Indian banks are going aggressive in their personal loan portfolio, with credit to the segment growing by 30.8 percent, compared to 19.4 percent on a year-on-year basis, the latest sectoral credit growth data with the Reserve Bank of India (RBI) showed.

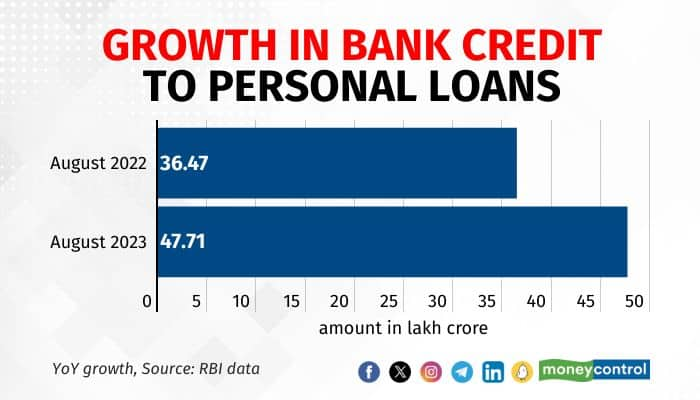

The total credit to the segment was Rs 47.70 lakh crore in August 2023, compared to Rs 36.47 lakh crore in August 2022.

Credit to the sector from April 2023 to August 2023 grew from Rs 40.85 lakh crore to Rs 47.70 lakh crore, growing by 16.8 percent, compared to 7 percent in the corresponding period last year.

Barring consumer durables, advances against fixed deposits and advances to individuals against shares, bonds, etc., saw a strong growth on a year-on-year (YoY) basis.

The major chunk of the total credit went to the housing segment -- of around Rs 24.56 lakh crore. On a YoY basis, the segment saw a growth of 37.7 percent, compared to 16.3 percent last year.

Also Read: Interview | Federal Bank’s unsecured retail segments working well: MDThe credit card segment saw a growth of 30 percent, compared to 26.8 percent last year. Credit to education jumped by 20.2 percent, compared to 11 percent last year. Vehicle loans and loans against jewellery saw a YoY growth of 20.6 percent vs 19.5 percent and 22.1 percent vs 9.2 percent, respectively.

Other personal loans, which saw a credit of Rs 12.20 lakh crore in August 2023, compared to Rs 9.68 lakh crore in August 2022, saw a growth of 26 percent vs 23.8 percent.

A slow growth pattern was seen in consumer durables, advances against fixed deposits and advances to individuals against shares and bonds.

Consumer durables grew by 11 percent, compared to 51 percent. Advances against FDs and individuals against shares, bonds, etc., saw a slow growth of 19.9 percent vs 38.1 percent and 4.2 percent vs 19.3 percent on a YoY basis, respectively.

Growth in unsecured portfolioRBI, in April 2023, had cautioned banks over their unsecured loan portfolio. These include personal loans, credit cards, small business loans and microfinance loans.

This came after some banks aggressively grew their unsecured portfolio. Earlier, in September 2023, in an interview with Moneycontrol, Shanti Ekambaram, Whole Time Director, Kotak Mahindra Bank, said that the bank plans to grow its unsecured portfolio to the mid-teens.

Federal Bank managing director and chief executive officer (MD & CEO) Shyam Srinivasan said that the bank’s unsecured retail loan portfolio is performing well and the lender plans to ramp up the segment in the next few years.

“Over the next few years, the bank’s unsecured business, which currently stands at 3-4 percent, may become 10 percent,” Srinivasan said.

What experts sayBut lately, caution has been a priority for banks in the unsecured lending business.

“After growing their retail-wholesale segment more towards the retail side, banks are looking at working on a more wholesale approach and going towards corporates. A balanced and a cautious approach is expected from the banks,” said a bank analyst.

For the overall growth in the personal loan segment, experts highlighted that the major factor which contributed to the strong growth of personal loans was the HDFC-HDFC Bank merger.

"Housing finance credit jumped 37 percent from 16 percent. This segment comprises the majority of credit to personal loans. Now, due to the HDFC-HDFC Bank merger, portfolio classification has happened, and this has infused HDFC Bank with a mega portfolio of HDFC," said Vijay Gaur, Lead Analyst, BFSI Research, CareEdge.

Other than this, Shripad Jadhav, President and Head, Retail Agri and Gold Loans, Kotak Mahindra Bank, said that banks are looking at lending to some segments like gold loan and vehicle finance aggressively as they are providing good growth.

"Due to the rising demand from festivals and other factors, some segments have seen good growth. Here, banks are trying to go aggressive," Jadhav said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.