Stocks with high earnings growth, sustainable business and credible management are the secret sauce for a sturdy wealth-creating portfolio.

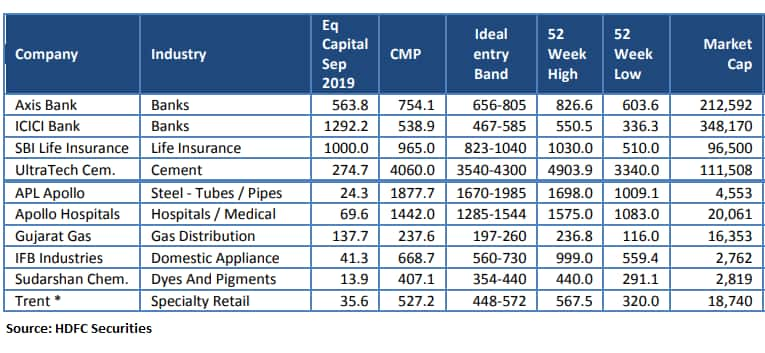

To give retail investors a taste of good things, HDFC Securities has come out with a report on 10 large, midcap and smallcap companies that can potentially double their earnings in three years (FY19 to FY22).

These stocks have the right framework in place and have withstood the slowdown well. Their business offers enough scope for growth and market share gains, says the report.

These companies have management that has proven history of creating superior business models that are least impacted by adverse cycles or regulations, it says.

Current valuations of these companies partly reflect the above and the expectations of improved performance. Hence, their stock returns from hereon may not necessarily mirror the earnings performance.

However, these companies give comfort that unless the macros of India remain dented for some more quarters, they have the ability to bounce back vigorously from the short-term adverse situations and deliver superior consistent earnings growth, the report says.

“We have given below the ideal entry bands in which lump-sum or staggered buying may be made. Investors can expect 15%-20% compounded returns in these stocks unless the entire buying is done at cycle highs,” it says.

Axis Bank is the third-largest private sector bank in India in terms of advances and deposits. The bank offers the entire spectrum of financial services to customer segments like large and mid-sized corporates, MSMEs, and agriculture and retail businesses.

HDFC Securities strongly feels that asset quality worsening has peaked out for corporate-facing banks. This is evident also in the case of Axis Bank as absolute NPAs have been reducing on QoQ basis since the last five quarters.

Higher corporate delinquencies are expected to be over by the end of this fiscal year. Worst being behind (in terms of asset quality) and strategic growth plans from new management give confidence about Axis Bank’s future.

ICICI Bank

ICICI Bank Ltd (IBL) is the second-largest private sector bank in India in terms of assets size and is designated as one of the Domestic Systemically Important Bank (D-SIB) in the country. The balance sheet size on a standalone basis stood at Rs 9,970 billion as of Q2FY20.

The ICICI Group has a unique franchise, with a presence across customer segments, products and geographies, excellent technical capabilities and a diverse talent pool. The bank’s strong market leadership is complemented by its robust franchise of 5,228 branches and 15,159 ATMs as on September 30, 2019.

SBI Life Insurance Company Ltd

SBI Life is the second-largest private sector life insurance company in the country and has a 6.3% market share in the industry. It has a diversified product mix across individual and group insurance products along with a multi-channel distribution network comprising bank assurance, individual agents, insurance brokers, direct sales, etc.

India is the world’s second-largest cement market. With 24 percent market share in India, Ultratech Cement is the largest manufacturer of grey cement, Ready Mix Concrete (RMC) and white cement in the country.

As the utilisation levels rise for the company, and the costs stabilise, the pricing power will come back. We expect 13% revenue, ~19% EBITDA and ~31% EPS CAGR led by its cost leadership, pricing, improving realisation and strong volumes over FY19-22E.

The stock trades at ~12.4x FY22E EV/EBITDA and ~USD 169 EV/MT. HDFC Securities is of the view that Ultratech, with a pan-India presence and strong sustainable financials, will continue to trade at a premium over mid-sized cement companies.

APL Apollo Tubes is the largest producer of electric resistance welded (ERW) steel pipes and sections in India with a capacity to produce 2.5 million tonnes per annum.

The ERW steel tubes market is pegged at Rs 30,000 crore and is estimated to grow at ~10-12% CAGR in the coming years. With the development of technology, steel pipes have found application as hollow structures in other industries such as building materials, automobiles, and daily utility items.

Over the next three years, we estimate revenues/EBITDA/PAT to grow at CAGR of ~16.5%/24%/40% on the back of strong volume growth, cost-efficient measures by the company through adoptions of new technology and reduction of the effective tax rate.

Apollo Hospitals Enterprises Ltd

Apollo Hospital Enterprise Ltd (AHEL) is one of Asia’s leading integrated healthcare service providers. It has a presence in hospital, pharmaceutical, primary care & diagnostic clinics space. It has telemedicine units, health insurance services, global projects consultancy, colleges of nursing and hospital management and a research foundation, epidemiological studies, stem cell & genetic research as well.

As on March 31, 2019, AHEL had 19 direct subsidiaries, 10 step down subsidiaries, four joint ventures, and four associate companies.

Gujarat Gas

Gujarat Gas Limited (GGL) is India’s largest city gas distribution company, with presence across 23 regions in the Gujarat, Union Territory of Dadra and Nagar Haveli and Thane Geographical Area (GA) (barring already authorised area including Maharashtra's Palghar locale).

The company has a 23,200-km pipeline network. It distributes around 9-9.5 million metric standard cubic meters of gas every day to about 13,55,000 households, around 2 lakh CNG vehicles (serving every day) and to more than 3,540 industrial customers.

IFB Industries is engaged in manufacturing a diversified product portfolio with an established brand presence of front load washing machines, top-load washing machines, dryers, ACs, microwave ovens, dishwashers, modular kitchen, and chimneys (totalling 82% of FY19 sales).

A substantial improvement in product diversification leading to improved revenue generation and localisation plans for input resources, favourable product mix, and control over operating expenditure are likely to result in margins expansion. Expansion in EPS and valuation rerating (based on industry valuation norms) could lead to improved stock price performance.

Sudarshan Chemical Industries Ltd

Sudarshan Chemical (SCL) is the fourth largest pigment manufacturer globally and the largest in India, and now aspiring to become the third largest over the next three years. SCL has continuously gained market share over the past few years.

SCL is well placed to continue rapid growth in the context of the expected exit from pigments business by its two largest global competitors (BASF and Clariant).

The company’s low-cost manufacturing advantage, technical capabilities, wide product portfolio and environmental compliance are some of the key positives for the company.

Trent Ltd

Trent is a Tata group company established in 1998. Trent operates retail stores across four formats: Westside, Zudio, Star and Landmark.

Accelerated store addition in the Westside format, rightsizing of Star Bazaar stores coupled with consistent growth in Zara are further expected to accelerate Trent’s financial performance.

Focus on profitable growth has been the hallmark so far of Trent. HDFC Securities expect steady SSSG (Same Stores Sales Growth) in Westside to continue despite an increase in store expansion. Given strong store economics, scalability and execution, HDFC Securities has a positive view on the stock.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.