India's central bank has sounded a strong warning on inflation, reiterating that a durable return to the medium-term objective of 4 percent is "far from assured" and that growth could also take a hit if it is not brought down to the target rate and "tethered" to it.

"The softer inflation prints for September and October 2023 and the prolonged pause in the stance of monetary policy has engendered a certain hypermetropia among some stakeholders – an irrational long-sightedness whereby inflation forecasts gravitating towards the 4 percent target sometime in the distant future are sighted clearly whereas high near-term risks of spikes in inflation outcomes on the back of food volatility are blurred," the Reserve Bank of India's (RBI) monthly State of the Economy article, released on December 20, said.

Also Read: No forward guidance again from Governor Das, but clues remain

"Under these conditions, a clamour rises for rate cuts or at least that the central bank commits to a path of moderation in the level of the policy rate. Such views imperil the conduct of monetary policy in the pursuit of its goal of durably aligning inflation with the target. These views also undermine the foundations of growth," it added.

The monthly State of the Economy article includes Deputy Governor Michael Patra - one of the three RBI representatives on the Monetary Policy Committee (MPC) - as one of its co-authors. The views expressed in the article do not reflect the central bank's official stance.

The comments come after the MPC held the repo rate unchanged at 6.5 percent for the fifth meeting in a row on December 8. And while market participants were pleasantly surprised by some cooling of hawkishness from the RBI on the liquidity front, Governor Shaktikanta Das refused to provide any sort of forward guidance on interest rates or the stance of policy, saying it would be "a mistake" to think the RBI was giving "any kind of a signal, that we are moving towards neutral".

"Reaching 4 percent should not just be a one-off event… The MPC should have confidence that, yes, 4 percent has now become durable," Das had said.

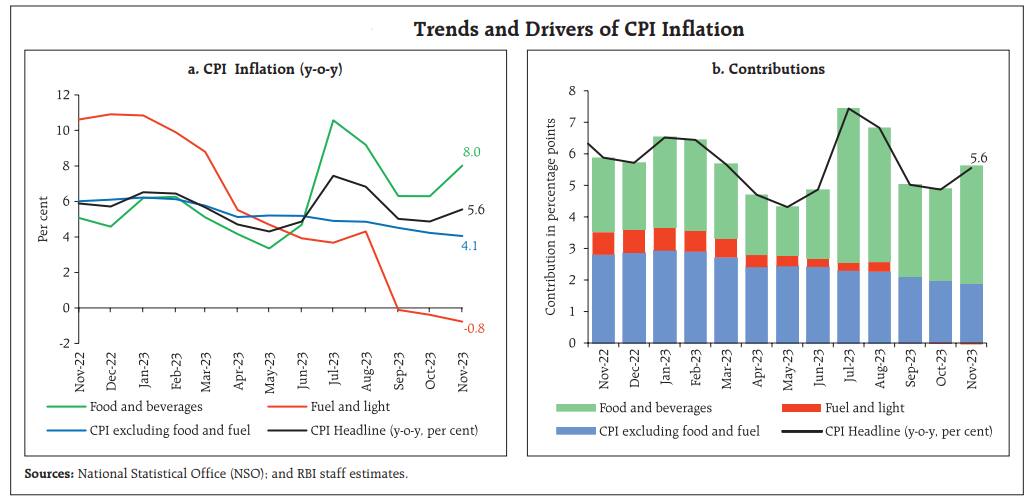

Data released since the MPC's December 8 decision showed that India's headline retail inflation rate rose less than expected to 5.55 percent in November, with economists broadly expecting it to rise further in December and test the upper-bound the RBI's 2-6 percent tolerance range. According to the RBI's latest forecasts, Consumer Price Index (CPI) inflation is seen averaging 4 percent in July-September 2024, meaning that it would hit the medium-term target after almost five years.

CPI inflation was last at the target rate in September 2019, when it had come in at 3.99 percent.

Economists, meanwhile, see the MPC beginning to cut the policy repo rate around the middle of 2024. But in the State of the Economy article, the RBI's economists added further warnings on the inflation front.

"The objective of aligning inflation with the target on a durable basis is far from assured... inflation is hurting discretionary consumer spending and this, in turn, is holding back top-line growth of manufacturing companies as well as their capex. If inflation is not brought back to the target and tethered there, there is a strong likelihood that growth may falter," they said.

Source: Reserve Bank of India

Source: Reserve Bank of IndiaAs per the State of the Economy paper, the medium-term outlook for inflation is higher than the RBI's official forecast. As per a 'dynamic stochastic general equilibrium' (DSGE) model developed by the RBI, CPI inflation is seen averaging 4.8 percent in 2024-25 - 30 basis points higher than the RBI's official forecast of 4.5 percent, mentioned in the October edition of the Monetary Policy Report.

The aforementioned DSGE model assumes global GDP growth of 2.6 percent and 2.1 percent for 2023-24 and 2024- 25, respectively; global retail inflation of 5.5 percent and 4.0 percent for 2023-24 and 2024-25, respectively; and an unchanged policy repo rate and US Fed funds rate of 6.5 percent and 5.5 percent for the current and next financial year, respectively.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.