The Reserve Bank of India’s (RBI's) recent quarterly forward looking survey showed that demand for loans in the mining, infrastructure and personal/retail sectors in Q3 and Q4 of financial year (FY) 2023-24 and Q1 of FY 2024-25 is expected to grow. But analysts and bankers highlight challenges to the growth.

The central bank, in its ‘Bank Lending Survey’ for the July-September 2023 quarter showed that the infrastructure sector grew 29.3 percent and the retail sectors by 47.8 percent, while mining recorded no growth.

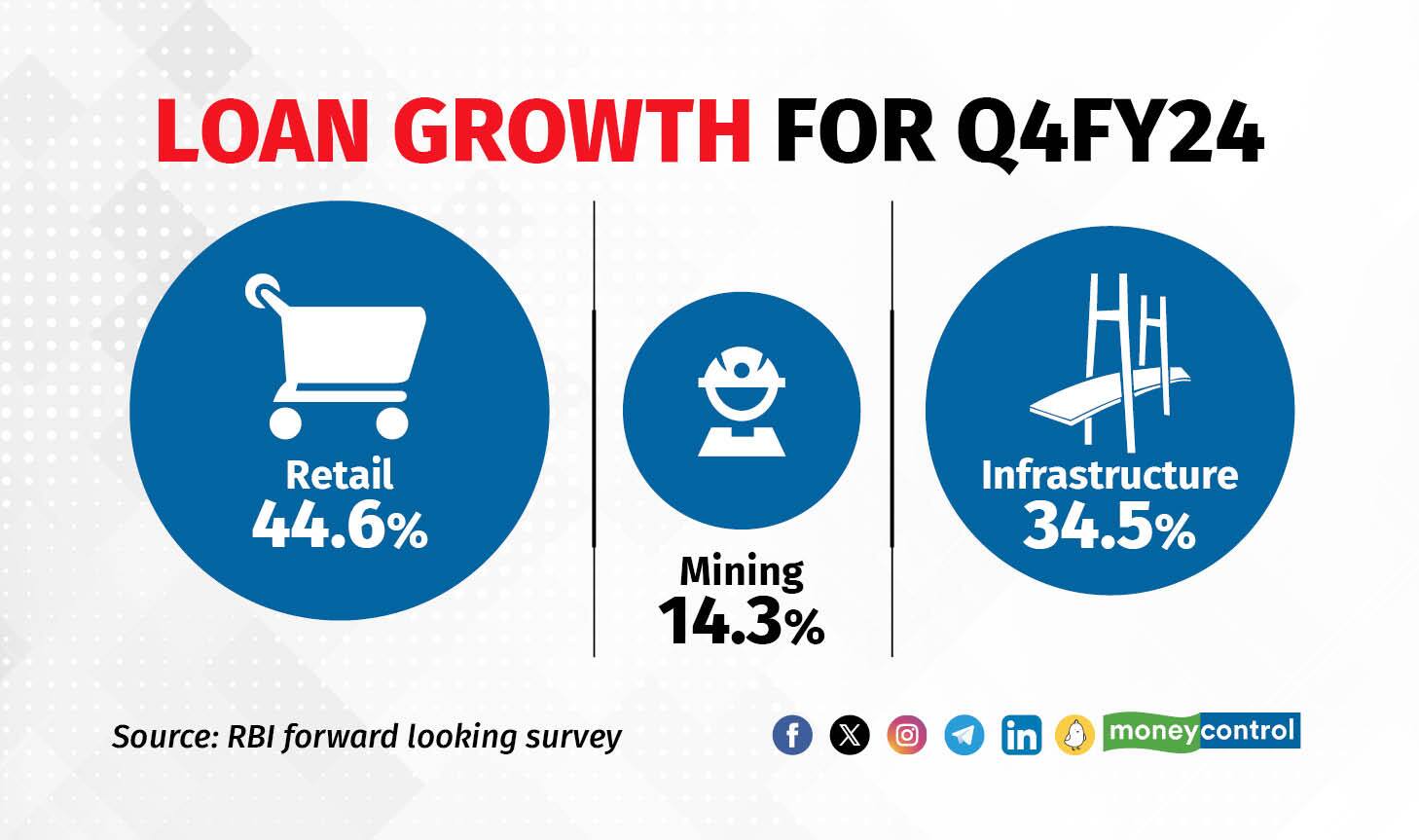

For Q3, the data showed that bank lending to mining, infrastructure and personal/retail sectors is expected to grow by 13 percent, 39.7 percent and 54.3 percent respectively. In Q4, lending to these sectors is expected to grow by 14.3 percent, 39.7 percent and 44.6 percent, respectively. Whereas for Q1 of FY25, the data showed that lending to the sectors will grow by 10.7 percent, 34.5 percent and 39.3 percent respectively.

Also read: Monitoring certain components of personal loans in the books of banks, NBFCs, says Guv Das

Here, analysts and bankers said that due to the aggressive growth in the retail segment, RBI has been warning banks to take a cautious approach.

“Retail lending from banks has been growing aggressively. Due to the festive season, we may see banks going more aggressive,” said Vijay Gaur, Lead Analyst, BFSI Research, CareEdge.

A senior executive of a bank, who did not wish to be named, said that banks have been maintaining a watchful approach in the retail loan segment.

Also read: Consumer confidence up, inflation easing slowly, RBI surveys show

“The segment has given banks good profits. But banks will keep a strong eye on lending,” the senior executive said.

For mining and infrastructure, a sharp rise in crude oil price due to the Israel-Palestine conflict can create short-term issues. Also, the domestication of manufacturing by several top economies can affect the sectors.

Jindal Haria, Associate Director, India Ratings and Research, said “The domestication of the manufacturing industry by countries in Europe and Asia can pose some challenges for mining and infrastructure.”

Growth in personal and retail loans

Indian banks are going aggressive in their personal loan portfolio, with credit to the segment growing by 30.8 percent, compared to 19.4 percent on a year-on-year basis, sectoral credit growth data for August 2023 showed.

