October's record trade deficit number may have been a shocker, but economists remain unperturbed as they expect the trade balance to improve immediately.

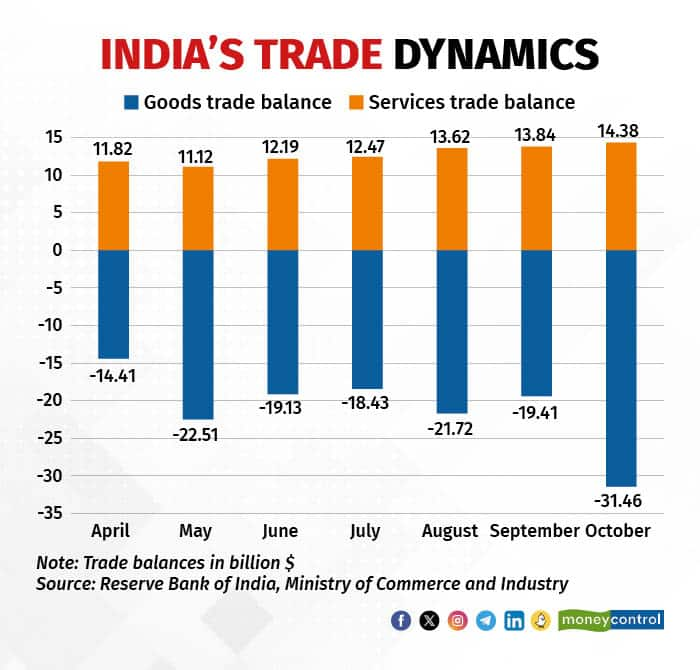

Commerce ministry data released on November 15 showed India's merchandise trade deficit surged to an all-time high of $31.46 billion in October from $19.41 billion in September. And while exports rose 6.2 percent to $33.57 billion, imports jumped 12.3 percent to $65.03 billion.

Like the trade deficit, imports in October were also at an all-time high.

"India's merchandise trade deficit presented a shocker for October. While we had been anticipating a widening of trade deficit amidst the onset of the festive season and September rally in crude oil price, the actual print did surprise considerably on the upside clocking," QuantEco Research's economists said.

Apart from the lagged impact of the increase in crude oil prices in September, the huge rise in the trade deficit was also down to the festive season, which sees a spurt in demand for gold. In October, India's gold imports were up 95 percent year on year at $7.23 billion. The year-on-year comparison for gold imports was skewed because of the difference in the festival calendar in 2023, with Diwali falling in November this year as opposed to October in 2022.

Also Read: With eye on key minerals, India to hold 6th round of trade talks with Peru in DecemberIndia, the world's largest importer of gold, sees an increase in the purchase of the yellow metal ahead of Diwali. So far in 2023-24, gold imports are up 5.5 percent at $29.48 billion.

No CAD concernsWith the 'Diwali effect' now over, the trade deficit is expected to moderate going ahead, with the figure for November seen around $23 billion-25 billion. On the whole, economists don't see any reason yet to change their forecasts for the full-year current account deficit.

"While the April-September 2023 CAD is tracking at sub 1.2 percent of GDP, October-December started on an ominous note, with likely widening in trade deficit versus the last two quarters," Madhavi Arora and Harshal Patel of Emkay Global Financial Services said in a note.

"That said, the recent moderation in prices of oil and gold is encouraging, and overall commodity prices on an average are likely to stay lower than in 2022-23... We maintain 2023-24 CAD estimate at 1.4 percent of GDP," they added.

A CAD of 1.4 percent of GDP for 2023-24 would amount to roughly $53 billion. In 2022-23, India's CAD was $67 billion, or 2 percent of that year's GDP.

Economists' estimates for this year's CAD are in the range of 1.3 percent to 2.0 percent of GDP. For the first quarter of 2023-24, the CAD stood at $9.2 billion. Data for the second quarter will be released at the end of December.

While the merchandise trade deficit surged, the services trade surplus increased even further in October to $14.38 billion – the highest so far in 2023 – from $13.84 billion in September and $11.88 billion in October 2022.

"Despite the slowdown in software services demand, the support to services is coming from Global Captive Centers, providing engineering, research and development services," Elara Capital said.

Underlying numbersAlthough there are no CAD concerns yet, the underlying numbers for the October trade data did raise some red flags.

On the export front, the 6.2 percent growth was aided by a favourable base effect, with October 2022 containing fewer working days due to Diwali, Nomura's Sonal Varma and Aurodeep Nandi pointed out. This helped mask weak sequential momentum in exports.

"That said, we note still-strong performance in electronics, and early recovery signs in engineering goods, textiles, and chemical (including pharmaceuticals) exports… Our analysis suggests that both export and import volumes are improving," Varma and Nandi added.

According to Arora and Patel of Emkay Global Financial Services, the fall in exports in October from September reflects "somewhat uneven external demand".

"This is contrary to the trend seen in rest of Asia, where exports have fared relatively well in October. That said, most key Asian nations are tech-led and typically helped by upturn in the tech cycle. India exports, however, are commodity-oriented and have not enjoyed the same gains as other Asian export hubs," Arora and Patel said.

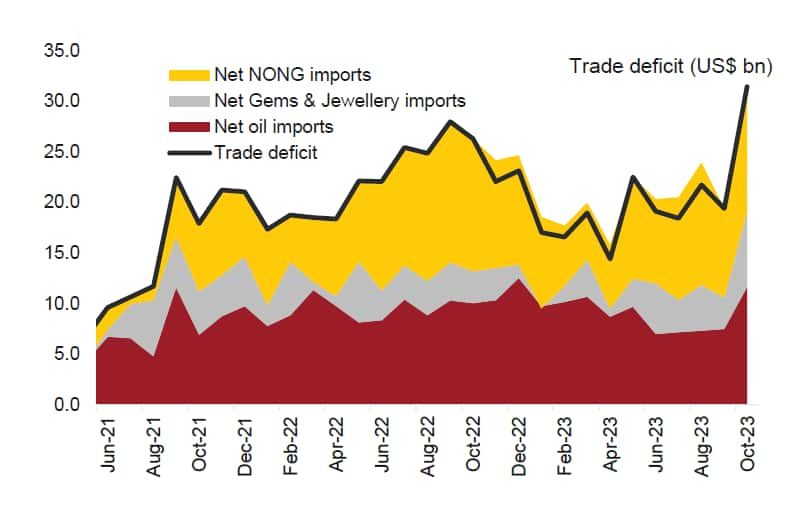

Source: IDFC First Bank Economics Research

Source: IDFC First Bank Economics ResearchWhile external demand is weak, record high imports are indicative of Indian demand for foreign goods holding up, even after excluding gold.

"Domestic demand conditions have held up better than external demand, resulting in net non-oil, non-gems and jewellery imports widening over the last few months," said Gaura Sen Gupta, IDFC First Bank's India Economist.

Also Read: Festive demand ebullient, says RBI bulletin"Indeed, over May to October, net non-oil, non-gems and jewellery imports have averaged at $10.3 billion per month versus $6.7 billion per month over January to April."

With domestic demand remaining more resilient than external demand, Sen Gupta sees the monthly goods trade deficit averaging $25 billion for the rest of 2023-24.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.