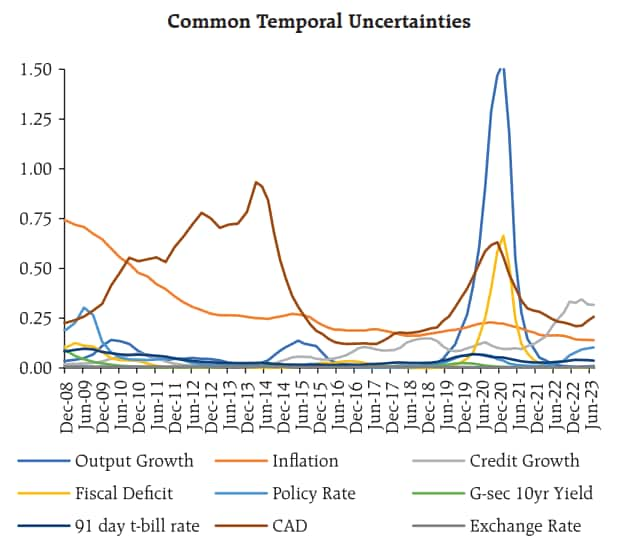

Uncertainties related to domestic credit growth have emerged since 2022, the Reserve Bank of India (RBI) has said in its monthly bulletin. In addition, the central bank's staff wrote that inflation-related uncertainties have cooled since September 2015, while those related to growth became "accentuated" during the COVID-19 pandemic from being "moderate" before that.

"...macro policy-related uncertainties remained low throughout the sample period except during 2020-21 when they increased due to the pandemic-induced fiscal expansion and monetary accommodation," the article, released on October 19, said.

Also Read: Four years of 4%-plus inflation – how RBI lost and is regaining control

Titled 'Measuring Uncertainty: An Indian Perspective', the article has been authored by RBI staff, including Deputy Governor Michael Patra. The views expressed in the article do not reflect the central bank's official stance.

Source: Reserve Bank of India

Source: Reserve Bank of India

The article's observation on increased credit growth uncertainty emerging since 2022 comes amid warnings from the RBI about a sharp increase in lending activity for certain types of personal loans.

"These are being closely monitored by the Reserve Bank for any signs of incipient stress. Banks and NBFCs would be well advised to strengthen their internal surveillance mechanisms, address the build-up of risks, if any, and institute suitable safeguards in their own interest," Governor Shaktikanta Das had said on October 6.

As per the latest RBI data, non-food bank credit growth stood at 19.9 percent as on August 25, while personal loans were up a huge 30.8 percent year-on-year.

Also Read: RBI data points to growth in lending to retail, infra, mining

The article uses data from the RBI's own survey of professional forecasters to construct an index of macroeconomic uncertainty, which suggests uncertainty was high after the Global Financial Crisis and until 2013-14, after which it started to fall and remained subdued till 2019-20, coinciding with the adoption of the flexible inflation targeting framework by the central bank.

However, the onset of the COVID pandemic led to increased uncertainty again, although it eased off by 2022 - albeit at a level higher than before the pandemic.

"Thus, unforeseeable shocks have driven macroeconomic uncertainty in the past one and a half decades," the article noted, adding that policy decisions can be "too restrictive" or "too lax" if analytical frameworks don't explicitly include some measure of uncertainty.

According to the authors, measuring macroeconomic uncertainty using data from professional forecasters is "superior to all other measures" that are available. Some of the other measures that are available use financial markets' data and data on news articles, among others.

"Measuring uncertainty by leveraging news text uses the frequency of certain keywords appearing in news articles to create an index of economic policy uncertainty... The important limitation of this measure is that it assumes that news reporters and editors are fully aware of all

uncertainty events and report them diligently," the article noted.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!