The total credit to the segment was Rs 47.70 lakh crore in August 2023, compared to Rs 36.47 lakh crore in August 2022. Credit to the sector from April 2023 to August 2023 grew from Rs 40.85 lakh crore to Rs 47.70 lakh crore, up 16.8 percent, compared to seven percent in the corresponding period last year.

In this category, the central bank has time and again warned banks of their unsecured loans. Unsecured loans include credit cards, personal loans and microfinance loans.

RBI Governor Shaktikanta Das, while announcing the Monetary Policy Committee (MPC)'s decisions on October 6, said that the central bank is monitoring certain segments of personal loans.

“Certain components of personal loans which are recording very high growth are being closely monitored by RBI for any signs of incipient stress. Banks and NBFCs would be well advised to strengthen their internal surveillance mechanisms, address the build-up of risks, if any, and institute suitable safeguards in their own interest,” said Das.

Also read: Bank credit to personal loan jumps 30.8% in August 2023, shows RBI data

Earlier, in an interview to Moneycontrol, Shanti Ekambaram, Whole Time Director, Kotak Mahindra Bank, said that the bank aims to grow its unsecured business. “We are very clear on the unsecured retail book and mid-teens is what we look to keep the portfolio,” Ekambaram said.

Similarly, Federal Bank too aims to grow its unsecured business.

“In the next few years, our unsecured business, which is currently around 3 to 4 percent of our business, may become 10 percent,” Shyam Srinivasan said in an interview with Moneycontrol in July 2023.

Also read: Interview | Federal Bank’s unsecured retail segments working well: MD

Mining and Infra

The sectoral credit data for mining showed a year-on-year (YoY) growth of 0.3 percent. Credit to the sector grew to Rs 50,668 crore in August 2023 from Rs 50,529 crore in August 2022.

Similarly, credit growth for infrastructure was at a marginal 2.2 percent YoY from Rs 12.13 lakh crore to Rs 12.39 lakh crore in August 2023.

Going ahead, experts highlighted that a surprise shot-up in the price of crude oil can pose challenges to the growth.

Gaur of CareEdge said: “Crude oil and its by-products are used for logistical and other purposes in the mining and infrastructure sectors. These sectors can only be affected in the short-term by the sharp rise in crude-oil price due to the Israel-Palestine conflict.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.