Tata Technologies, the first Tata group company to be listed in 20 years as it launches an initial public offering (IPO) on November 22, has a significant revenue concentration from the parent company Tata Motors, but will soon reduce the dependence, said CEO Warren Harris.

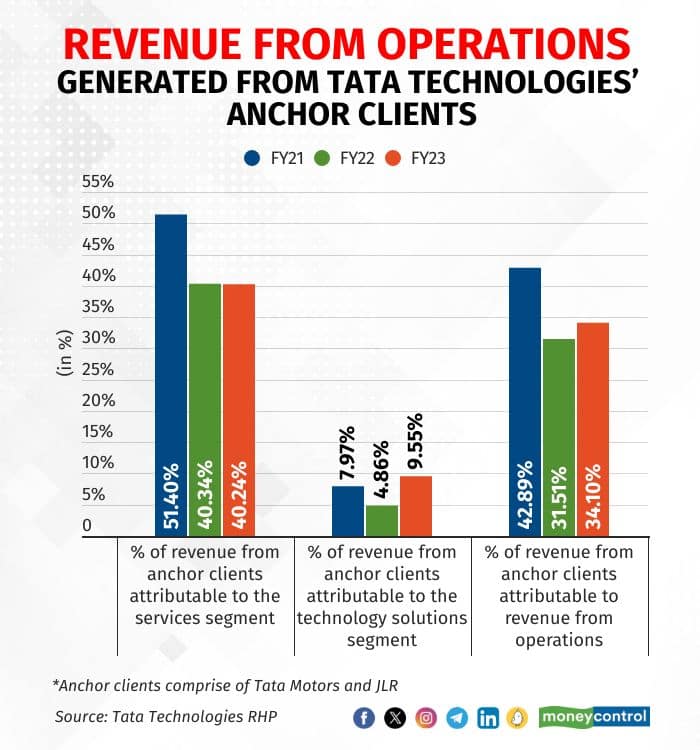

The contribution of Tata Motors and JLR (Jaguar Land Rover) to Tata Technologies will fall in the medium to long term, said Harris in an interview with Moneycontrol. In FY23, Tata Motors and group companies contributed over one-third revenue for Tata Technologies.

Also Read: Tata Technologies IPO: 10 things to know before subscribing to Rs 3,042 crore issue

Tata Tech IPO will be the first in two decades for a Tata Group company after Tata Consultancy Services (TCS) went public in 2004. Tata Tech's top two captive customers account for the bulk of the revenue for the company. The CEO clarified the company's position when asked about its capability to secure orders from Tata Motors' competitors.

Harris said that the group or Tata Motors will have no operational influence on Tata Technologies.

“Let me make it very clear. There is no operational influence that the group or indeed Tata Motors positions on Tata Technologies. And so we are free to target and work with whoever we feel is appropriate in terms of the value that we can deliver,” Harris said.

Tata Motors has ambitious investment plans in the EV sector. Harris says that in the near term work for Tata Motors may increase, but the contribution will fall in the long run.

“Tata Motors and JLR have made public statements about their capex and their investments in electric vehicles, both here in India and in the UK, and places like China. And we are part of the ecosystem of partners that will help them deliver their product plans going forward. We are relatively bullish in the short term in terms of the growth rates of Tata Motors and JLR. But certainly medium to long term, we expect the contribution in percentage terms to come down,” Harris added.

Also Read: Tata Technologies IPO: Company in talks with Morgan Stanley, Blackrock, US hedge funds

Slower Revenue CAGR Versus PeersTata Technologies’ revenue growth rate has been behind all the peers except Cyient for FY20-23E. The automotive segment’s contribution to its revenue stood at 64.5 percent in FY22 and 75 percent in 9MFY23, second only to KPIT. Further, it derives 30 percent of its revenue from India which is higher compared to peers.

The company is confident in its ability to grow organically at a rate equal to or exceeding market growth rates. The CEO anticipates double-digit growth in engineering, research and development (ER&D) markets for FY24.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.