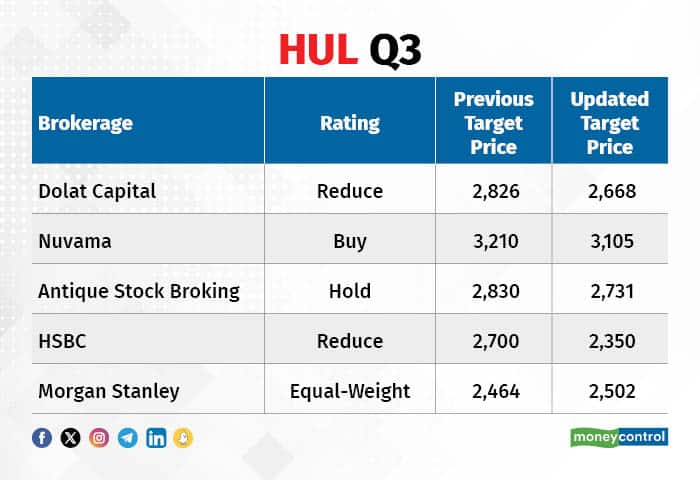

HUL Q3

HUL Q3

Morgan Stanley said that the earnings came below its estimates for the fourth consecutive quarter. The brokerage maintained its equal-weight call, but slashed its target price to Rs 2,464 from Rs 2,502, claiming that the negative pricing remains a key headwind for the FMCG major.

HSBC concurred with the view, adding that the weak earnings are not a symptom of macro weakness, but the growth is lacklustre, especially since previous drivers of growth - the home care and BPC segments - have seen muted growth. The brokerage downgraded its call to reduce, cutting the target price from Rs 2,700 to Rs 2,350 apiece.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.