Bharti Hexacom’s Rs 4,275-crore IPO opened on April 3 and will close on April 5, marking the first public stock sale by the Bharti Airtel group in 12 years. Also, it is the first public issue of the new financial year 2024-25. The last IPO before this from the Bharti group was that of Bharti Infratel, now known as Indus Towers, which was listed back in 2012.

Several analysts have assigned a subscribe rating to the issue owing to reasonable valuation and strong parentage. However, high debt and volatile financial performance in the past few years are key concerns.

Offer detailsBharti Hexacom is a subsidiary of Bharti Airtel. The issue is entirely an offer-for-sale of 7.5 crore shares. This means that the entire proceeds will go to the selling shareholder Telecommunications Consultants India, which will dilute a 15 percent stake. The price band for Bharti Hexacom IPO has been fixed at Rs 542-570 per share.

Promoter Bharti Airtel holds a 70 percent stake in the company, and Telecommunications Consultants India holds the remaining 30 percent stake.

Should you subscribe to the issue?Choice: SubscribeThe domestic telecommunication market is effectively operating with a duopoly structure. Bharti Hexacom, promoted by Bharti Airtel, gains from synergies with its parent company and affiliates. “Considering the higher entry barrier for the new players, continued capex requirement and higher spectrum costs, we believe, there will be continued improvement in the operating & financial performance of the company in the medium term. We assign a ‘Subscribe’ rating to the issue,” said analysts at Choice Equity Broking.

Marwadi Financial: SubscribeConsidering the trailing 12-months (Dec 2023) and FY24 annualised EPS of Rs 9.67 and Rs 7.52, respectively, on a post-issue basis, the company is going to list at a P/E of 58.95x / 75.80x with a market cap of Rs 28,500 crore, whereas Bharti Airtel is trading at a P/E of 63.3x. “We assign a ‘Subscribe’ rating to this IPO as the company has strong parentage and an established brand along with a presence in markets with high growth potential. Also, it is available at a reasonable valuation as compared to its peers,” said analysts at Marwadi Financial Services.

AUM Capital: SubscribeBharti Hexacom is expected to leverage Bharti Airtel’s launch of 5G services across the country. “The company aims to maintain an efficient capital structure with high balance sheet flexibility. It is vouching to repay its debt obligations through internal accruals as it holds liquid investments and cash worth Rs 2,000 crore at the end of December 31, 2023. We would hence recommend a ‘Subscribe’ to the issue,” said analysts at AUM Capital.

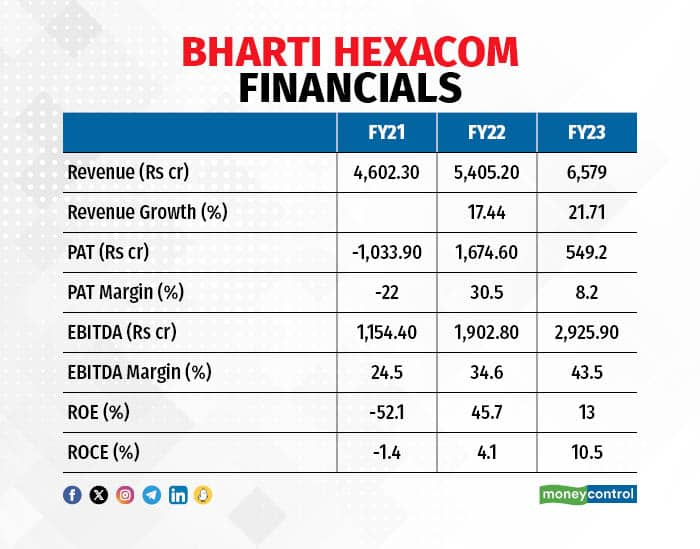

Financials

Bharti Hexacom offers consumer mobile services, fixed-line telephone and broadband services under the brand Airtel to customers in Rajasthan and the North East telecommunication circles in India. It recorded a 67.2 percent on-year decline in net profit at Rs 549.2 crore in FY22-23, primarily due to a higher base owing to exceptional gains of Rs 1,951.1 crore in the previous year.

Also Read: Bharti Hexacom raises Rs 1,924 crore from anchor investors before IPO opens on April 3

The company had a healthy topline. Revenue from operations during the year grew 21.7 percent to Rs 6,579 crore from the previous year. Its EBITDA (earnings before interest, tax, depreciation and amortisation) increased by 53.7 percent to Rs 2,925.9 crore with a margin expansion at 43.5 percent during the same period. As of FY23, total debt stood at Rs 6,269.3 crore and debt to equity ratio was 1.5x while the return on capital employed (RoCE) was 10.7 percent.

Comparison with peersAt present, there are primarily four pan-India telecom service providers, Reliance Jio, Bharti Airtel, Vodafone India and BSNL. During 9M FY24, top-2 players Jio and Airtel cornered around 80 percent of the market in terms of revenue and 72 percent in terms of subscriber base. Due to financial stress, VIL’s position in the market has continuously declined since FY18.

Also Read: Bharti Hexacom IPO: 10 things to know before you buy into the Rs 4,275-cr issue

Bharti Hexacom enjoys a 40 percent market share in the Rajasthan circle and 51 percent in the North-East circle which comprises the states of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland and Tripura.

Anchor investorsAhead of the IPO, the company raised Rs 1,923.75 crore from 97 anchor investors on April 2. The list included marquee names like Blackrock Global Funds, Pictet, Smallcap World Fund, Capital Group, American Funds, Fidelity Funds, Abu Dhabi Investment Authority, Morgan Stanley and HSBC.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.